Updating hundreds of thousands of type curves with new production data is no small feat. At Enverus, we use a proprietary type curve algorithm to draw and update type curves automatically in Enverus CORE based on our cleaned production data, leaving our analysts time to work on high-value analysis.

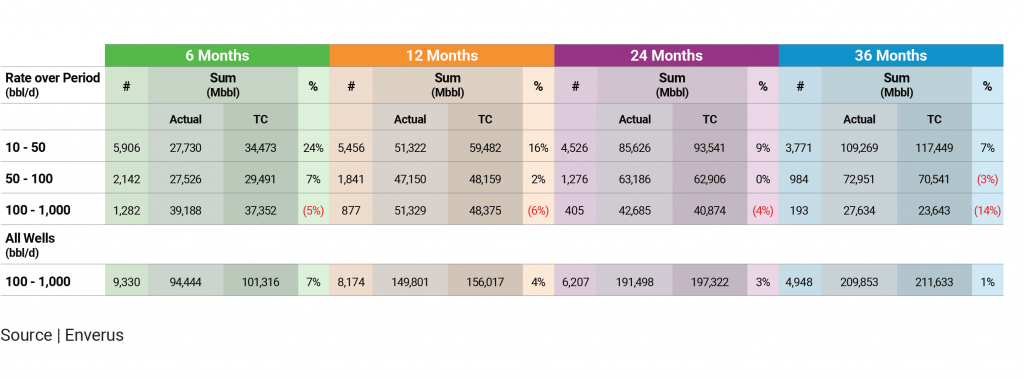

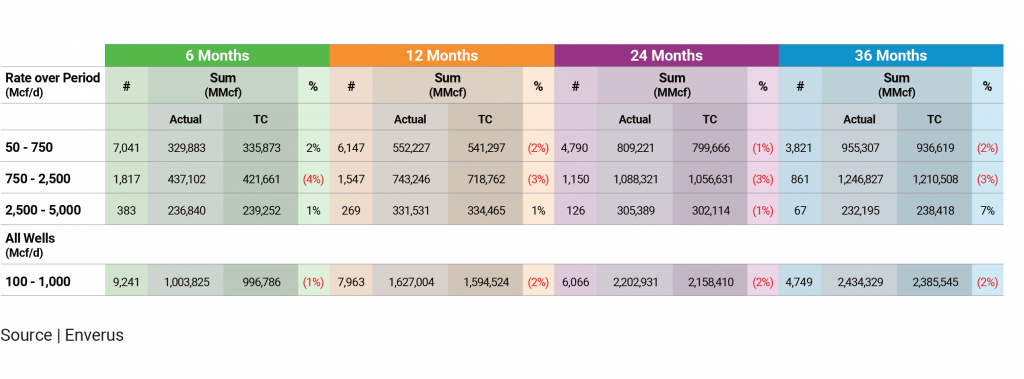

We conducted a study to determine the accuracy of algo-generated type curves against known production. The analysis cut off the most recent six months of production data from a randomly sampled set of 9,300 Enverus CORE type curves and redrew the type curves based on the truncated production profiles. The forecasted six months of production based on our generated type curves were compared against actual output to calculate the percentage difference in cumulative volumes. This process was repeated three more times but varied the number of months of production removed – first by removing a total of 12 months of production data, then 24 months and finally 36 months. In each case the forecasted volumes were compared against the known production. Figures 1 and 2 show results for oil and gas wells.

Our type curve accuracy on a percentage-basis generally falls in the low single digits for cumulative production and is more accurate during high-rate periods than low-rate ones. We suspect this is due in part to low-rate wells likely being shut-in targets and requiring more downtime for maintenance, and the difficulty of capturing these events in short-term forecasts.

FIGURE 1 | Comparison Between Estimated Cumulative Volumes Over Time and Actual Volumes for Oil Wells

Note | All wells in this analysis had at least 15 months of production and less than three months of downtime.

FIGURE 2 | Comparison Between Estimated Cumulative Volumes Over Time And Actual Volumes for Gas Wells

Note | All wells in this analysis had at least 15 months of production and less than three months of downtime.