Confidently navigate the volatile energy market, from maximizing the subsurface to reducing emissions in the sky. We partner with you to connect the dots that reveal hidden value and better decisions throughout the entire asset lifecycle.

Enverus Intelligence® Research, Inc., a subsidiary of Enverus, provides the Energy Transition Research products. See additional disclosures.

When you need the upper hand, Enverus has you covered with industry-driven content curated directly from our team of intelligence professionals.

to diversify or expand your energy portfolio.

for changes in the market and minimize future costs to ratepayers.

with analysts empowered by the energy industry’s most trusted data and analytics as a single source of truth.

Consider our team an extension of yours to help solve your unique challenges and navigate through the ever-changing energy transition landscape.

Energy Transition Research is your guide to understanding how decarbonization is driving interest in renewables, alternative fuels, and emission abatement technologies (including CCUS), backed by granular data and analytics, and transparent methodology.

Energy Transition Today: Delivers timely insights into technologies, policies and market forces shaping the shift to low carbon energy.

Weekly

Morning Energy (Energy Transition): Tracks the market’s most recent trends, controversial topics and up-to-date reports from the analyst team. Delivers opinionated views on all the important topics.

Weekly

Power Pulse: Covers key announcements across the renewable electricity sector, including generation, transmission, energy storage, critical materials and services, and growing demand from electric vehicles, data centers and AI.

Monthly

Carbon Innovation Pulse: Covers energy transition applications of traditional E&P technologies such as geothermal, direct lithium extraction, CCUS, as well as clean fuels like hydrogen and biofuels.

Monthly

Fundamental Edge: Provides detailed oil and natural gas supply and demand outlooks and price forecasts. This is a highly focused piece highlighting the most asked questions by our clients on the current market and future drivers.

Monthly

Energy Transition Market Tracker: Equity tracking report covering the financial performance and strategies for 90+ equities across transition sectors as well as integrated traditional energy businesses.

Quarterly

Energy Transition M&A Trends: Leverages our Energy Transition M&A platform, which has captured 7,000+ deals across 100 countries spanning power (generation, distribution, storage and integrated assets) plus alternative fuels, CCUS, equipment manufacturing, electric vehicles and mining of energy transition metals.

Quarterly

Subsurface Innovation Quarterly: Highlights trends and key themes impacting subsurface-led low carbon technologies like CCUS, DLE, geothermal, natural hydrogen and helium.

Quarterly

Class VI Quarterly Update: Delivers timely updates on newly announced or operational Class VI wells and projects, highlighting key developments and insights critical to understanding the evolving carbon storage landscape.

Quarterly

Critical Point: A deep dive into the themes and issues shaping the energy transition. Includes updated economic outlooks and benchmarking of power and decarbonization assets across owners and regions, and technical analysis of the technologies and investments driving a lower carbon future.

Annually

Energy Transition Activity Map: Visualize the layers of analytics required to navigate the transition.

Annually

P&R Fundamentals: A detailed review of the current trends and policies impacting power assets, markets and firms in key ISOs.

Annually

CCUS Fundamentals: A deep dive slide deck covering specific trends or areas of interest focused on the emerging CCUS industry, providing fresh insight and calls to action.

Annually

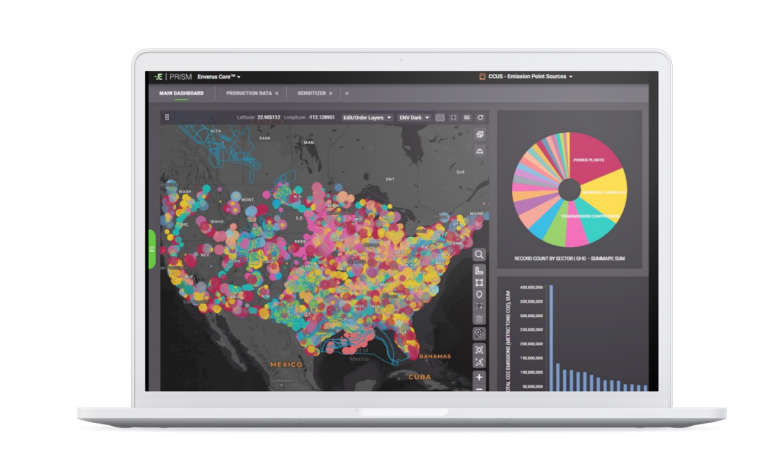

CCUS Activity Map: A comprehensive visualization tool that integrates key layers, including CCUS projects, Class II and Class VI wells, and infrastructure to support strategic evaluation of CCUS projects and competitive positioning.

Annually

Clean Fuels Fundamentals: A deep dive slide deck covering specific trends or areas of interest focused on the clean fuels industry, providing fresh insight and calls to action.

Annually

Deal Insights: Offers highlights and analysis on recently announced M&A deal activity, including market comps on comparable deals and the impact on the market.

Ad Hoc

Long-Term Load Forecast: Considers historical and emerging load drivers of power demand and models variables that incrementally impact our power demand forecast through 2050.

Ad Hoc

Electric Vehicle Forecast: Fleet growth, penetration and impact on natural gas, oil and power demand.

Ad Hoc

Data Center Capacity Expansion Outlook: This report series provides refreshed L48-level views on the expected growth in data center capacity and associated power demand with a focus on understanding hyperscaler capital programs

Ad Hoc

Conference Summary Notes: Insights and observations from recent industry conferences.

Ad Hoc

Research: Energy Transition Research covers the full spectrum of energy transition topics moving from molecules to electrons. Topical and market responsive research focused on delivering insights into an evolving energy landscape.

Ad Hoc

PRISM Signals: Provides timely insights into key trends, assets or companies leveraging Enverus PRISM® datasets and visualizations. Readers can access the corresponding Prism workbooks for further exploration.

Ad Hoc

Holistic, full value chain analysis assessment of the opportunities and risks facing stakeholders in the energy transition.

Transparent inputs and methodologies, replicate research workflows using Enverus solutions.

Intelligence-led connection between our unbiased analytics and software solutions.

Evaluate carbon capture, utilization, and storage (CCUS), from source-to-sink. Analysis brings fresh insight into catalysts, viability of economics and subsurface risk, and calls to action within this emerging and rapidly evolving industry.

Valuations and technical assessments of power and renewable technologies, assets and companies.

Updated perspectives on changes to the power load shape and growth, generation mix, transmission builds and more.

Data-driven forecast of the supply and demand fundamentals and insights from global geopolitical influences.

Evaluation of state of low carbon and renewable fuel markets, including technical, policy and demand analyses.

Proprietary and quantitative evaluation of environmental, social and governance (ESG) performance by company is published and updated at a regular cadence.

A long-term outlook of the global primary energy mix required to limit global warming.

Find buildable acreage, design and optimize assets, or develop a trading or hedging strategy with insights across the renewable asset lifecycle.

Unlock returns of electron and molecule-based energy transition technologies with deal insights, from power generation assets to CCUS and hydrogen.

Quickly screen potential projects with critical details. CCUS Analytics connects all aspects of evaluation in one platform.

Designed for today’s rapidly evolving regulatory environment and investment landscape, Enverus equips operators and investors with targeted insights to navigate regulatory challenges smartly and efficiently with deep analytics on energy assets’ emission profiles.

With Enverus Instant Analyst™, you receive answers you can trust, delivered in seconds. Sourcing from 25+ years of vetted data and research on the most trusted SaaS platform designed exclusively for energy.

Comprehensive coverage of power markets and insights into emerging energy technologies and project economics.

Streamline your strategic decisions with actionable insights and centralized data for molecule-based project tracking and viability, updated daily through Enverus PRISM®.

The following blog is distilled in part from Enverus Intelligence® Research (EIR) publications. After nearly a decade on the sidelines, EOG Resources has made a bold return to the M&A arena with its $5.6 billion acquisition of Encino Acquisition Partners (EAP)....

The following blog is distilled from Enverus Intelligence® Research (EIR) publications. As the upstream oil and gas sector faces mounting pressure from rising costs and dwindling Tier 1 inventory, the need for smarter, faster and more efficient development strategies has never...

The first quarter of 2025 has seen a remarkable surge in oil and gas mergers and acquisitions (M&A) within the upstream oil and gas sector, with transactions totaling $17 billion. This dynamic environment presents both challenges and opportunities for small...

The following blog is distilled from Enverus Intelligence® Research (EIR) reports. As core inventory in top-tier shale plays becomes increasingly scarce and expensive, conventional upstream operators are turning their attention to the “best of the rest”—secondary basins that are quietly delivering compelling...

What Conventional Oil & Gas Operators Can Learn from the Central Basin Platform Right Now While unconventional plays often dominate headlines, there’s a quiet confidence building in the Central Basin Platform (CBP). Operators here aren’t chasing hype. They’re managing mature...

Gevo recently announced the sale of carbon dioxide removal (CDR) credits from its North Dakota facility for the first time, following the acquisition of an ethanol plant with carbon capture capabilities nearly a year ago. This is one of several...

The following blog is distilled in part from Enverus Intelligence® Research (EIR) publications. After nearly a decade on the sidelines, EOG Resources has made a bold return to the M&A arena with its $5.6 billion acquisition of Encino Acquisition Partners (EAP)....

The following blog is distilled from Enverus Intelligence® Research (EIR) publications. As the upstream oil and gas sector faces mounting pressure from rising costs and dwindling Tier 1 inventory, the need for smarter, faster and more efficient development strategies has never...

The first quarter of 2025 has seen a remarkable surge in oil and gas mergers and acquisitions (M&A) within the upstream oil and gas sector, with transactions totaling $17 billion. This dynamic environment presents both challenges and opportunities for small...

The following blog is distilled from Enverus Intelligence® Research (EIR) reports. As core inventory in top-tier shale plays becomes increasingly scarce and expensive, conventional upstream operators are turning their attention to the “best of the rest”—secondary basins that are quietly delivering compelling...

What Conventional Oil & Gas Operators Can Learn from the Central Basin Platform Right Now While unconventional plays often dominate headlines, there’s a quiet confidence building in the Central Basin Platform (CBP). Operators here aren’t chasing hype. They’re managing mature...

Gevo recently announced the sale of carbon dioxide removal (CDR) credits from its North Dakota facility for the first time, following the acquisition of an ethanol plant with carbon capture capabilities nearly a year ago. This is one of several...

The following blog is distilled in part from Enverus Intelligence® Research (EIR) publications. After nearly a decade on the sidelines, EOG Resources has made a bold return to the M&A arena with its $5.6 billion acquisition of Encino Acquisition Partners (EAP)....

The following blog is distilled from Enverus Intelligence® Research (EIR) publications. As the upstream oil and gas sector faces mounting pressure from rising costs and dwindling Tier 1 inventory, the need for smarter, faster and more efficient development strategies has never...

The first quarter of 2025 has seen a remarkable surge in oil and gas mergers and acquisitions (M&A) within the upstream oil and gas sector, with transactions totaling $17 billion. This dynamic environment presents both challenges and opportunities for small...