CALGARY, Alberta (June 5, 2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS and generative AI company, has released new research that analyzes which oil and gas plays show the greatest rate of increase in drilling speeds and whether well costs correlate with drilling speeds. In addition, the report looks at how well designs are affecting drilling efficiencies.

“Cost reduction efforts to improve capital efficiency are top of mind for every operator these days. Drilling speed improvements, driven by larger-scale operations and changes to wellbore design, have a measurable impact on well costs, and operators that have the best drilling performance tend to have the lowest costs in a basin,” said Steve Diederichs, a director at EIR and author of the new report.

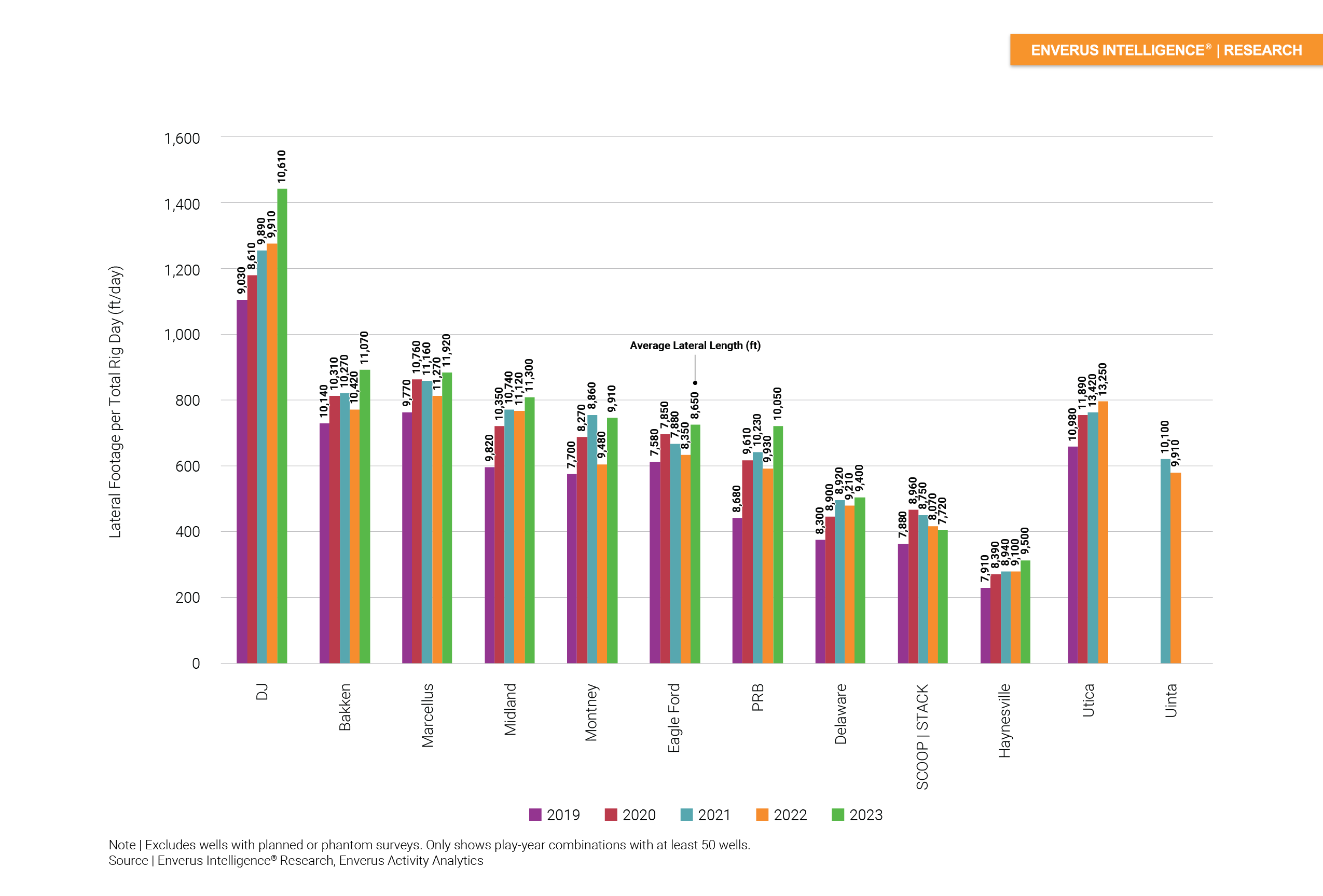

“Rigs across major unconventional basins last year were 30% more efficient at drilling productive lateral feet per total rig day compared to 2019. In the Permian, the Texas-New Mexico play that produces the most oil in America, the improvement jumped to 35%” Diederichs said.

Key takeaways from the report:

- Rigs across major unconventional basins last year were 30% more efficient at drilling productive lateral feet per total rig day compared to 2019.

- Drilling speeds are better correlated with the E&P than the rig provider. We see reasonable correlations between faster drilling speeds and lower-cost operators in both the Permian and Eagle Ford.

- A higher well count on a pad enables batch drilling and is typically associated with faster drilling speeds. The Midland screens more positively than the Delaware in terms of operators pivoting to larger-scale, pad-level operations.

EIR’s analysis pulls from a variety of Enverus products including Enverus Intelligence® Research, Activity Analytics, DSU Analytics and Forecast Analytics.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections between energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted energy-dedicated SaaS company, with a platform built to create value from generative AI, offering anytime, anywhere access to analytics and insights for more than 95% of U.S. energy producers and more than 40,000 suppliers. Learn more at Enverus.com.