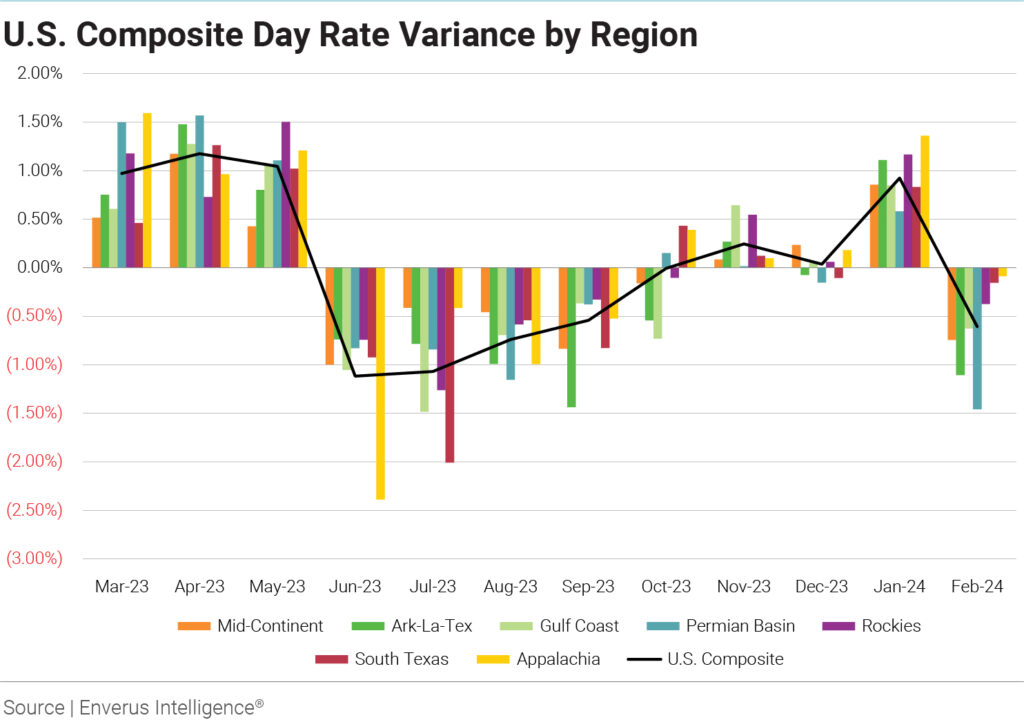

Day rates in the U.S. can’t seem to make up their mind, and neither can drilling contractors. All the Enverus Day Rate Survey’s seven regions saw rig rates decline sequentially in February, for the first time since October. Drillers surveyed in February also turned pessimistic as new-year optimism dissipated, citing the soft natural gas price as the main culprit behind declining rig demand.

The U.S. composite day rate fell $146 or 0.61% in February to $23,759. All seven regions saw rates increase in January and last November, while December was a mixed bag in which the overall composite declined but more regions rose than fell.

February’s decline was hardly a rout, with only two regions falling by more than 0.75%. The national composite rate for each of the survey’s five main rig classes declined; but breaking down day rates by both class and region showed increases for 40% of the categories. However, these gains were confined to rigs with less than 1,500 hp. More than 80% of all active rigs are 1,500-1,999 hp.

The Permian Basin saw the biggest decline in February as its composite day rate fell $349 or 1.46% from January to $23,534. Four of the Permian’s five rig classes moved lower.

The other big loser in February was the Ark-La-Tex—no surprise to anyone following Henry Hub prices. The Ark-La-Tex composite fell $274 or 1.11% to $24,491 as a warm U.S. winter drove the final nail into any hope of a natural gas market rebound boosting the Haynesville during 2024.

“Low commodity pricing and soft budgets have caused our wait lists to shrink,” an Ark-La-Tex driller told the Enverus survey team. Only 73 drilling rigs were active in the Haynesville in late February, near the region’s three-year low and a 12-rig decline in two months. Enverus Intelligence® | Research’s (EIR) February Fundamental Edge report, available to EIR subscribers, predicted that Haynesville production in 2024 would be 1.18 Bcf/d lower than in 2023 with sub-$2.00/MMBtu prices “inevitable” this year.

Drilling contractors delivered a similar message in their 4Q23 earnings calls. For example, two Haynesville clients that Independence Contract Drilling expected would sign extensions at the start of the year instead canceled their campaigns, CEO Anthony Gallegos said during a Feb. 28 earnings call, adding that ICD has already moved one of the spurned rigs to the Permian.

Precision Drilling CEO Kevin Neveu said in a Feb.7 earnings call that his company was “transitioning from being very gas-focused a couple of years ago, which served us quite well during the pandemic, to pushing more into West Texas, more into the oilier basins. And it’s tough when there’s not a lot of new opportunities popping up.” However, Patterson-UTI CEO Andy Hendricks was more upbeat in his Feb. 15 earnings call, saying his company was having discussions with its natural gas customers about adding rigs later this year.

Respondents to the Enverus survey also mentioned Q1’s traditional softness, weather issues and recent M&A activity among major operators holding up the release of new 2024 capex spending. Those factors are more likely to support a near-term rebound. “The decrease in activity is related to the Q1 softness. I do expect the market to recover, though, in Q2 and Q3,” an Appalachian driller told the survey team.

“With some of the mergers and acquisitions going on in the industry, you would think these companies are getting ready to increase their activity,” an Ark-La-Tex driller told the Enverus survey team. U.S. upstream M&A valued at $144 billion was announced in 4Q23—an all-time high, according to an EIR report—driven by the ExxonMobil-Pioneer Natural Resources, Chevron-Hess and Occidental Petroleum-CrownRock megadeals.

Still, the Enverus Day Rate Survey revealed drillers’ mindsets had darkened dramatically between January and February. Roughly 20% of participants expect more work during the next six months compared with 75% during the prior survey. Two-thirds of drillers surveyed in February expect the work volumes to stay the same.

Only 7% of drillers surveyed in February reported bid requests were increasing, far below the 55% recorded in the January survey. The percentage of drillers reporting a decline in bidding activity surged to 61% compared with 27% in the prior survey.

Three-fourths of respondents reported that daily operating costs had stabilized during the past three months. The remaining 25% of drillers were basically split evenly between saying costs had increased and decreased. Similar to January’s survey, respondents reporting declines attributed them to better in-house maintenance of rigs and more experienced crews, which possess the know-how to run equipment more efficiently.

To see the full results of the Enverus Day Rate Survey for February, check out the latest issue of Oilfield Pulse.

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.