Equinor is acquiring 45% stakes in two of Standard Lithium’s direct lithium extraction (DLE) projects in the Smackover Formation in Southwest Arkansas and East Texas, less than a month after closing the book on its U.S. onshore shale operatorship. Under terms of the agreement, the Norwegian energy company will compensate Standard Lithium for $30 million in past costs net to the acquired interests and solely fund $60 million of costs—$40 million at the Arkansas project and $20 million in Texas—to progress the projects towards FIDs, representing a $33 million carry for Standard Lithium. Further development costs will be funded on a pro-rata basis. Equinor will also make milestone payments of up to $70 million total if positive FIDs are taken.

Equinor’s DLE investment is potentially the most significant and concrete to date from a major oil and gas producer, although others are exploring the technology, including ExxonMobil, Occidental Petroleum, Saudi Aramco and ADNOC. These investments are focused on DLE without the use of evaporation ponds, which has not yet been deployed commercially. DLE with evaporation ponds has been used commercially in Chile and Argentina.

Potentially most concrete DLE investment to date from a major O&G producer.

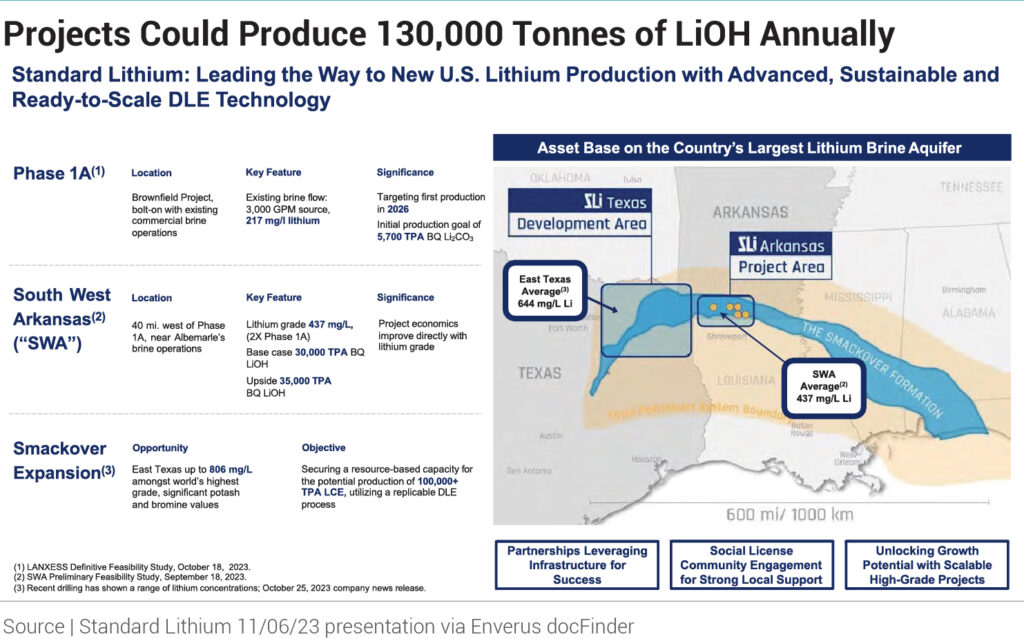

“This partnership with Equinor is a major accomplishment for Standard Lithium. It has long been our belief that success in this sector hinges on strategic partnerships with companies who share our vision and bring complementary strengths,” Standard Lithium CEO Robert Mintak said. He added, “With this partnership, we have the opportunity to accelerate our progress and carve out a significant role in shaping the future of sustainably produced lithium.” The Southwest Arkansas project, located in Magnolia, is targeting 30,000 tonnes of annual lithium hydroxide production capacity. The lithium brine resource in the area has an average concentration of 437 mg/L, according to Standard Lithium. The best well in the East Texas project area had a measured concentration of 806 mg/L, and the area has an average grade of 644 mg/L from three wells so far. Standard Lithium estimates a DLE project in East Texas could potentially produce 100,000 tonnes or more annually of lithium hydroxide.

Equinor said it will support the operator with core competencies such as subsurface and project execution capabilities. This is not Equinor’s first investment in DLE, although it is the company’s largest to date. In 2021, its venture capital arm—Equinor Ventures—invested in Lithium de France, which is developing combined geothermal and DLE projects in France.

Norwegian firm will reimburse $30MM, solely fund $60MM, pay up to $70MM on FID.

“Sustainably produced lithium can be an enabler in the energy transition, and we believe it can become an attractive business,” Equinor SVP Morten Halleraker said. “This investment is an option with limited up-front financial commitment. We can utilize core technologies from oil and gas in a complementary partnership to mature these projects towards a possible final investment decision.”

The transaction did not cover Standard Lithium’s Phase 1A demonstration project in El Dorado, Arkansas, where it is already partnered with German chemicals company Lanxess AG. That project is targeting annual production of 5,400 tonnes of battery-quality lithium carbonate from brine resources with an average grade of 217 mg/L. In March, Standard Lithium installed a new commercial-scale DLE column supplied by Koch Technology Solutions at the El Dorado plant. The new Li-Pro lithium selective sorption unit is the same size and design as the company intends to use for the Southwest Arkansas project.

Find more great content on the renewable energy sector, carbon management and environmental investments in the latest issue of Energy Transition Pulse.

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.