[contextly_auto_sidebar]

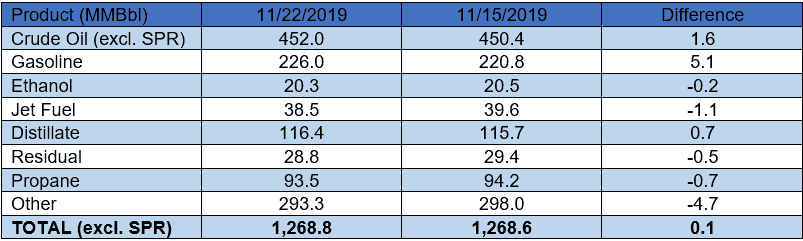

US crude oil stocks increased by 1.6 MMBbl. Gasoline and distillate inventories increased 5.1 MMBbl and 0.7 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 3.64 MMBbl alongside a gasoline build of 4.38 MMBbl and a distillate draw of 0.67 MMBbl. Analysts, to the contrary, were expecting a crude oil draw of 0.42 MMBbl. Total petroleum inventories posted an increase of 0.1 MMBbl.

US crude oil production increased 100 MBbl/d last week, per EIA. Crude oil imports were up 0.22 MMBbl/d last week, to an average of 6.2 MMBbl/d. Refinery inputs averaged 16.3 MMBbl/d (0.1 MMBbl/d less than last week’s average).

WTI futures were up for a second day on Tuesday, with the January contract settling at $58.41/bbl. Intraday trading lifted prompt futures to a high of $58.56/Bbl before heading lower into the close. Renewed optimism over trade talks between the US and China was a likely driver, but trading volume was also fairly low during the session. With OPEC/non-OPEC meetings planned for December 5-6 in Vienna, yesterday’s price movements could very well have been the result of traders putting on positions ahead of the talks. Nevertheless, Tuesday’s news that China’s top trade negotiator, Liu He, had a phone conversation with Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer marks at least some improvement in US-China relations. According to a statement from China’s commerce ministry, “both sides discussed resolving core issues of common concern” and discussions were still ongoing regarding a phase one agreement.