[contextly_auto_sidebar]

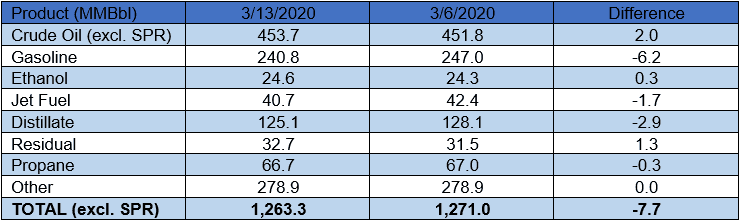

US crude oil stocks posted an increase of 2.0 MMBbl. Gasoline and distillate inventories decreased 6.2 MMBbl and 2.9 MMBbl, respectively. Yesterday afternoon, API reported a crude oil draw of 0.42 MMBbl alongside gasoline and distillate draws of 7.8 MMBbl and 3.6 MMBbl, respectively. Analysts, to the contrary were expecting a crude oil build of 2.9 MMBbl. Total petroleum inventories posted a large decrease of 7.7 MMBbl.

US crude oil production increased 100 MBbl/d last week, per EIA. Crude oil imports were up 0.13 MMBbl/d last week, to an average of 6.5 MMBbl/d. Refinery inputs averaged 15.8 MMBbl/d (0.12 MMBbl/d more than last week’s average).

Crude oil prices continue to spiral downward, with April WTI trading below $24/Bbl this morning. Further price declines may be unstoppable given the immense oversupply conditions that are emerging now and are anticipated over the coming months as Saudi Arabia, Russia, and other parties to the erstwhile OPEC+ agreement ramp up production just as global demand is cratering due to efforts by governments to control the global spread of novel coronavirus. Due to the unprecedented speed at which demand liquid fuels and petrochemical feedstocks is being destroyed, refiners around the globe are beginning to face the prospect of economic run cuts as their margins disintegrate. Meanwhile, a gaping contango structure has set traders off on a global rush to fill ullage both on land and at sea. Unless Saudi Arabia and Russia can put an end to this madness soon, we may soon see oil prices in the teens and, ultimately, witness a cascade of forced production shut-ins.