Introduction

Producers and stakeholders are at a crossroads, as the oil and gas market balances asset longevity with immediate returns, while also managing the escalating demand for operational efficiency. Asset teams are key to successfully navigating this delicate and complex environment, holding the keys to unlock ways to optimize resource allocation while sustaining profitability.

Our investigation transitions now to strategizing development across the area of interest in the Midland Basin that we dove into to explore the subsurface intricacies in Part 1: Decoding the Subsurface.

Our aim in Part 2 of the Advanced Workflow Blog Series is to chart the most resource-efficient and economically viable pathway forward, though four key steps:

Part 2: Comprehensive Production Evaluation – Looking Beyond Single Well Performance

Step 1. Decoding the Development Paradigm

The Midland Basin, with its diverse stratigraphy, defies simple, blanket development strategies. Techniques like batch drilling and simultaneous completions are promising but require nuanced application due to the basin’s geological variability.

The biggest question within these batch drills or co-completed developments is, What is the optimal spacing for each zone? And, subsequently, how does my development timing impact spacing? The answer to these questions varies across the basin, alongside the variation in the optimal amount of stacked pay and productivity per zone. To identify an answer, we need to look at the whole drilling spacing unit (DSU) to truly understand how the wells will impact one another, both horizontally and vertically in the subsurface.

Step 2. Aggregating Metrics at the DSU Level

Average well production can only take your analysis so far because it lacks nuance around spacing and full stack development. When production and economics are aggregated at the DSU level, this then allows us to truly identify the parts of the basin that are the most prolific, but also potentially the most depleted, all while factoring in the geological diversity that defines the basin.

Step 3. Quantifying Production Degradation: Timing Matters

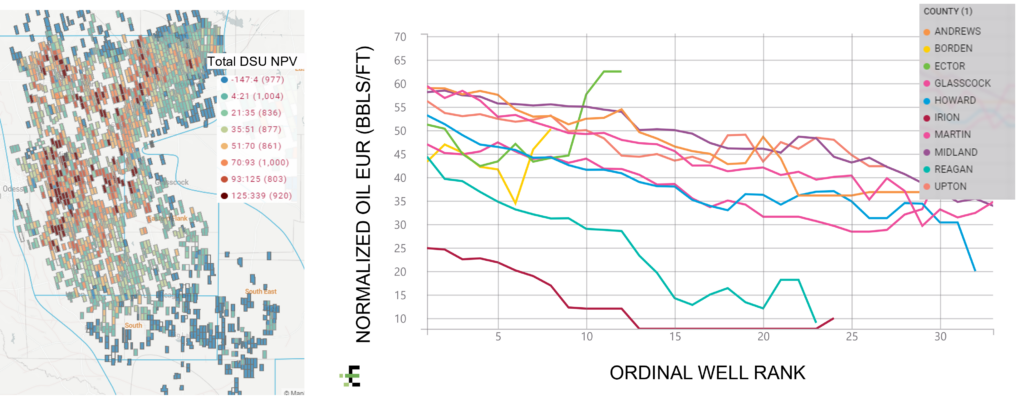

A distinct pattern across the basin underscores the influence of development timing on production efficiency. Our analysis reveals a noticeable decline in oil EURs for wells initiated later within the same units, a trend particularly pronounced in shallower regions of the basin. The data suggests the critical need for foresighted development strategies that preserve future production potential.

In the most heavily developed areas, we are seeing lateral-normalized oil EURs drop from around 45-60 bbls/ft in the first wells in the unit to about 28-44 bbls/ft in the twenty fifth well in the unit (Figure 1). This puts undeveloped reserves heavily at risk when units are revisited after only one or two zones are developed initially.

We see this production degradation impact is more exaggerated in shallower zones of the Midland Basin (e.g. Jo Mill, Middle Spraberry and Lower Spraberry).

Step 4. Finding the Development Sweet Spot

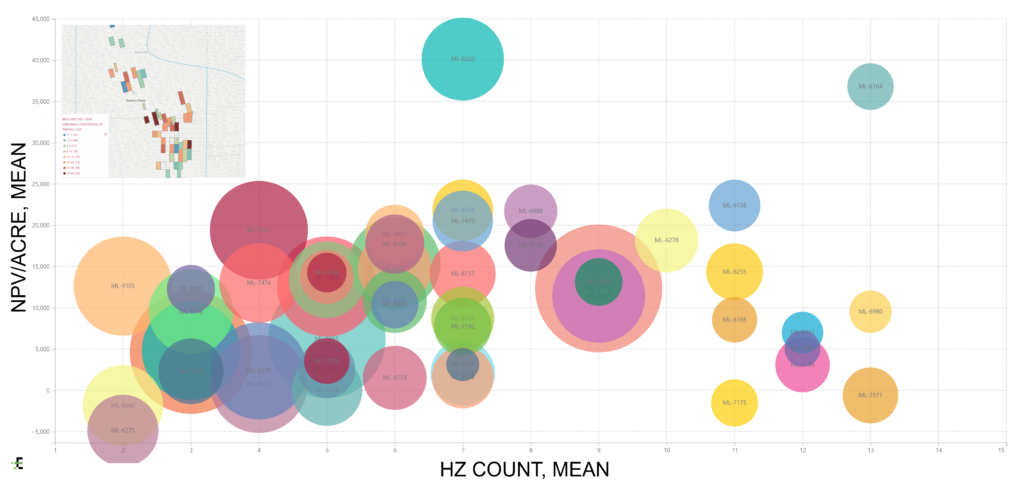

As more wells are packed into a DSU, EUR and NPV per acre is expected to improve – to a tipping point. It is possible to reach the point of diminishing returns by packing too many wells into the unit, thus negatively affecting capital efficiency (Figure 2).

The allure of maximizing immediate well count within a DSU can lead to a short-sighted saturation, jeopardizing long-term capital efficiency. Striking the right balance between well density and economic sustainability demands a tailored, strategic approach to development.

Key Takeaways: The Enverus Advantage

As the industry contends with these complex challenges, the transition from well-centric analysis to overarching development strategy becomes imperative. Comprehensive insights and analytics from Enverus empower stakeholders to not only navigate but thrive amid these dynamics. With Enverus Development Modeling Solutions, you will be able to strike that balance between productivity, inventory and capital efficiency to deliver a blueprint for maximized profitability.

Join us in our upcoming webinar where we go deeper into these strategies, offering a comprehensive guide on deploying Enverus tools for optimal development planning.