[contextly_auto_sidebar]

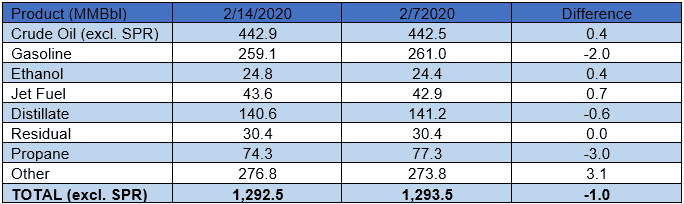

US crude oil stocks posted an increase of 0.4 MMBbl. Gasoline and distillate inventories decreased 2.0 MMBbl and 0.6 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 4.16 MMBbl alongside gasoline and distillate draws of 2.67 MMBbl and 2.63 MMBbl, respectively. Analysts were expecting a smaller crude oil build of 2.5 MMBbl. Total petroleum inventories posted a decrease of 1.0 MMBbl.

US crude oil production remain unchanged last week, per EIA. Crude oil imports were down 0.43 MMBbl/d last week, to an average of 6.5 MMBbl/d. Refinery inputs averaged 16.2 MMBbl/d (0.2 MMBbl/d more than last week’s average).

Front month WTI futures were up $1.24/Bbl to close at a three-week high of $53.29/Bbl on the penultimate day of trading on the March contract yesterday. The shrinking number of new coronavirus cases in China continues to ease concerns about the impact of COVID-19 on the Chinese economy. The US Treasury Department’s imposition of sanctions on Rosneft Trading for its dealings with Venezuela has also brought forward the prospect of further production declines in the beleaguered Latin American country. Crude oil production in Venezuela had been stabilizing at around 800-850 MBbl/d after steady declines in recent years, but declines may resume if exports are hampered by the new sanctions.