Over the last few quarters, executives at U.S. upstream operators have grown accustomed to analysts asking about cost inflation. It’s an inevitable part of every conference call. During the late July to mid-August earnings season for Q2, the question shifted to possible deflation, with companies across America’s shale patch making small note of an improved cost environment. Falling H2 costs were broadly predicted, but companies don’t seem to be making significant changes to their 2023 plans as a result.

The consensus is that there will be lower costs in some specific categories such as sand, steel, tubulars, chemicals and services. Some companies have reaped savings; Eagle Ford pure-play SilverBow Resources, for example, says it has realized 5-10% in drilling and completion savings this year. Others haven’t, because of specific needs or because they locked in pricing at the end of 2022 or early this year. A deflationary environment looks to benefit their 2024 outlook more than 2023.

Callon Petroleum CEO Joseph Gatto said spot market items like steel casing and sand are down 15-20% and chemicals and service equipment costs have softened. “We recently re-contracted two drilling rigs at rates that were below our previous rates. Overall, we expect to realize an incremental $15 million in savings in the second half both from service costs and the early impacts of structural design modifications,” Gatto said.

EOG and Pioneer’s preference for high-spec rigs keeps them out of spot market.

Pioneer Natural Resources COO Richard Dealy also noted declines in steel, casing, tubular goods and chemicals, but says the rigs that have seen price declines so far aren’t for Pioneer. “We’ve heard commentary about rig rates and frac fleet rates coming down. From what we have seen, those are mainly on spot rates, and they’re on, what I’d call, less efficient rigs and Tier 2 equipment on the frac side. And when we look at our contracts, just given our size and scale, our contracts today are still below where those spot prices are being quoted,” Dealy said.

Similarly, EOG Resources COO Lloyd Helms said his company is also picky about its equipment. “As a company, we focused on sustainable cost reductions through our operational efficiency gains. As a result, we do seek out the highest-performing equipment in crews, super-spec rigs, electric frac fleets, etc., that’s really less exposed to some of these headline inflation numbers that we’re seeing on the more marginal-end equipment on the spot market,” Helms said.

Big waves of sourcing & contracting coming for 2024; spot buyers may save now.

If Permian player APA Corp. saves any money in H2, it’s going to count its cash. CEO John Christmann said that despite deflation in service costs, the company is operating at a “good cadence,” so any benefits from lower costs “would come to free cash flow and the [D&C] program will be pretty stable.” He noted that lower costs at this point in the year are more actionable in 2024 depending on the commodity price outlook.

“We do try to go in every year with a pretty set framework on the capital side,” Christmann said. “And so, a lot of what’s going on this fall will dictate what our service costs will look like for the portions that we will try to lock down for next year… And clearly, you’ve had a little bit of softening in some areas right now, but I think everybody is waiting to kind of see what prices do in the back half of the year to really steer next year’s capital.”

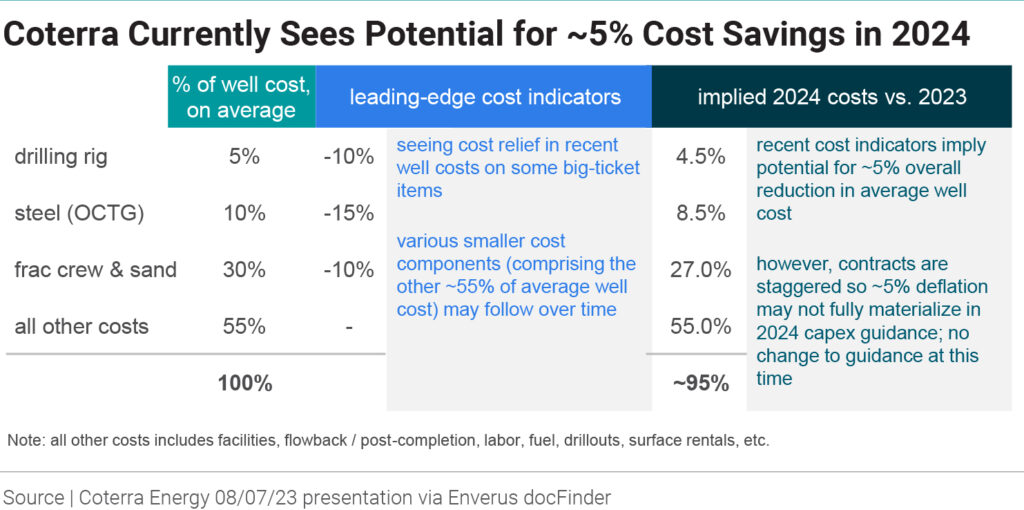

Multi-basin operator Coterra Energy is also looking toward the future. CEO Thomas Jorden lamented that while costs have moderated, they have not come down as “significantly as we hoped.” He expects 2024 wells costs to fall 5% with some “big ticket items” potentially dropping as much as 10-15%.

Appalachian and Haynesville driller Southwestern Energy is also making a 10-15% deflationary call on 2024. Gas-producing peer Chesapeake Energy anticipates a 5-7% drop in D&C costs next year. However, oil-weighted Occidental Petroleum’s CEO Vicki Hollub isn’t ready to say 2024 costs will come down or acknowledge much softening YTD.

“We’re seeing some things start to plateau in terms of cost. We’re seeing labor being still a bit tight,” Hollub said. “But we’re not seeing as many people wanting to change jobs. It’s just a matter of getting the skills that we need in the field, and that’s where the big challenge is to get truckers to drive trucks and people to do the welding and those kinds of fill jobs are so important to us. While we’re not seeing much reduction in service company costs, we don’t expect that. But I don’t think we’ve settled on expecting any kind of increase next year.”

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.