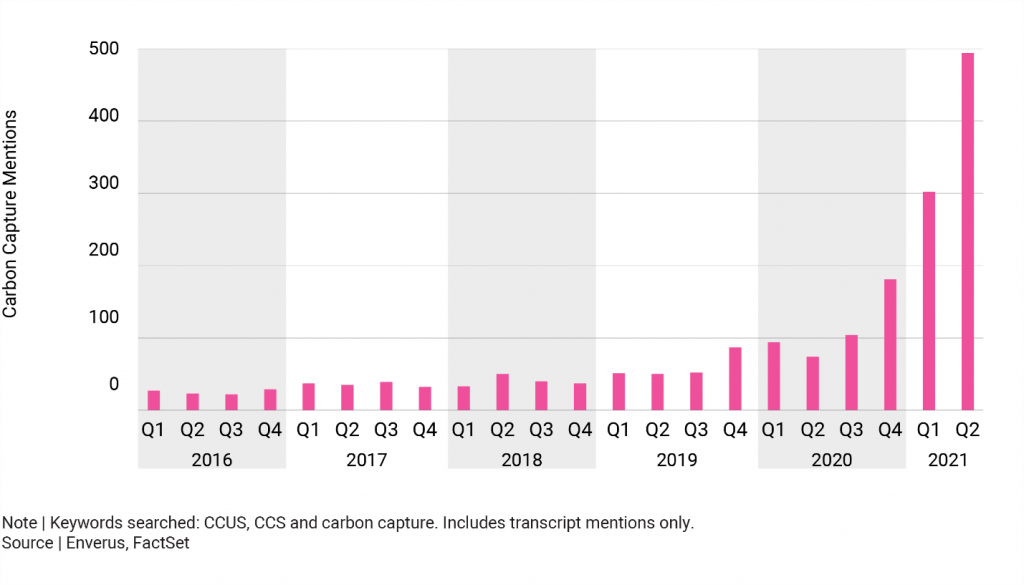

Over the past few quarters, interest has surged in carbon capture, utilization and storage (CCUS) technology. Policy enhancements are providing a pathway to viable carbon capture business models and have spurred a string of announced projects across the value chain. As companies begin screening for the most compelling opportunities for carbon capture, offtake and storage operations, we believe it is critical to understand emission profiles. This information helps locate and quantify cheap-to-abate emission volumes and identify profitable CO2 reduction opportunities using CCUS.

FIGURE 1 | Carbon Capture Headline Mentions by Quarter

OK, wait … what is CCUS?

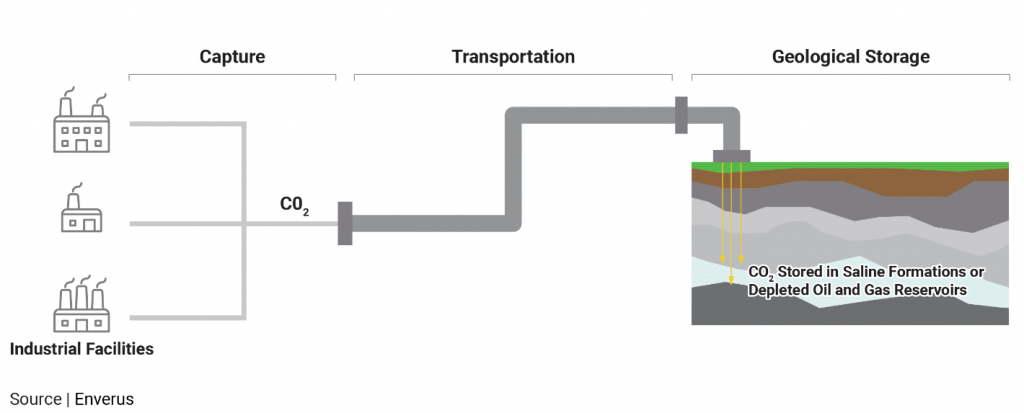

CCUS, or carbon capture, utilization and storage, is the process of capturing CO2 from industrial point sources and either sequestering it permanently underground or using it for EOR or the production of other materials, fuels or chemicals. The value chain can be thought of in three segments: carbon capture, transportation and storage in an appropriate sink. Today, CCUS technology is used to capture CO2 emissions from industries such as power generation, natural gas processing, fertilizer production and oil refining.

FIGURE 2 | CCUS Value Chain

How do we characterize emission profiles?

The following factors allow us to grade point sources to identify attractive CCUS opportunities:

- Location of point sources.

- Density of point sources.

- Point source CO2 volumes.

- Purity and concentration of CO2 in gas streams.

Why is understanding emission profiles important to CCUS deployment?

At the sector and projects levels, significant deviation in capture cost estimates reflect the varied concentration and purity of CO2 in the processed gas stream. Natural gas processing and ammonia production screen, on average, as some of the lowest capture cost subsectors because CO2 is inherently produced in the process. Iron and steel, power generation and cement manufacturing, on the other hand, are typically the hardest to abate due to the lower concentration of CO2 in the gas streams.

The size and density of stationary sources are also important considerations. CCUS typically favors facilities with higher emissions as economies of scale are more easily reached through lower per-unit transportation and storage costs.

How do these projects actually make money?

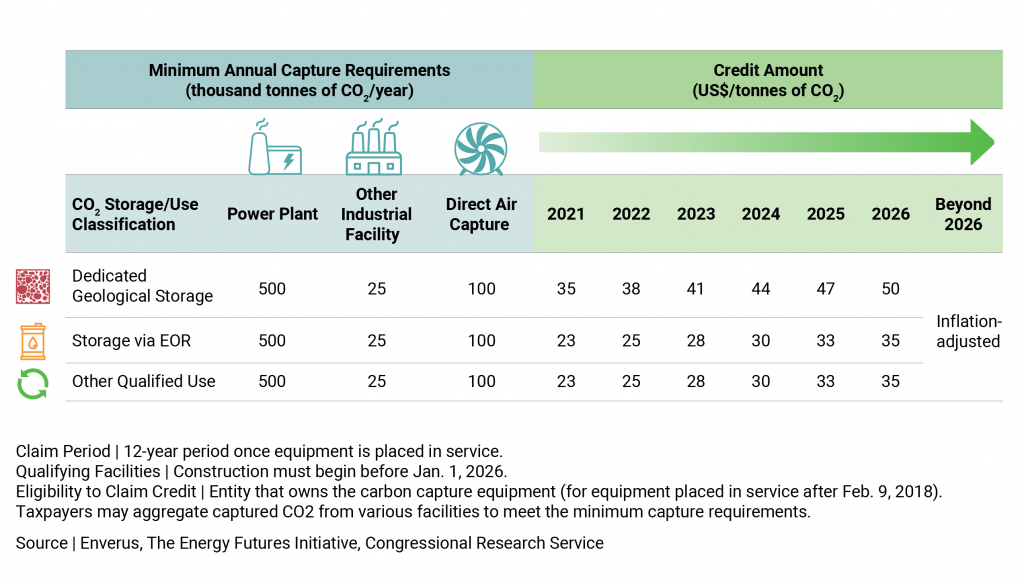

Earlier this year, the U.S. federal government expanded and extended its 45Q tax credit to provide increased stability and certainty for CCUS developers and investors alike, and to enhance the economics for both CO2-EOR and permanent sequestration. The tax credit flatlines in 2026 at $35/tonne for CO2-EOR applications and $50/tonne for permanent sequestration. The credit value must be shared across the capture, transportation and storage entities.

FIGURE 3 | Summary of the Internal Revenue Code Section 45Q Credit

In Canada, the carbon tax provides a strong incentive for emission reduction. The regulated price is C$40/tonne CO2 in 2021 and escalates towards C$170/tonne CO2 in 2030.

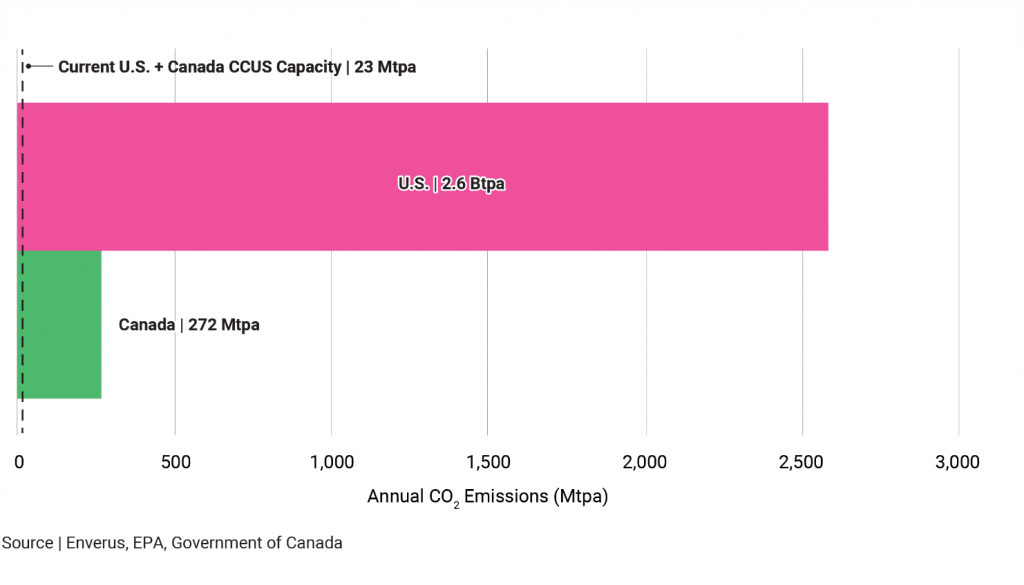

What’s the size of the prize?

In 2019, the U.S. and Canada combined emitted nearly 3 billion tonnes of CO2 from stationary sources, about 9% of the global total. As of September 2021, operational CCUS projects capture roughly 23 million tonnes per year (Mtpa) of CO2 across both countries, or less than 1% of 2019 emissions. We believe significant opportunities exist to scale the technology to meet emission reduction objectives.

FIGURE 4 | 2019 CO22 Point Source Emissions by Country

Got it! So how do we locate these opportunities?

Through the combined efforts of Enverus ESG Analytics and Enverus Intelligence, we analyzed emission profiles across more than 9,000 facilities to identify top opportunities for CCUS deployment. Factors such as facility location, CO2 volumes and sector were all key considerations leveraged in our analysis. This information is invaluable for infrastructure players, operators and low-carbon investors interested in understanding the CCUS landscape and seeking out the most compelling projects in the space.

We hope that we can show you how our analytics and insights will benefit your workflows. You can book a preview of our solutions with us here. Or fill out the form below and an Enverus Expert will reach out to you!