CALGARY, Alberta (March 6, 2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the leading and energy-dedicated SaaS company, has released a report that serves as a U.S. emissions stocktake for the oil and gas sector, evaluating industry progress based on the latest data issued by the U.S. Environmental Protection Agency.

In the report, EIR analyzes trends in the upstream and gathering sectors from 2020-2022, highlighting where operator efforts are paying off and which sources are harder to mitigate. EIR’s analysis also compares the top-producing operators and identifies the main reasons behind the most notable step changes in emission intensity.

“The upstream and gathering sectors successfully reduced venting and flaring emissions while still increasing production from 2020-2022, leading to a 12% drop in emission intensity across the Lower 48,” said Ivana Petrich, senior associate with EIR.

“Operator performance varied, however, and we believe the next five years will prove critical for companies to address easier-to-abate emissions ahead of quickly changing regulations. Despite a 23% drop in reported methane emissions, we calculate that many plays would still, on average, be exposed to the Inflation Reduction Act’s waste emissions charge that came into effect on Jan. 1, based on 2022 emissions,” Petrich said.

Key takeaways:

- Reported upstream and gathering emissions fell from 2020-2022, albeit at a decelerating pace, mainly because of decreases in upstream venting and flaring emissions. Total emissions declined by 5% despite a 9% increase in production, leading to a 12% drop in emission intensity across the Lower 48.

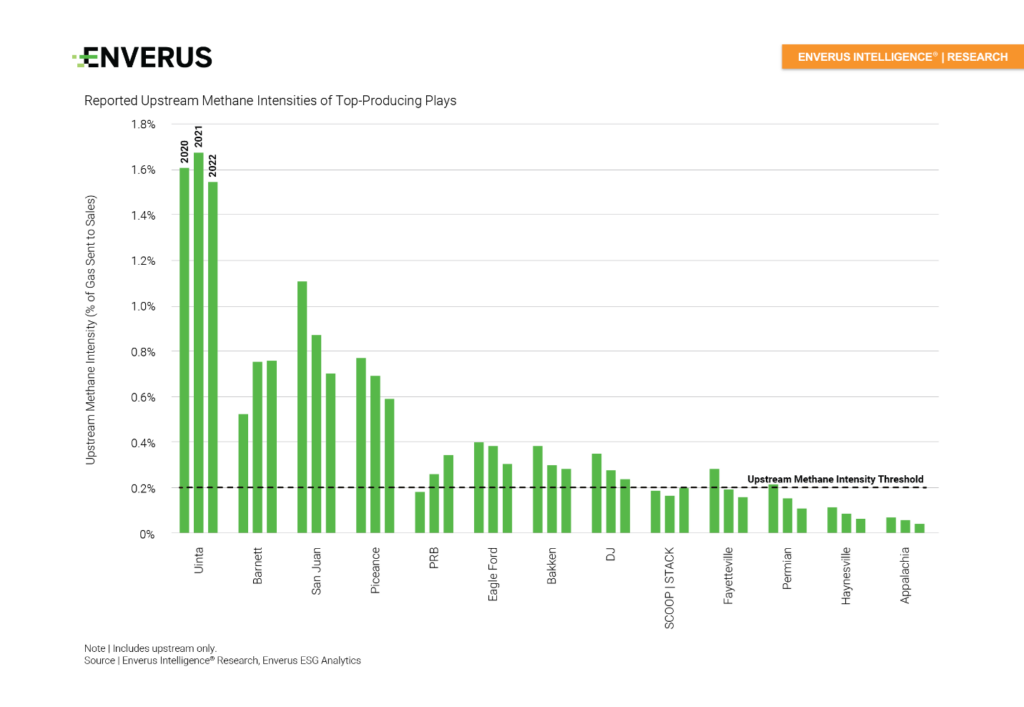

- Total reported methane emissions decreased by 23% from 2020 to 2022 ahead of the final Quad O rules and the Inflation Reduction Act waste emission charge. Despite this, EIR calculates that eight of the 13 top-producing U.S. plays would still, on average, breach the EPA’s upstream methane intensity threshold based on 2022 emissions.

- Of the top 50 U.S. operators in 2022 by production volumes, over two-thirds reported Y/Y decreases in cross-sector emission intensity; however, 18 companies still sit above the broader U.S. average.

Additional Resources:

- EPA’s Quad O regulations expected to trigger tsunami of plugged wells (Feb. 7, 2024)

- EPA’s emission revision: More rules, double the methane, triple the tax (Sept. 19, 2023)

You must be an Enverus Intelligence® subscriber to access this report.

Members of the media should contact Jon Haubert to schedule an interview with one of Enverus’ expert analysts.

EIR’s analysis pulls from a variety of Enverus products including Enverus Intelligence® Research and Enverus ESG® Analytics.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, energy-dedicated SaaS platform, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Learn more at Enverus.com.

Media Contact: Jon Haubert | 303.396.5996

View all press releases at Envers.com/newsroom.