[contextly_auto_sidebar]

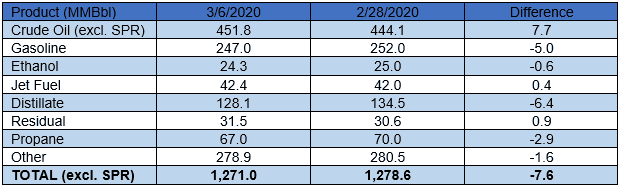

US crude oil stocks posted a large increase of 7.7 MMBbl. Gasoline and distillate inventories decreased 5.0 MMBbl and 6.4 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 6.41 MMBbl alongside gasoline and distillate draws of 3.1 MMBbl and 4.7 MMBbl, respectively. Analysts were expecting a smaller crude oil build of 1.85 MMBbl. Total petroleum inventories posted a large decrease of 7.6 MMBbl.

US crude oil production decreased 100 MBbl/d last week, per EIA. Crude oil imports were up 0.17 MMBbl/d last week, to an average of 6.4 MMBbl/d. Refinery inputs averaged 15.7 MMBbl/d (5 MBbl/d more than last week’s average).

Crude oil futures rebounded from four-year lows on Tuesday on talk of fiscal stimulus measures being considered by the Trump Administration. The April NYMEX WTI contract settled higher at $34.36/Bbl yesterday, up $3.23/Bbl from Monday’s settlement. Nevertheless, crude futures have been trading lower this morning and the contango structure continues to deepen, giving traders incentive to park barrels in storage. Sharply lower OSPs and the prospect of higher production in April as Saudi Arabia and others vie for market share continues to pressure physical markets, weakening demand for spot barrels and spurring a slew of capex cuts by North American oil producers.