[contextly_auto_sidebar]

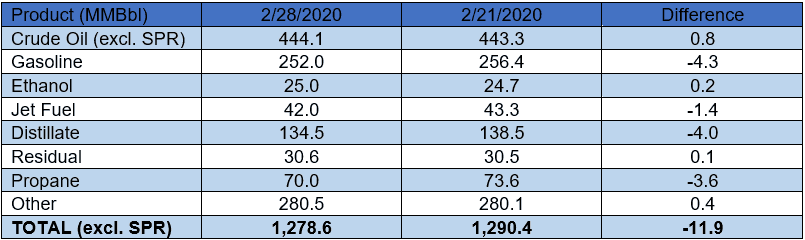

US crude oil stocks posted an increase of 0.8 MMBbl. Gasoline and distillate inventories decreased 4.3 MMBbl and 4.0 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 1.7 MMBbl alongside gasoline and distillate draws of 3.9 MMBbl and 1.7 MMBbl, respectively. Analysts were expecting a larger crude oil build of 3.3 MMBbl. Total petroleum inventories posted a large decrease of 11.9 MMBbl.

US crude oil production increased 100 MBbl/d last week, per EIA. Crude oil imports were up 21 MBbl/d last week, to an average of 6.2 MMBbl/d. Refinery inputs averaged 15.7 MMBbl/d (0.31 MMBbl/d less than last week’s average).

Front month WTI futures posted a modest increase of $0.43/Bbl to settle at $47.18/Bbl on Tuesday. Both WTI and Brent moved up sharply with the announcement that the Federal Reserve cut its target interest rate by 50 basis points, but subsequently lost ground in afternoon trading. Despite more accommodative monetary policy, market participants remain concerned about the potential for deeper demand destruction resulting from the global spread of COVID-19. All eyes are on this week’s OPEC and OPEC+ meetings scheduled for Thursday and Friday. Last month the OPEC+ Joint Technical Committee proposed deepening cuts by another 0.6 MMBbl/d in the second quarter, but Saudi Arabia has recently begun voicing support for a cut of 1 MMBbl/d. Russia has voiced support for extending current production cuts, but has so far resisted calls for larger reductions in output.