Offshore Gulf of Mexico (GOM) is becoming the destination of choice for international oil companies seeking new, low-carbon acreage to explore and develop. Lease Sale 257 on Nov. 17 garnered $192 million in winning bids, about double the average of the previous seven auctions, across 170 deep- and 140 shallow-water blocks. The sale went ahead after a court blocked the Biden administration’s lease moratorium imposed early this year. The moratorium was to allow the U.S. Department of the Interior to review the environmental impacts associated with oil and gas activities on public lands and in offshore waters.

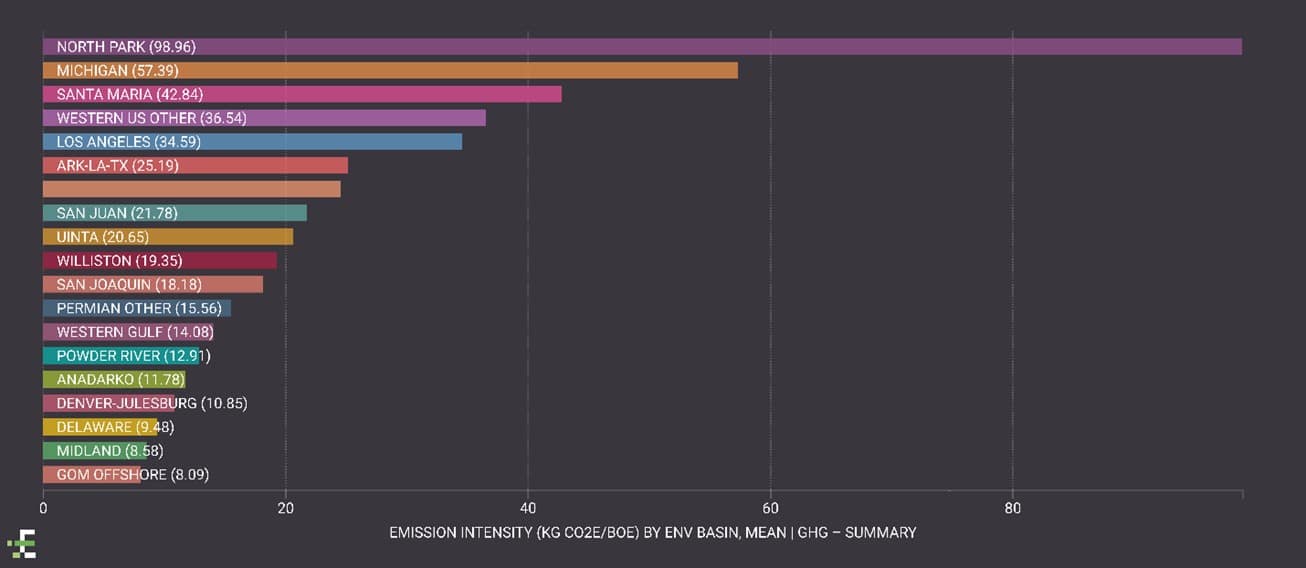

Unsurprisingly, the sale drew criticism from environmentalists despite the basin offering the lowest Scope 1 greenhouse gas emissions intensity in the U.S. at 8 kg CO2e/boe (Figure 1). The GOM’s Scope 1 emissions are even competitive on a global scale. The Oil and Gas Climate Initiative (OGCI), whose members include the so-called supermajors responsible for 30% of total world oil production, has a 2025 emissions target of 17 kg CO2e/boe from its members’ operated upstream assets, more than double the GOM average.

We mostly attribute the low emissions profile to a well-developed gas offtake infrastructure and market that reduces the need for flaring. In addition, the GOM has strict ESG regulations, relatively young infrastructure and significant discovered but undeveloped hydrocarbon resources. The continued investment by supermajors confirms the basin’s global top-tier status despite their commitment to reduce oil production and emissions. Chevron, Shell and BP accounted for half of money spent at Sale 257, strengthening their positions in the basin. Other U.S. operators are following suit, with Occidental spending 33% more this year than its total spending in the region for all sales since 2019.

With global demand for oil and gas still increasing, the GOM looks set to attract a growing proportion of the supermajors’ development capital spending, allowing them to produce more oil and gas but still improve their overall carbon intensity scores. Using our PRISM data platform, Enverus clients are readily able to benchmark U.S. ESG metrics at a basin, play, operator or asset level, helping them make smarter and faster investment decisions during the energy transition.

Figure 1 | U.S. GHG Emission Intensity by Basin

Source | Enverus