The four forces of the energy evolution blog series continues today with a focus on tax equity structures. Utilizing tax equity structures greatly helps the economics of renewable projects and draws more investors to the sector. To understand the benefits of tax equity structures, it is important to understand the difference between an efficient and an inefficient taxpayer. An inefficient taxpayer can’t utilize the tax benefits afforded from a renewable project to full capacity, whereas an efficient taxpayer can utilize these against their immediate tax liabilities. Most developers of wind and solar assets in the United States are inefficient taxpayers since they do not have a tax burden from operations at the start of commercial operations of the project but have access to tax credits to offset them. Tax equity investors, the efficient taxpayers, are usually large corporations with continued tax liabilities from operations. To monetize and pull forward tax benefits, tax equity structures have become commonplace in the United States.

In a tax equity agreement, the developer (the inefficient taxpayer) will assign its tax benefits to another party (the efficient taxpayer) for equity investment in the project. The tax equity investor, a limited partner, in this case is only interested in the tax benefits the project generates. Under the partnership regulations of the US government, there does not exist an obligation to share a fixed allocation of the cash flows and tax credits from an investment in accordance with the size of an equity investment. In addition, these allocations can change over time based on predefined triggers. This enables different allocation structures to be possible in a tax equity partnership. There are several catches of note per the IRS rules. One is that both partners need to have a minimum of 1% interest in the tax and cash benefits of a project. Another rule of these structures is that tax losses allocated to the limited partner can’t exceed their tax equity investment.

There are two common examples of allocation: fixed flip and yield-based flip. The fixed flip structure allocates the majority of the tax benefits to the tax equity investor for a pre-determined period of time. After that period, the allocation can be changed or “flipped.” The initial period can vary, but most arrangements are made to flip in year seven or eleven of operations. This is because most assets are depreciated on a five-year MACRS schedule (which runs its course in year six) or the PTC credits (which are awarded for the first 10 years) have run their course. After these events, the tax benefits would become less prominent. The yield-based structure involves a non-static allocation. It is one in which the majority of the tax benefits are allocated to the tax equity investor until they get to a pre-determined rate of return. At that time the allocation can be flipped. Under both structures, more complexities can be introduced. For example, multiple periods or rate of return hurdles in which the allocation changes. It is also good to keep in mind that the tax equity investment and the allocation of benefits under this structure are based on both parties’ economic analysis of the risked returns. They will only enter such an arrangement if they both find that it provides them a sufficient expected return.

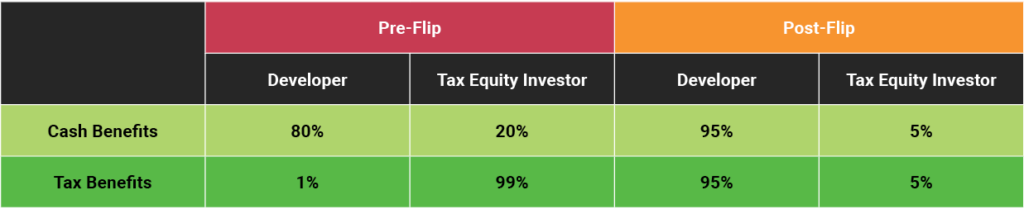

Let’s look at a few examples. In Figure 1, we consider a simple wind project tax equity structure with one flip event per the partnership agreement. Per the above discussion, the timing of the flip could occur after a fixed period or be triggered by the tax equity investor reaching a certain rate of return on their investment. To keep it simple, say that we have a fixed flip structure in which the allocation flip occurs at the start of year seven of operations. During the first six years, since the tax equity investor can utilize the tax benefits that the wind project is generating from both the PTC and depreciation, they are allocated 99% of the tax benefits. The developer keeps the minimum amount allowed, 1%, of the tax benefits. The tax inefficient developer couldn’t utilize these benefits without this structure and is able to pull the value of these benefits forward thanks to the tax equity investment and keep 80% of the cash benefits they generate. The tax equity investor utilizes the tax benefits right away and they get 20% of the cash benefits generated by the project. Starting in year seven, the flip as defined by the partnership agreement occurs and the developer starts to receive 95% of the cash and tax benefits, whereas the tax equity investor is reduced to a 5% interest in both.

Next, let’s consider a solar project tax equity structure but this time, we will introduce two flip periods. The first flip period will be the first quarter of operations. The second flip period will be the second quarter of operations through the end of year six. The post-flip period is year seven onwards. Why could such a structure exist? One reason would be that solar projects can claim the ITC, which is a large tax credit awarded in the first quarter of operations. Thus, it would make sense to allocate as much of this tax benefit as possible to the efficient taxpayer who can use it when it is realized. It can be safely assumed that the rest of the tax benefit will be realized based on operations and the depreciation schedule. Additionally, this flip and allocation structure could make sense since there are rules that limit the tax losses that can be allocated to the limited partner based on the size of the tax equity investment. This structure could ensure that the partnership stays within the confines of these rules. So, in this structure, in the first quarter of operations, when the ITC is realized, the tax equity investor will be allocated 99% of the tax benefits and the developer will get the minimum 1%. From the second quarter through year six of operations, the tax benefits are split evenly. Throughout these two periods, the cash benefits are split 80% to 20% in favor of the operator. In year seven and onwards, the developer receives 99% of both the cash and tax benefits, whereas the tax equity investor retains the minimum 1%.

Tax Equity in 2021 surpassed $20 billion. Tax equity usually makes up ~35% of the capital stack for a solar project and ~65% of the capital stack for a wind project. As a fair parting warning, given that these tax structures are complex and the rules are always changing, you should always consult a tax specialist to understand what is applicable to your project or investment.

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.