Permitting information for oil and gas wells is one of the most readily available and least lagged pieces of data on industry activity, but it is often seen as a poor indicator of future drilling activity. There is no requirement that a company actually act on the permit, and some companies keep large inventories of permits to provide optionality or possibly obscure their plans. In contrast, some E&P companies will permit only the wells they intend to drill.

Permit usage efficiency scores derived from Enverus Core data give a good indication of where a company falls on that spectrum. Permit usage efficiency is the percentage of all approved permits that have moved into any status beyond approval in the well life cycle—i.e., a pad was cleared, or a well was drilled, completed and/or put on production. A high permit usage efficiency implies that permitting data on that company provides a relatively accurate forecast of future activity.

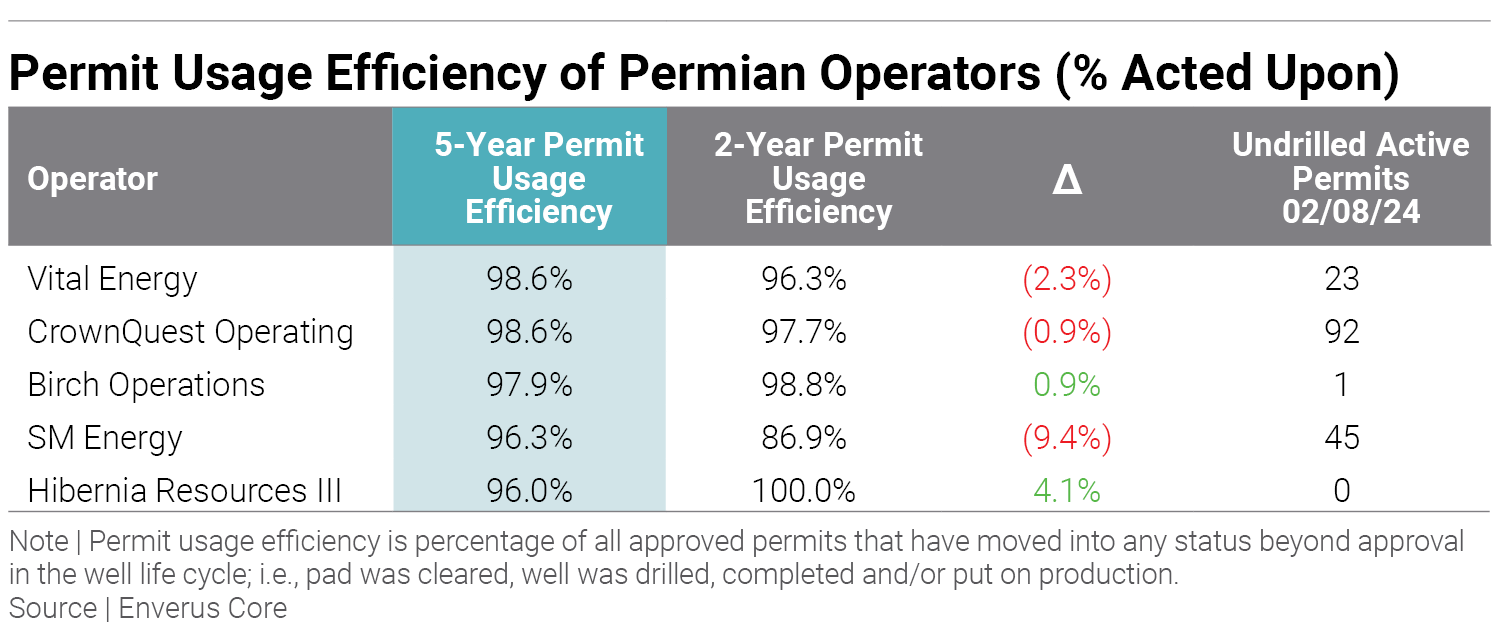

Enverus has ranked a collection of the most prominent operators in the Permian based on their average permit usage efficiency in the basin over the last five years. (Enverus Core users, click here to interact with the workbook.) Vital Energy ranks the highest, having converted 98.6% of its drilling permits, followed by just a hundredth of a percent by privately held CrownQuest Operating, whose operating JV company CrownRock LP is being acquired by Occidental Petroleum. Private equity-backed Midland Basin player Birch Operations came in third at 97.9%, SM Energy fourth at 96.3% and Hibernia Resources III, which is being acquired by Civitas Resources, fifth at 96.0%. Hibernia is one of two ranked companies that had 100% permit usage efficiencies in the last two years—the other being Surge Operating.

For the most part, operators that had five-year permit usage efficiency exceeding 90% also had a very high drilling efficiency over just the most recent two years of activity. This consistently high conversion indicates that these companies apply only for permits of wells they intend to drill rather than use them as placeholders for potential future activity.

Conversely, companies on the low end of the long-term permit usage range appear mostly to have not attempted to improve their efficiency. The few companies that have demonstrated significant improvements include Callon Petroleum, Tap Rock Resources, APA Corp., which agreed in January to acquire Callon, Surge Operating and Lario Oil & Gas.

Interestingly, some of the largest players in the Permian are collected at the bottom of permit usage efficiency scale. These include Marathon Oil, EOG Resources and Devon Energy, which hold 1,466 undrilled active permits among them. (Enverus Core users, click here to interact with the workbook.) Companies working with operators in the Permian should be aware and use this and other data available from Enverus to get a much more accurate reflection of possible work from these major players.

The above table represents a small selection of the companies ranked in the latest issue of Upstream Pulse. Enverus Intelligence Publications subscribers can see the full ranking here.

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.