As winter approaches, it’s critical that power traders, analysts and asset managers stay up to date about shifting dynamics in the power markets. Our Winter 2024 Power Market Outlook webinar explored the latest developments for the New York Independent System Operator (NYISO), Mid-Columbia (Mid-C) and ISO New England (ISO-NE) regions. This blog expands on the highlights, diving into weather forecasts, renewable energy transitions, market dynamics and price predictions to equip you with actionable insights for the season ahead.

With a 15-year head start in renewables and grid intelligence, real-time grid optimization tothe node, and unparalleled expertise in load forecasting that has outperformed the ISO forecasts, Enverus Power and Renewables is uniquely positioned to support all power insight needs and data driven decision making. More than 6,000 businesses, including 1,000+ in electric power markets, rely on our solutions daily.

NYISO: Navigating Renewable Expansion Amid Volatile Weather

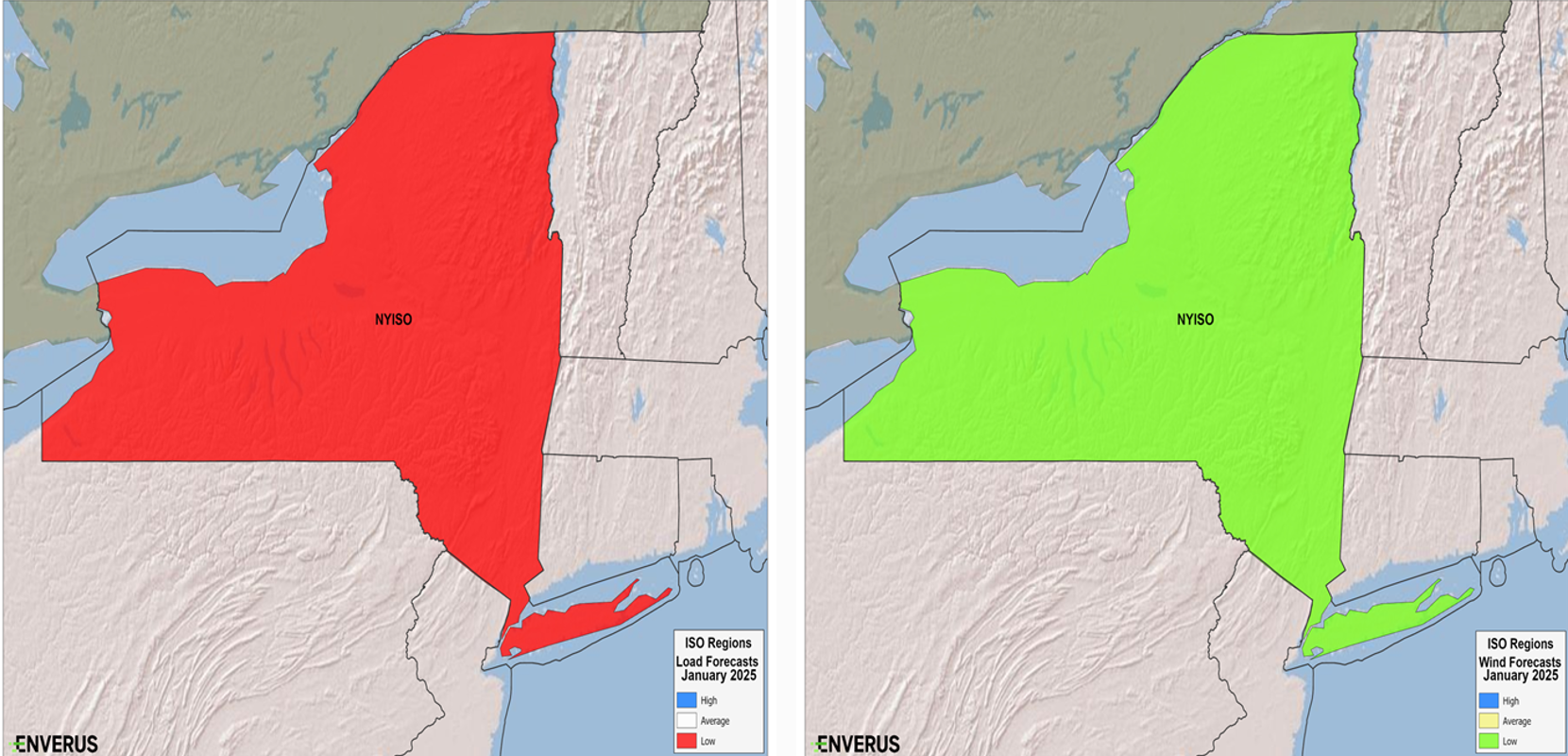

Weather Outlook and Load Predictions

NYISO’s winter will likely be shaped by ENSO-neutral to weak La Niña conditions, with December predicted to experience below-average temperatures, increasing heating degree days. In contrast, January and February are forecasted to be milder, reducing overall load expectations but leaving room for price volatility during cold snaps.

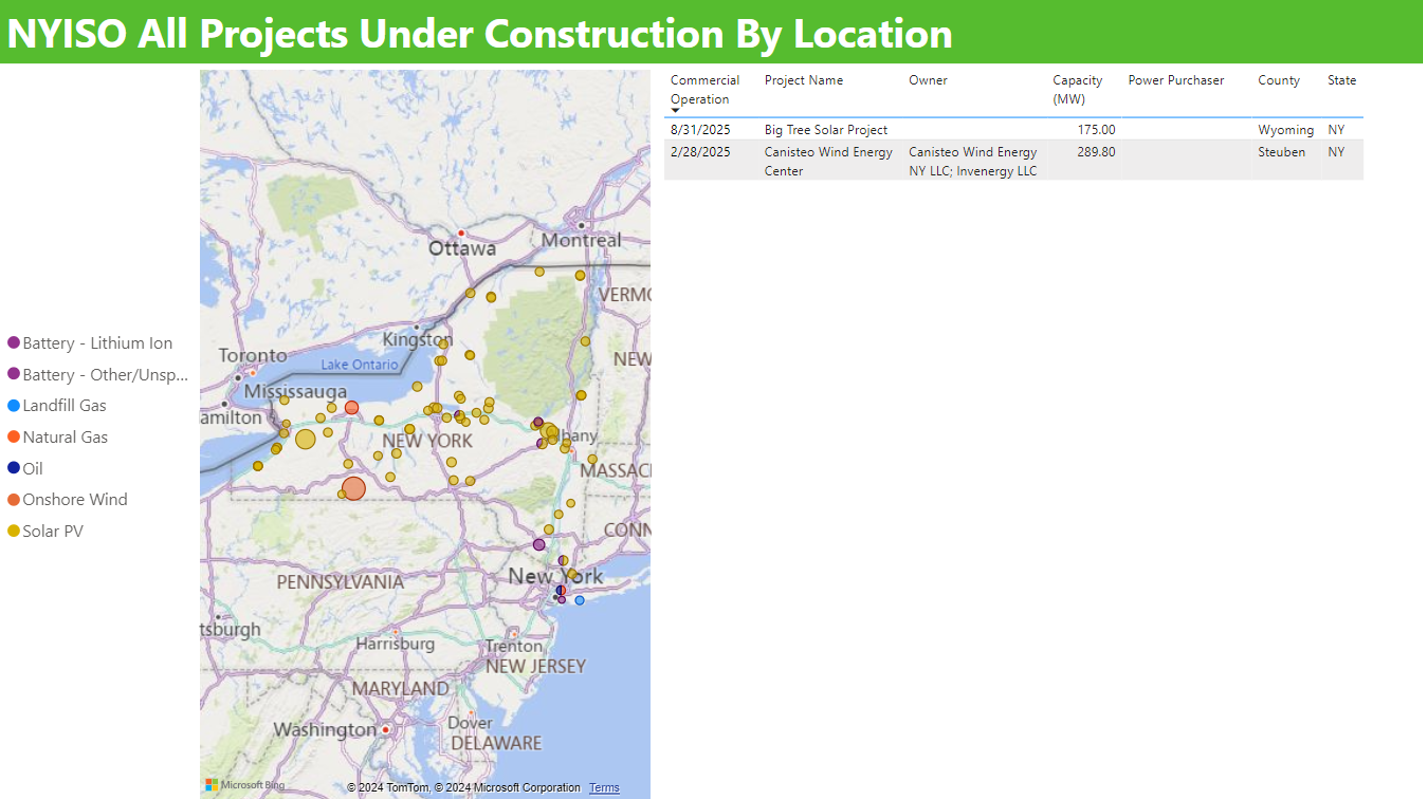

Renewable Energy Developments

New York continues its ambitious clean energy transformation, driven by projects like:

- Big Tree Solar Project (175 MW with 20 MW of battery storage), anticipated to address grid congestion in western New York

- Steel Winds Energy Center, a 290 MW wind facility aimed at bolstering regional reliability

Market Dynamics and Price Forecasts

NYISO faces high variability in December prices, with bullish scenarios driven by tight reserves and potential cold spells. January’s milder temperatures may soften demand, but lingering risks remain from high gas prices and constrained capacity. The Regional Greenhouse Gas Initiative has further raised fossil fuel generation costs, influencing heat rate forecasts.

Interested in getting insights like these daily? Check out a sample of our Power Market Publications:

ISO-NE: Balancing Growth and Clean Energy Ambitions

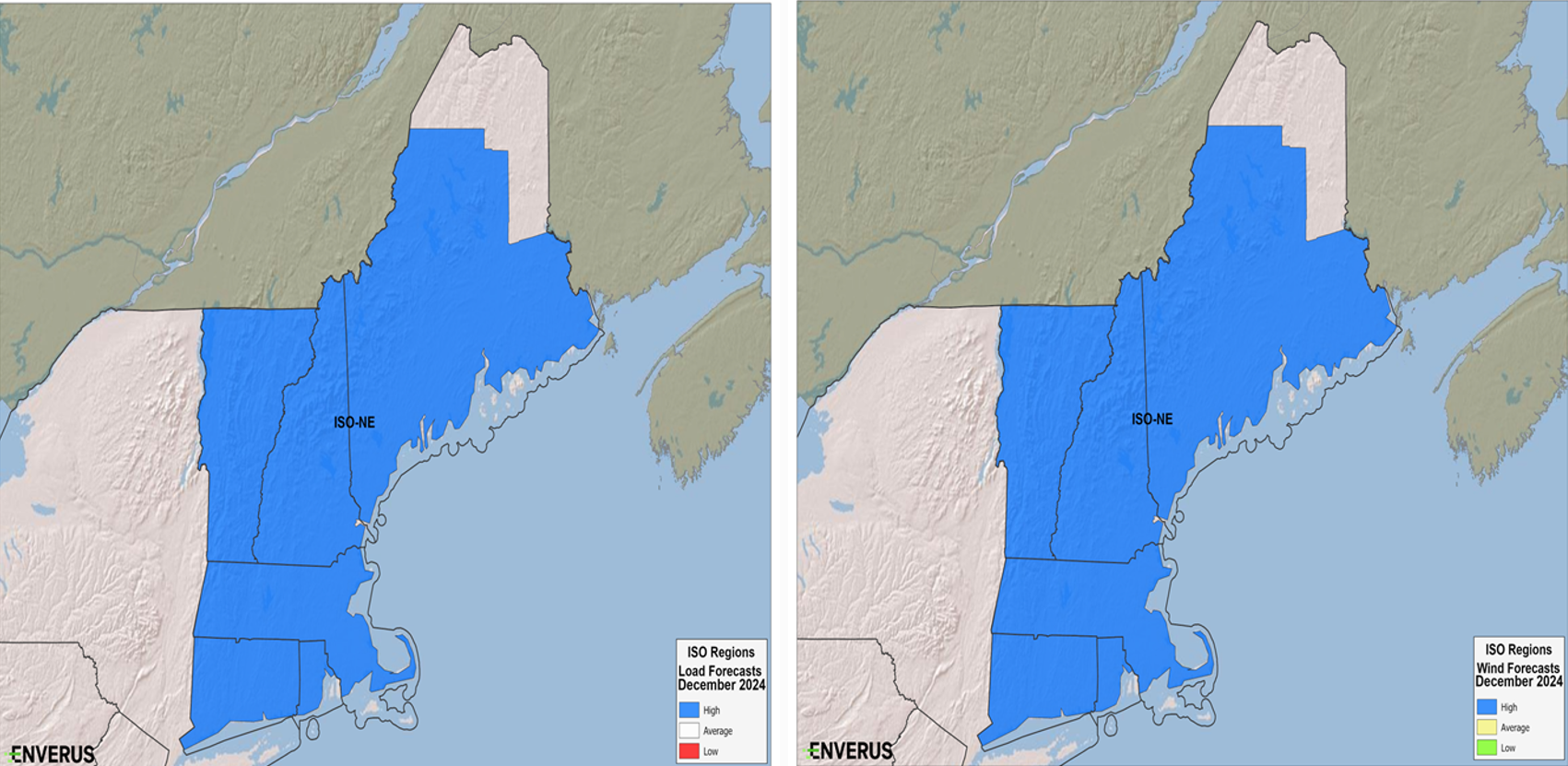

Weather Patterns and Load Predictions

ISO-NE is expected to experience above-average temperatures for much of the winter, except December, which may be colder than usual. The potential for short-term extreme weather remains high, warranting close monitoring.

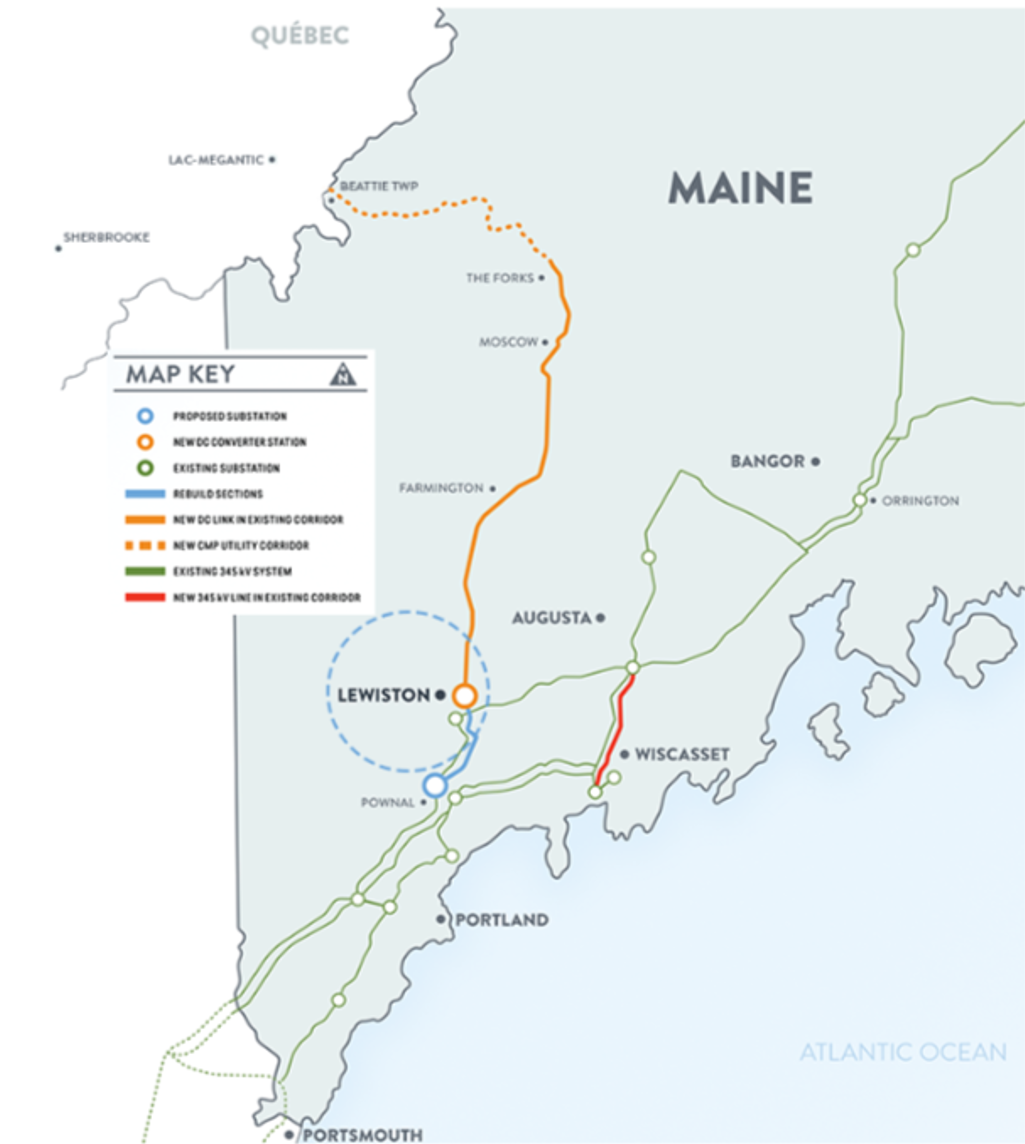

Infrastructure Developments

ISO-NE is advancing projects like:

- Vineyard Wind, partially operational with a capacity of 136 MW, leading the nation’s offshore wind initiatives

- New England Clean Energy Connect (NECEC), bringing 1,200 MW of hydro power from Canada into the grid

Market Trends and Prices

ISO-NE’s price trends mirror NYISO, with December facing the most upward pressure due to heating demand. Low solar generation further shifts reliance to natural gas and oil, raising winter price forecasts. Transmission upgrades aim to reduce localized congestion, though key constraints remain.

Mid-C: Capacity Challenges and the Influence of Hydro Generation

Hydro and Load Forecasts

The Mid-C region is expected to see average precipitation levels, with potential dry spells in December offset by wetter January conditions. Historically cold winters like 2017 serve as analog years, pointing to risks of sharp and prolonged demand spikes.

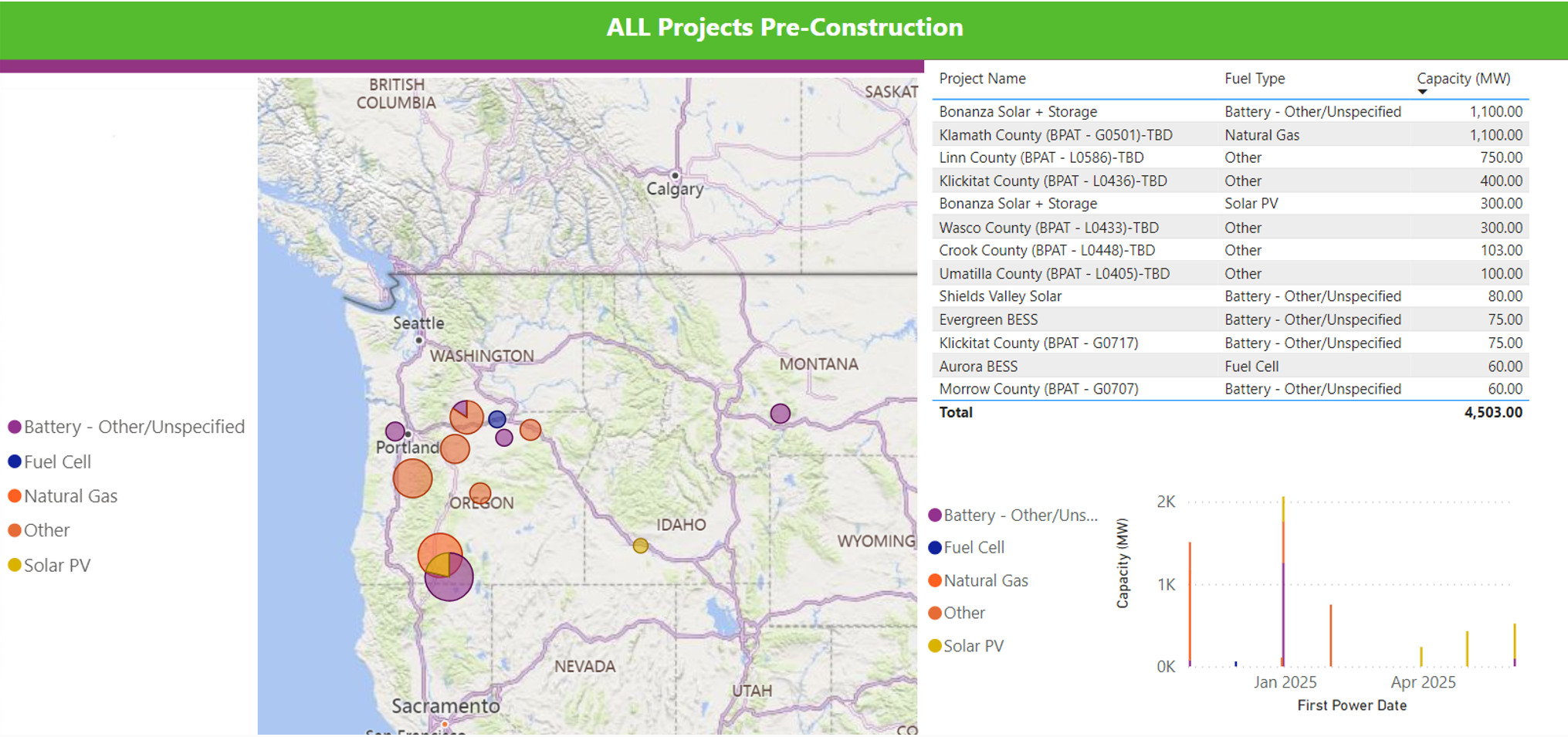

Mid-C faces pressing capacity issues due to limited new thermal builds and coal plant retirements, notably Colstrip. While renewable additions like the Klamath Cogen expansion (1,100 MW) provide some hope, they are insufficient to address the near-term shortfall.

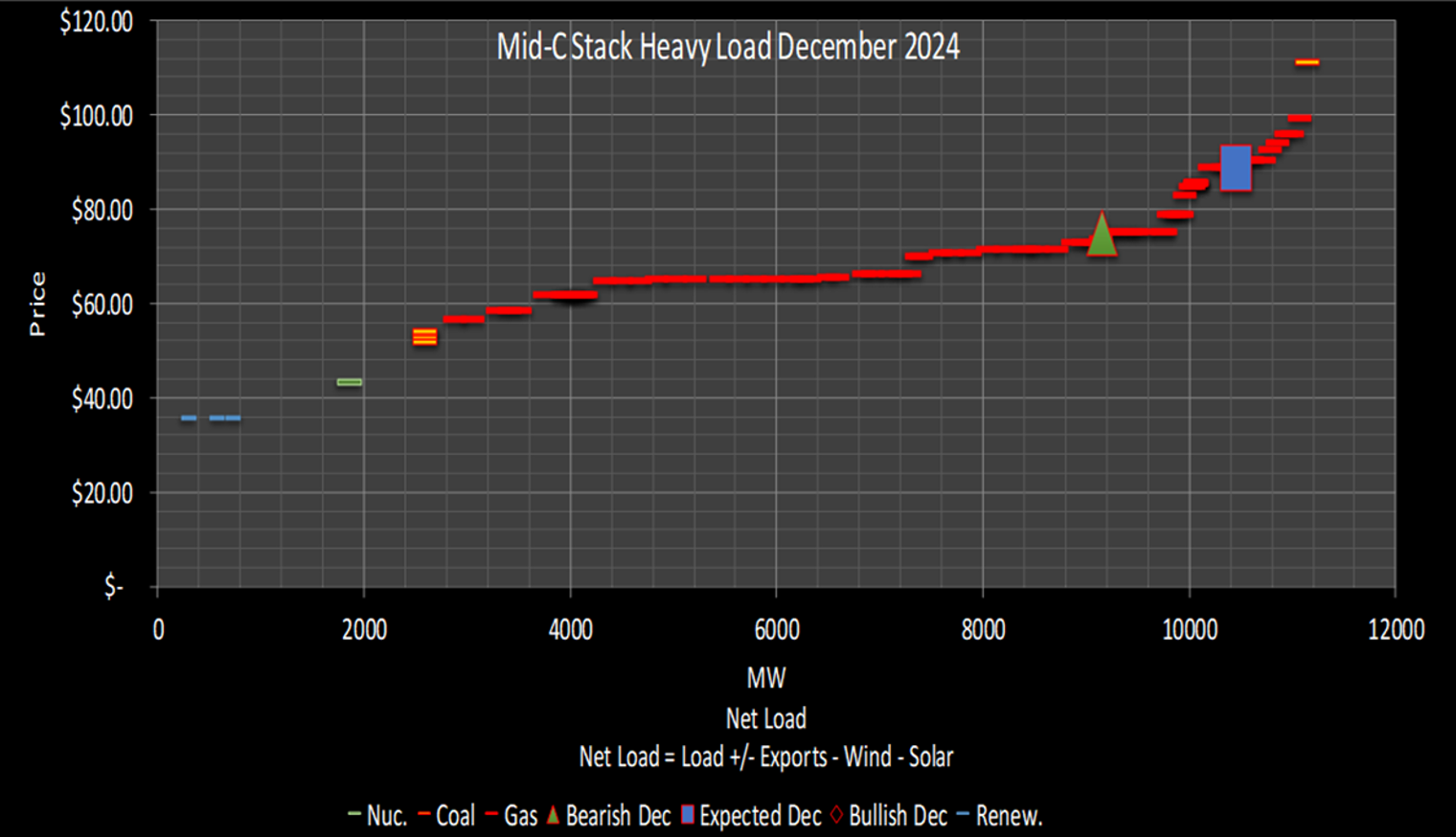

Price and Market Dynamics

Capacity constraints, combined with Washington’s carbon pricing, push Mid-C’s prices higher than the market base case. December’s hydro generation levels will play a pivotal role in price trends. Scarcity pricing is a significant risk during prolonged cold snaps, particularly as wind generation typically declines during such events.