Finding high-yield investments has become more difficult in recent years. One reason why E&P stocks have outperformed all sectors year-to-date (XOP up 88% versus S&P up 23%) is because of attractive free cash flow (FCF) yields, even after the sector has rallied. Nearly all E&P stocks continue to offer double-digit FCF yields — based on our estimates in 2022 — and screen attractive versus stocks in other sectors.

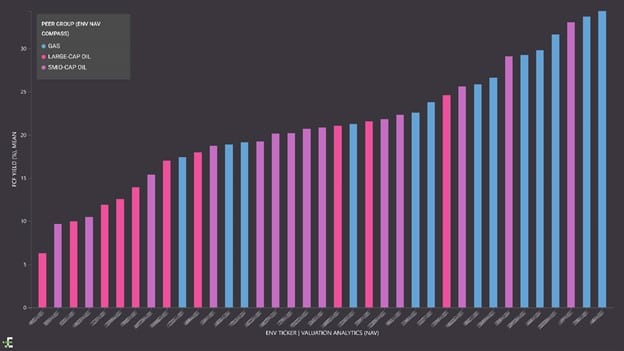

2022E FCF Yields (Assuming Strip Commodity Prices)

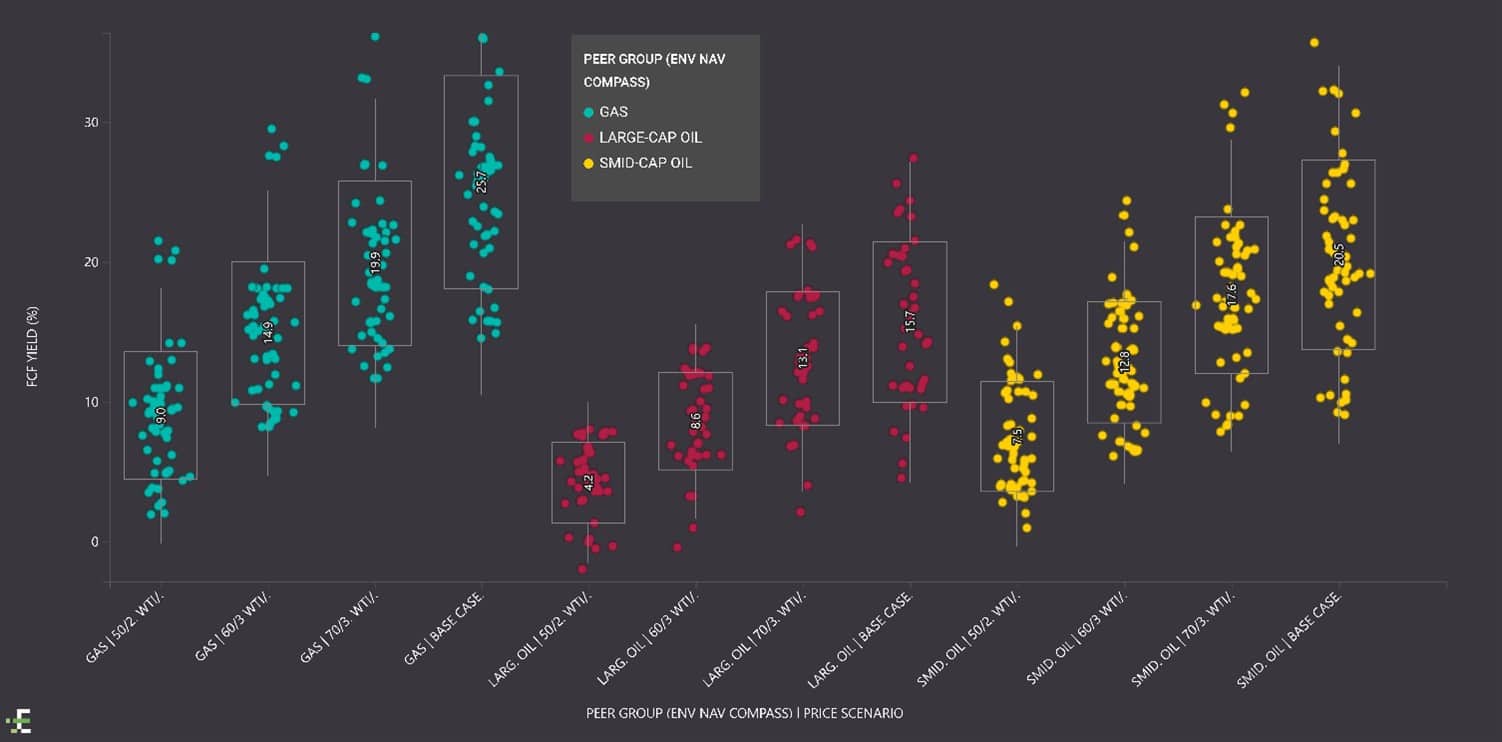

Even in lower price scenarios that are more representative of the market’s long-term expectations, E&Ps’ FCF yields still screen attractive.

2022E FCF Yields at Lower Price Scenarios

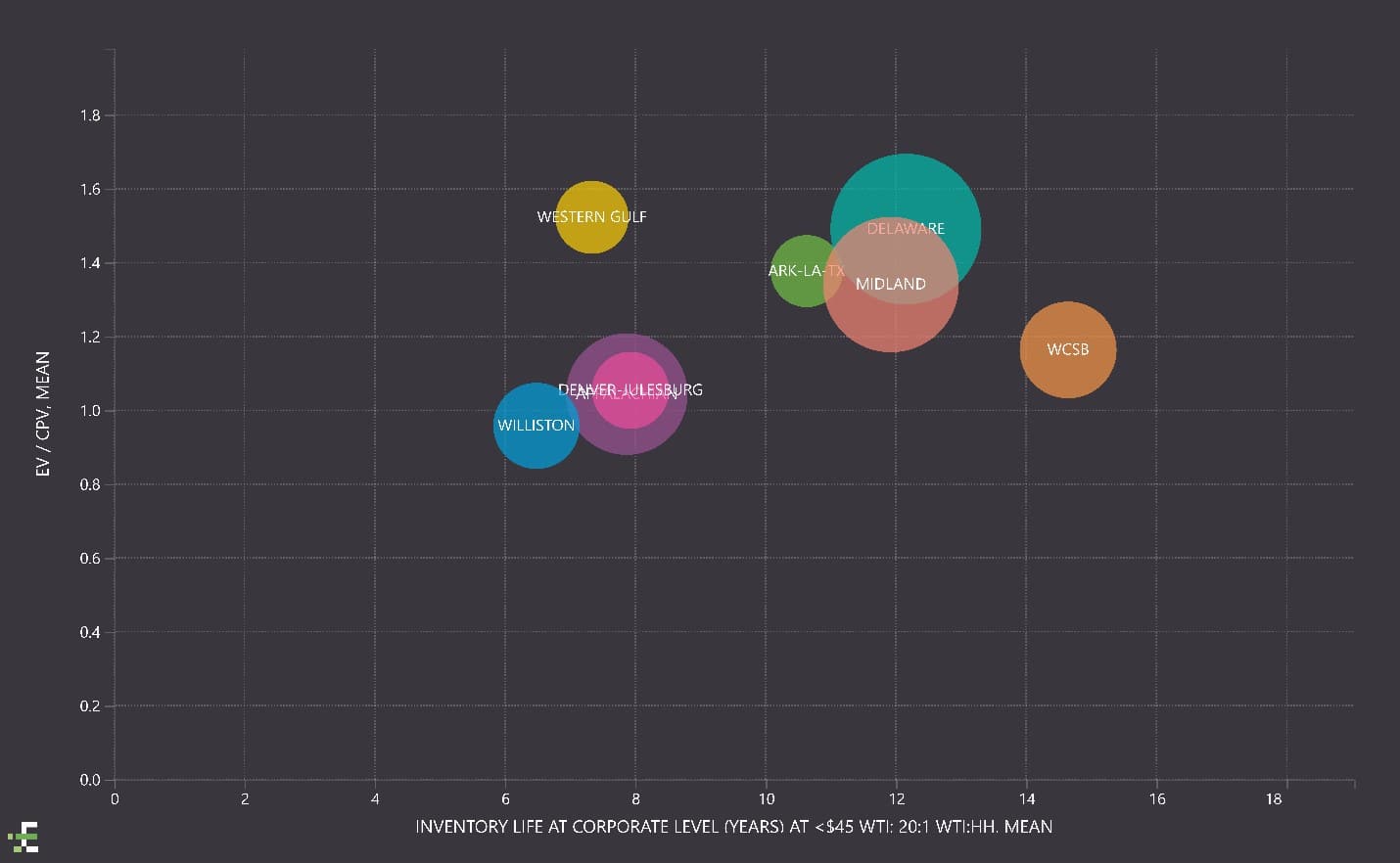

But short-term FCF yields can only reveal so much about a sector’s overall value. The market is ascribing value to potential growth — or long-term yield sustainability — as indicated by a positive correlation between higher valuation multiples and our estimates for high-quality well inventory lives.

However, accurately estimating inventory remains difficult for investors. We see significant dislocations between market value and intrinsic value at the individual stock level. Attractive relative-valuation opportunities exist for investors willing to invest the time and effort.

Valuation Multiples Versus High-Quality Inventory Life by Basin Peer Group