Marblehead Xf has been one of the top day-ahead and real-time MISO constraints this year. What you might not know is that some transmission outages caused dramatic changes in shift factors for this constraint. Our product, Panorama, uses topology-based shift factors to accompany our other market-leading congestion tools. Why does this matter? Identifying these changes ahead of time can give you an edge on the market.

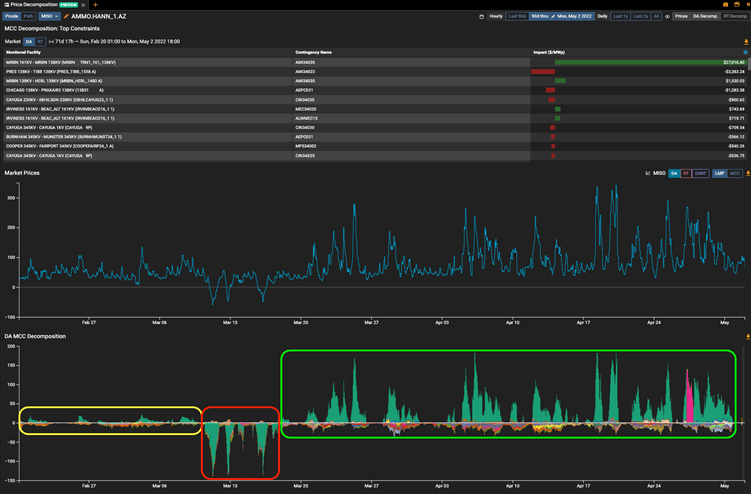

To illustrate the importance of having accurate shift factors, we’ve taken a snapshot from our Price Decomposition module for the AMMO.HANN_1.AZ pnode. The middle section (blue line) shows the hourly day-ahead LMPs, while the bottom section displays the individual day-ahead constraint impacts. Within the bottom section, Marblehead’s impact can be seen in the shaded green areas. You can quickly identify three distinct periods. In the first period (yellow box), Marblehead’s impact is slightly positive; in the second (red box), it flips to negative; and in the third (green box), it’s back to positive at a much greater magnitude.

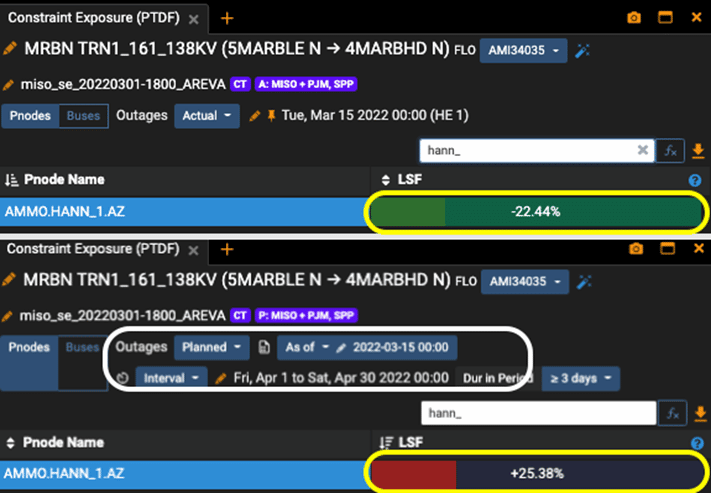

While this is a great postmortem tool, we can also use our product to predict future shift factors. The image below shows what you would see if you looked at the Marblehead constraint on the first day of the April auction (March 15). The top section shows shift factor using the actual transmission outages on March 15, while the bottom section shows exposure for the upcoming month using the planned transmission outages as of the same day.

To quantify the financial implications of the shift factor change, we evaluated one of the previous top paths and compared it to the April top path using Panorama shift factors.

| Source | Sink | ON P/L | OFF P/L | |

| Previous top path | AMMO.PENOCTG1 | AMIL.MRDSA.ARR | $4,231 | $974 |

| Panorama top path | AMMO.PENOCTG1 | AMMO.HANN_1.AZ | $19,917 | $10,647 |

| Change in sinks | AMIL.MRDSA.ARR | AMMO.HANN_1.AZ | $15,687 | $9,672 |

Assuming you bought in the April prompt auction, the Panorama top path would have resulted in a gain of almost $20,000 per megawatt (on peak), more than $15,000 higher than using the March top sink.

Maybe you weren’t directly impacted by this change but would like to be better prepared in the future for similar situations. If so, please fill out the form below and one of our specialists will get in touch with you.