Mounting pressure to decarbonize operations and improved tax incentives are building significant momentum behind carbon capture, utilization, and storage (CCUS) projects. Given the increasingly competitive and crowded landscape, operators and investors need the resources to quickly screen opportunities and better understand where to focus.

A typical project takes around 10 years from concept to commissioning, so a meaningful increase in CCUS capacity won’t be seen until the end of this decade. Looking further ahead to 2030, forecasted capacity creates a classic hockey stick as capacity accelerates upward with additional capacity heavily weighted toward petroleum and natural gas systems.

To put CCUS growth into context, U.S. and Canadian CCUS capacity was less than 2% of 2021 CO2 emissions but is conservatively estimated to expand to 12% by 2040. This number is only set to grow further as CCUS project commitments continue to stream in. This means ramping up from 40 million tons of CO2 capture capacity to at least 320 million tons per year.

Point Source Targeting & Emission Hub Evaluation

Infrastructure & Transportation

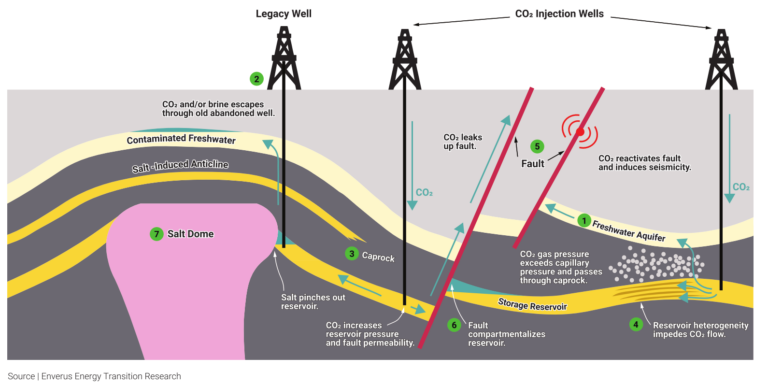

Subsurface Storage Screening & Risk Evaluation

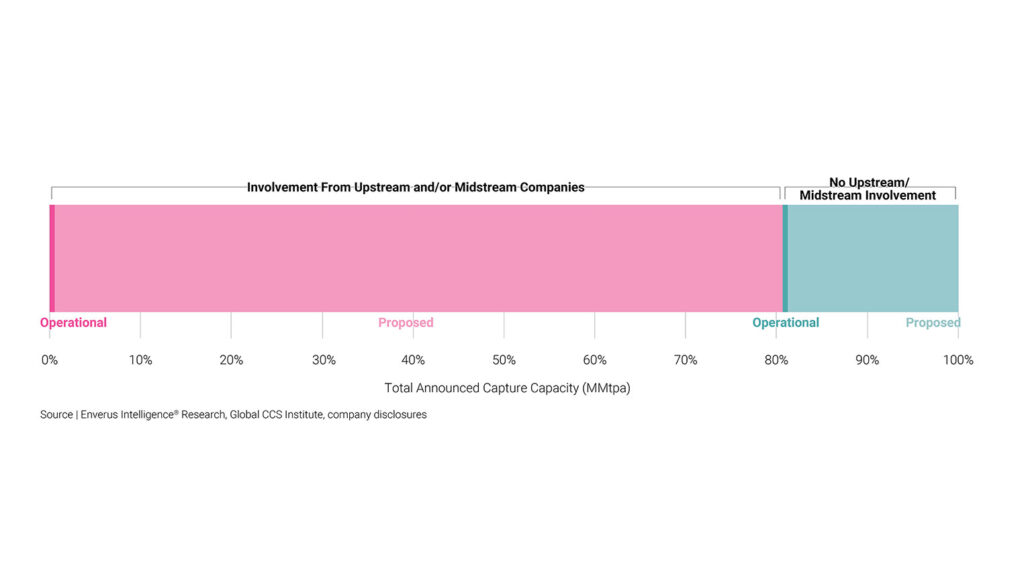

While a few pure play CCUS players have emerged, 80% of CCUS projects are led by upstream and midstream companies, including supermajors and large operators who can afford to be first movers and absorb more of the policy and technical risks. Smaller CCUS project developers targeting less than 5 million tons of additional CO2 capacity annually are led by oil and gas operators who are partnering with natural gas processors, LNG and power generators.

Large-scale CCUS projects are underway and set to come online by mid-decade, driven by permanent sequestration and hub-style projects that enable developers to capture economy of scale.

A critical success driver for economical CCUS projects includes having a short distance between emissions and injection sites.

Identify where to build new or convert existing infrastructure and predict capacity required for long term investments. Leverage geospatial filtering around existing pipelines in PRISM to identify emission sources within a viable distance for your project to be successful.

It is also important to identify what opportunities there are for using existing CO2 pipe, or repurposing natural gas pipes, which lines might be able to be twinned, or if the project will require a new infrastructure system altogether.

1. Assess surface land potential and ownership

2. Assess surface risks such as presence of floodplains

3. Integrate additional surface information

4. View everything, everywhere, all at once.

Confidently navigate the volatile energy market, from maximizing the subsurface to reducing emissions in the sky.

Read More about Energy Transition Research

Subsurface Studio helps your geoscience team to be more productive in less time. It accelerates the creation of robust subsurface models, allowing you to perform sophisticated subsurface analysis in minutes instead of weeks. Read More About Subsurface Studio

Enverus ESG analytics to gain transparency to power the future of energy.

Read More About ESG Analytics

Make the most informed decisions for your investments and operations by enhancing your market and infrastructure outlook.

Read More About Midstream

Bring improved accuracy to your power forecasts with AI and machine learning-based load, renewables and price forecasts.

Read More About Power and Renewables

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.