[contextly_auto_sidebar]

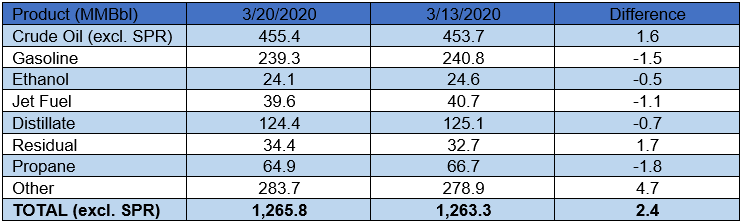

US crude oil stocks posted an increase of 1.6 MMBbl. Gasoline and distillate inventories decreased 1.5 MMBbl and 0.7 MMBbl, respectively. Yesterday afternoon, API reported a crude oil draw of 1.25 MMBbl alongside gasoline and distillate draws of 2.6 MMBbl and 1.9 MMBbl, respectively. Analysts, to the contrary were expecting a crude oil build of 2.8 MMBbl. Total petroleum inventories posted an increase of 2.4 MMBbl.

US crude oil production decreased 100 MBbl/d last week, per EIA. Crude oil imports were down 0.42 MMBbl/d last week, to an average of 6.1 MMBbl/d. Refinery inputs averaged 15.8 MMBbl/d (18 MBbl/d more than last week’s average).

May WTI settled at $24.01/Bbl on Tuesday, up from Monday’s open of $22.52/Bbl. Although flat price appears to have caught a brief respite from the sharp daily declines seen recently, pressure on time spreads continues to mount. Indeed, the contango in the WTI front spread has widened to close to $2.70/Bbl as of this morning. Prompt physical differentials are also reeling, with the Dated Brent to Frontline swap plumping lows of -$3.40/Bbl earlier this week. Given abysmal gasoline cracks and the backing up of supply chains, refiners have embarked on a round of heavy economic run cuts. Aside from worsening prompt physical market conditions, the run cuts have disproportionally hammered light sweet grades due to their higher gasoline yields compared to distillate-rich medium and heavy sours. Mars is now at a $0.63/Bbl premium to LLS. Despite the fact that primary inventories in the United States have not shown signs of stress to-date, all signs point to significant builds in the near future.