[contextly_auto_sidebar]

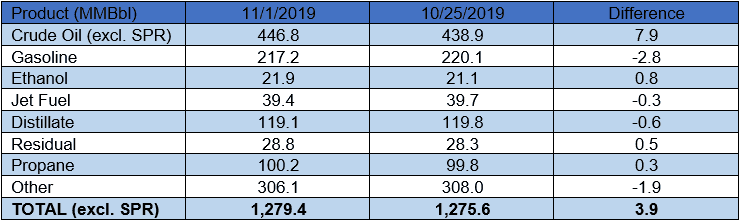

US crude oil stocks increased by 7.9 MMBbl. Gasoline and distillate inventories decreased 2.8 MMBbl and 0.6 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 4.26 MMBbl alongside gasoline and distillate draws of 4.0 MMBbl and 1.6 MMBbl, respectively. Analysts were expecting a crude oil build of 1.5 MMBbl. Total petroleum inventories posted a decrease of 3.9 MMBbl.

US crude oil production remained unchanged last week. Crude oil imports were down 0.62 MMBbl/d last week, to an average of 6.1 MMBbl/d. Refinery inputs remained low. Averaging 15.8 MMBbl/d (0.24 MMBbl/d less than last week’s average), which was a major factor behind the large crude build.

West Texas Intermediate for December delivery settled higher on Tuesday at $57.23/Bbl, up 69 cents per barrel from the prior day. Flat price had been up for the past three sessions and was approaching five-week highs. Sentiment was lifted by reports that US and Chinese officials may be close to reaching an agreement to partially roll back some tariffs as part of the Phase One trade deal currently under negotiation. Prices had also been bolstered with the release of third quarter earnings reports from US E&Ps, which so far have been pointing toward lower capex plans in the year ahead. Oversupply concerns continue to linger, though, capping gains. Indeed, OPEC’s World Oil Outlook report released yesterday made headlines due to its grim forecast of non-OPEC production (led by the United States) outstripping global demand over the next five years. OPEC plans to meet next month to discuss further cuts to production.