[contextly_auto_sidebar]

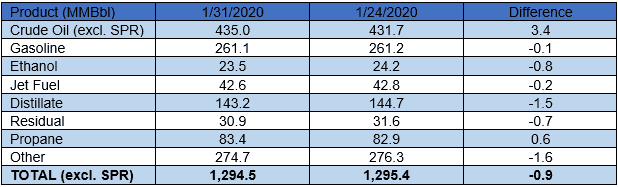

US crude oil stocks posted an increase of 3.4 MMBbl. Gasoline and distillate inventories both decreased 0.1 MMBbl and 1.5 MMBbl respectively. Yesterday afternoon, API reported a crude oil build of 4.2 MMBbl alongside a gasoline build of 1.96 MMBbl and a distillate draw of 1.78 MMBbl. Analysts were expecting a smaller crude oil build of 2.8 MMBbl. Total petroleum inventories posted a decrease of 0.9 MMBbl.

US crude oil production decreased by 100 MBbl/d last week, per EIA. Crude oil imports were down 46 MBbl/d last week to an average of 6.6 MMBbl/d. Refinery inputs averaged 16 MMBbl/d (48 MBbl/d more than last week’s average).

The deteriorating global demand outlook has continued to exert downward pressure on prompt crude futures, with front month WTI closing Tuesday below $50/bbl for the first time in over a year. The contango structure that crept down the curve in recent days also continues to widen, signaling that oversupply conditions are present in physical markets. Indeed, run cuts by Chinese refiners have already weighed on spot cargo markets. With Beijing putting millions in quarantine and governments around the world imposing air travel restrictions, Chinese state-owned and independent refiners alike are reducing throughputs in order to rein in growing product inventories. The deterioration of market conditions in China (the country that was supposed to make up a third of the IEA’s forecasted 1.2 MMBbl/d of global demand growth this year) has prompted OPEC and allied non-OPEC countries to consider holding an emergency ministerial meeting this month, with additional production cuts of 500-800 MBbl/d being discussed.