Even multi-national conglomerates can suffer devastating trade losses. In 2019, a subsidiary to a global manufacturing firm was forced to shutter after a single oil derivatives trader racked up more than $300 million in losses when his positions settled prematurely.

“Sound and thoroughly enforced” risk management systems are paramount

What went wrong on that trade floor? According to the company, the trader manipulated data within the risk management system, creating an internal mirage that made the transactions appear to be related to bona fide trades with customers.

The company maintains that adequate risk management controls were in place, but it is also actively engaging in a tightening of its risk management systems to prevent any future recurrence.

Trade validations, audit trails, and forward curve management

Without secure and armored systems in place, you lack the ability to make regular validations and proactive risk management that keep the entire ship afloat.

This dramatic blow to a large company’s global bottom line puts a spotlight on energy trading and risk management. It further highlights the importance of price validations, audit trails, and management of forward curves and their impact on the business.

Energy traders are more sophisticated than ever. Yet our team often encounters companies that lack the necessary internal processes to manage the nightmares that can result from human error in trading. Without secure and armored systems in place, you lack the ability to make regular validations and proactive risk management that keep the entire ship afloat.

From Excel users who have one individual running the entire forward curves management process, to groups that use manual curve generations pulling from multiple internal systems, there are several ways that our standard out-of-the-box solutions can enhance homegrown systems.

Manual intervention versus automated processes

Any manual data entry processes are prone to human error. Even a minor misreporting of pricing data could result in millions of dollars in unforeseen exposure. A lack of automation and validation triggered intervention means it may be too late to hedge a risk, even if the curve is off by a small amount.

In an ideal world, a curve management system is in place, performing automated calculations and validations and notifying users when to act. These systems help risk and pricing managers proactively manage price risk versus reactively responding when an unforeseen exposure is found.

This is particularly true in nested scenarios, where one forward curve builds into the next layer. In these scenarios, firms need to view the individual inputs throughout a calculation and easily audit these results. Whether a methodology changes or a settlement price is corrected, risk managers should have the ability to apply quality controls to their data. It is vital to have the capability to look for validation scenarios. If prices exceed a certain threshold, users should be notified, and the problem can be addressed immediately.

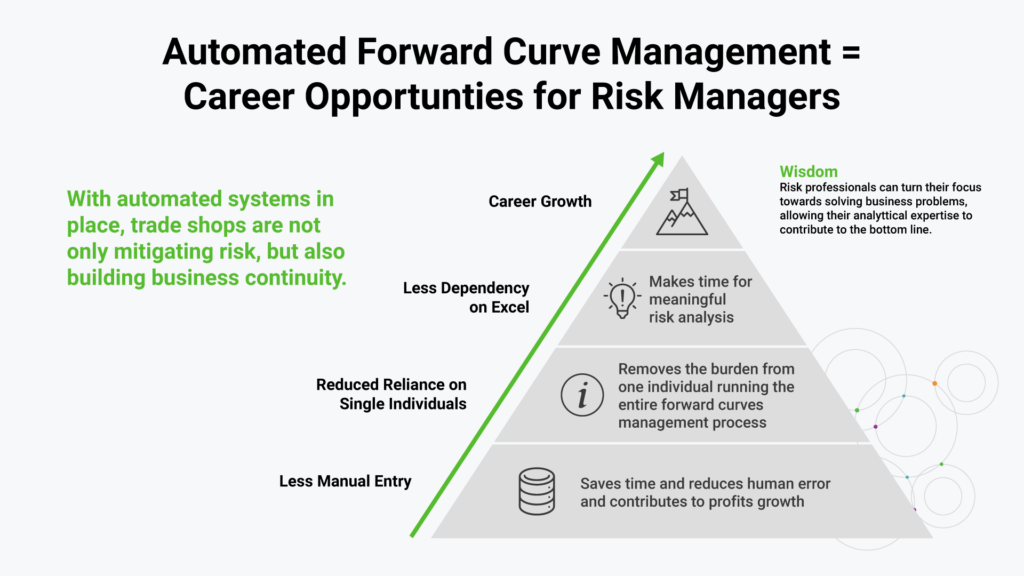

Automated forward curve management helps risk managers grow the bottom line

With automated systems in place, trade shops are not only mitigating risk, but also building business continuity. When companies use a system to automate their curve management and embed validations into their business process, these professionals can turn their focus toward solving business problems, allowing their analytical expertise to contribute to the bottom line.

Many risk managers have teams performing drawn-out and repetitive daily tasks, rather than utilizing their strong skillset to grow the entire trade organization. An automated system helps trade floors reroute their talent and leverage their advanced commodity market backgrounds. Suddenly these teams are using their skillsets to find and act on validations and market swings. Wouldn’t you rather look for trade opportunities instead of managing manual processes in Excel?

At Enverus Trading & Risk, we have standard processes running more than 10 million forward curves. Our standard out-of-the-box solution can be tailored to your needs with fresh custom processes to enhance audits and compliance practices through forward curve management. We recognize that every trade shop has different demands, which is why we work with customers to address their individual needs. Don’t be shy about learning more and sign up for a tour of our forward curves services today.

Fill out the form below to speak with an expert.