[contextly_auto_sidebar]

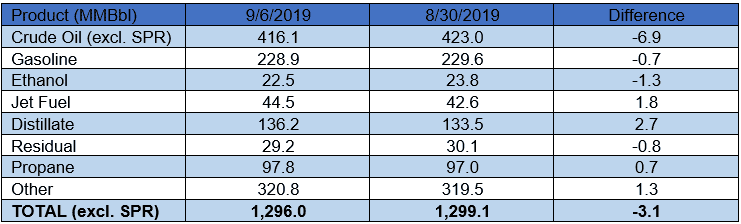

US crude oil stocks posted a decrease of 6.9 MMBbl from last week. Gasoline inventories decreased 0.7 MMBbl and distillate inventories increased 2.7 MMBbl. Yesterday afternoon, API reported a large crude oil draw of 7.2 MMBbl, alongside a gasoline draw of 4.5 MMBbl and a distillate build of 0.6 MMBbl. Analysts were expecting a smaller crude oil draw of 2.6 MMBbl. The most important number to keep an eye on, total petroleum inventories, posted a decrease of 3.1 MMBbl. For a summary of the crude oil and petroleum product stock movements, see the table below.

US crude oil production remained unchanged last week, per the EIA. Crude oil imports were down 0.2 MMBbl/d last week, to an average of 6.7 MMBbl/d. Refinery inputs averaged 17.5 MMBbl/d (114 MBbl/d more than last week’s average), leading to a utilization rate of 95.1%. Prices slides down despite of the large crude draw and total petroleum stocks withdrawal. Prompt-month WTI was trading down $1.41/Bbl, at $55.99/Bbl, at the time of writing.

Prices have been on an upward trend since last week following a couple of consecutive weeks of declining crude inventories as well as heightened tensions in the Middle East after Yemeni troops launched missile attacks against Saudi troops, an incident that could complicate US-Iran relations as well. Prices last week also got support from comments by the Chinese Commerce Ministry that US and Chinese officials would meet in October to resume the negotiations on the ongoing trade disputes on import duties and intellectual property rights. However, the uncertainty around this issue and its impact on global economic health have been pressuring prices and will continue to do so until a deal is officially announced by both parties.

The rally in prices continued at the beginning of the week as crude futures rose to their highest settlement in nearly six weeks, following the comments from Saudi Arabia’s new energy minister on Saudi Arabi and OPEC’s commitment to supply cuts and balancing the market. The new Saudi energy minister, Prince Abdulaziz bin Salman, who replaced Khalid al-Falih, said the Kingdom will stay committed to the supply cuts to keep the oil supply tight. The price reaction to this news was positive as the market anticipates that Saudi Arabia will remain committed to increasing prices in order for a successful IPO of Saudi Aramco. The OPEC+ deal’s joint ministerial monitoring committee will meet on Thursday in Abu Dhabi. The market will be closely watching any outcome from this meeting in terms of any announcement on the supply cuts. The expectation will be the continuation of supply curbs by the group in order to increase prices in a market where demand continues to deteriorate.

Although the bullish sentiment has increased over the past week due to Middle East tensions and Saudi Arabia’s willingness to balance the market, the price rally had a brief pause on Tuesday after the departure of US National Security Adviser John Bolton. Bolton’s departure raised the possibility of easing tensions with Iran, which potentially could lead to the US lifting the Iranian oil sanctions, thus increasing the oil supply in the market.

The recent bullish sentiment from Saudi Arabia and rising tensions in Middle East as well as the uncertainty around the US–China trade war will continue to keep prices volatile in the near term. The recent range between $53.00 and $58.00 that held prices last week may hold in the coming week without developments on the US–China trade disputes and an unexpected outcome from the JMMC meeting in Abu Dhabi. The long-term range between $50.00 and $61.00 will likely hold trade without significant resolution of the trade wars or additional reductions in OPEC output. The longer the market stays in this tight range, the more likely significant volatility will occur when it breaks out of the range, either up or down.