This blog is based on a segment of CBC’s “Business Report, Calgary Eyeopener with Loren,” featuring Enverus Intelligence® Research’s* very own Al Salazar. Listen to the full segment here. (link: https://www.cbc.ca/listen/live-radio/1-5-calgary-eyeopener/clip/16038979-business-report-al-salazar)

Electric vehicles: A looming shadow on the U.S. market?

Despite the relatively scant incentives for buying an EV in the U.S. compared to other countries, the U.S. Environmental Protection Agency (EPA) presented its plan in 2023 to tighten tailpipe emissions regulations. Under these proposed rules, 54-60% of new vehicles sold in the U.S. would need to be electric by 2030, and then 64-67% by 2032.

Even though electric vehicles have been on sale in the U.S. for several years now, their market share remains low. This is reflected in EV sales, which seat at merely about 8-9% and can be attributed to a few distinct reasons:

- Cross-cultural differences between the U.S. and Europe, with the latter leaning more towards EVs,

- High-interest rates swinging the decision pendulum away from pricier EVs,

- The prevalence of “range anxiety” – a looming concern in the realm of long-distance driving in the U.S., where the fear of running dry on charge before reaching a charging station reigns.

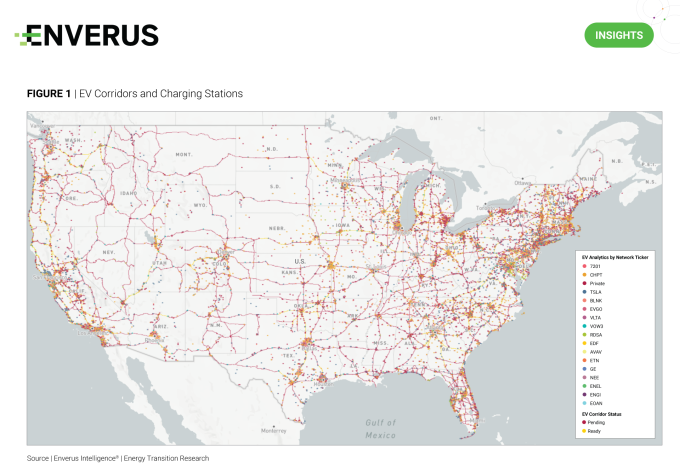

The Enverus Intelligence® Research Energy Transition team reported that to assuage this dread of “range anxiety”, the Biden administration is gunning for a rapid expansion of EV corridors via the installation of 500,000 electric chargers. The designated charging stations to meet this ambitious goal must tout at least four 150 kW chargers with CCS connectors within a mile of a corridor.

(July 6, 2023)

Global EV adoption: A mixed bag

According to Al Salazar, EV sales showed an increase of around 30% year over year globally. China led this trend with roughly 40% of passenger car sales being EVs, representing significant market dominance. Their high EV growth may partly be attributed to China’s restrictions on obtaining licenses for non-electric cars, thus skewing preferences towards EVs. Lastly, European adoption is slowing with 26% of total passenger car sales being EVs. Canada has placed a 2035 deadline for all new vehicle sales to be EVs, keeping in stride with many other OECD countries. However, as Salazar remarks, the government can mandate all day, but as always, the effectiveness of such regulations ultimately falls to consumer preferences.

Imported EVs vs. domestic production

An interesting dynamic in the EV landscape comes from competition between American EV manufacturers, like Tesla, and Chinese manufacturers, such as BYD, Tesla’s notable rival. Hindrances, such as import taxes, and strict regulations about the origins of EV batteries to qualify for the IRA $7500 rebate have put the Chinese manufacturers at a significant disadvantage within the U.S. market, keeping cheap Chinese EVs out of North America.

Role of oil in the global EV narrative

Despite the increased adoption of EVs, the oil industry might not see a significant hit. Consensus estimates suggest that by 2030, gasoline demand could decline by 2-3 million barrels a day, according to Salazar, which would put a downward effect on pricing.

However, keep in mind the use case of Norway, where 80% of vehicles are EVs and alternative fuel vehicles. Even among the high EV usage, oil consumption has stayed relatively flat, due to population growth and increased use of diesel and public transit.

The wider transportation industry’s continued heavy reliance on fossil fuels, alongside these findings, suggests that the adoption of EVs doesn’t mean the downfall of oil demand and prices.

Authors

Al Salazar is a seasoned member of the Enverus Intelligence team, bringing over 23 years of experience in the energy industry with a focus on fundamental analysis of oil, natural gas, and power. Throughout his career, Al has held key positions at EnCana/Cenovus and Suncor, where he honed his skills in forecasting, hedging, and corporate strategy. Al’s 15-year tenure at EnCana/Cenovus was particularly impactful, where he contributed significantly to the company’s success.Al earned his bachelor’s degree in Applied Energy Economics from the University of Calgary in 2000, followed by an MBA with honors from Syracuse University in 2007. Al’s academic background, coupled with his extensive professional experience, has equipped him with a deep understanding of the energy industry’s complexities and the necessary skills to navigate them effectively.

Product Marketing Manager at Enverus Intelligence® | Research (EIR) and Trading & Risk

Chris leads the development and communication of the value these products provide various industries, including oilfield services, investment funds, wealth management departments, banks, E&P oil and gas departments, and midstream operators. Chris helps provide customers across the energy ecosystem with the intelligent connections and actionable insights that allow them to uncover new opportunities and thrive.

* About Enverus Intelligence®

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Click here to learn more.