The rapid adoption of AI has created exponential demand for data centers. Hyperscalers such as Microsoft, Google and Amazon require reliable, low-carbon electricity to power future data centers, leading to a renewed interest in nuclear energy. Repowering shuttered reactors has proven highly economical due to favorable power purchase agreements (PPAs), such as the one struck by Constellation Energy and Microsoft to restart the Three Mile Island Unit 1 reactor. New reactors require more initial investment. Enverus Intelligence® Research modeled an achievable ~10% IRR on a $100/MWh PPA at a $7 billion/GW capital cost.

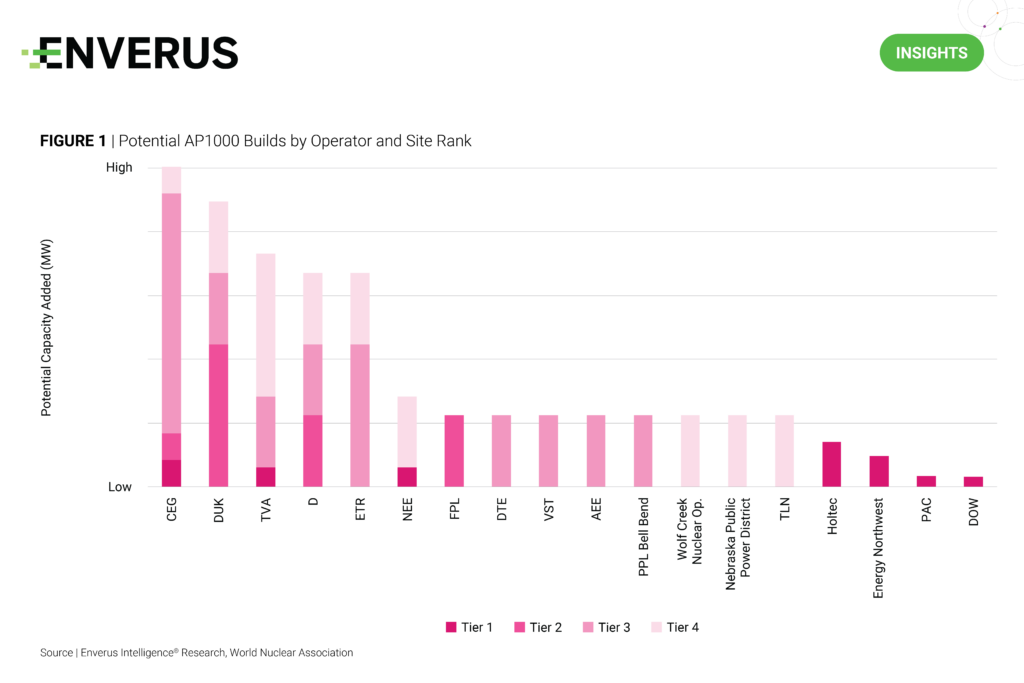

The gap between foreign and domestic costs is glaring, with the Vogtle 3 and 4 reactors costing $18 billion and $13 billion, respectively, compared to South Korean and French reactors built for half the cost. Supply chain development and a single dominant design are keys to delivering U.S. reactor costs in line with other nations. Figure 1 illustrates the potential for expanding U.S. nuclear capacity to meet aggressive targets of 35 GW of capacity by 2035 and 200 GW by 2050. Key operators like Constellation Energy, Duke Energy, Dominion Energy and Florida Power & Light operate sites that screen well for near-term construction starts, with Holtec International’s Palisades and NextEra Energy’s Duane Arnold sites already leading a new wave of nuclear activity.

Highlights:

Nuclear in Its AI Era – Enabling the Next Generation of Reactors – Demand for computing power coupled with the surge of AI is prompting technology giants to pursue reliable, low-carbon power sources for data centers, fueling a resurgence in interest in nuclear power. Enverus Intelligence® Research evaluates various IPP’s existing nuclear energy portfolios and their opportunities for large-scale deployments.

U.S. Power Grid – A Layered Landscape of Opportunities – This dynamic and interactive map providing a comprehensive view of the power asset landscape, including operating and developing projects across a variety of technologies, under-utilized plant capacity and energy community tax credits, highlighting the most influential drivers of the U.S. energy transition. Designed to demonstrate the risks and opportunities within this evolving landscape, this map enables users to interact with data in innovate ways, unlocking critical insights.

Alternative Fuels M&A – From Policy Boosts to Business Resilience – Deal flow in the alternative fuels sector has surged over the past four years, driven by regulatory incentives and the maturation of technologies that lower investment risk. We take a deep dive into notable deals across five fuel types to determine the most dominant strategies driving M&A activity and speculate on the implications for future capital deployment in the sector.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.