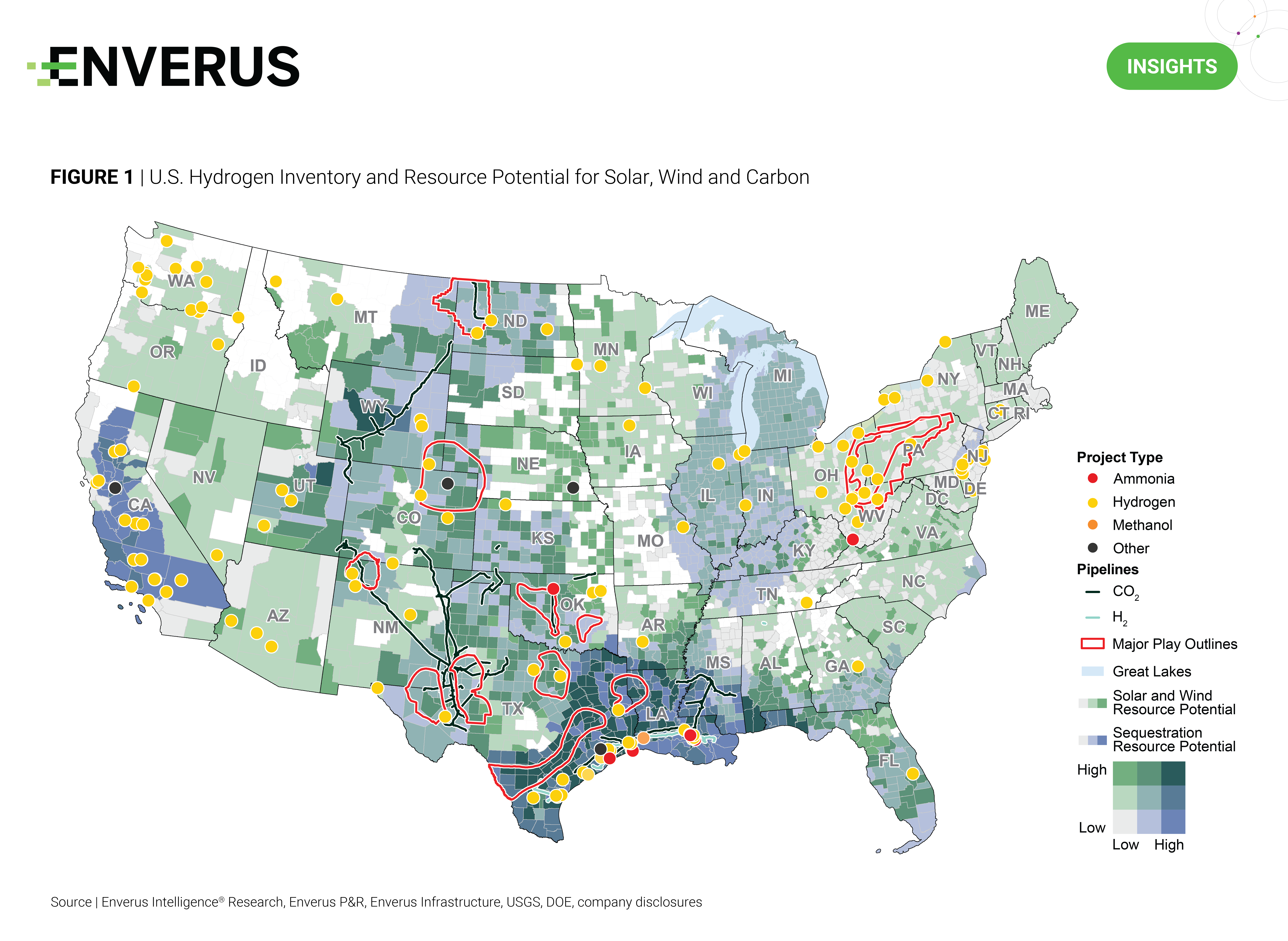

Hydrogen technology has received a lot of attention over the past few years due to ambitious decarbonization targets and transformative funding programs. With the majority of tracked U.S. clean hydrogen capacity skewed to early development stages, the hype has yet to translate to commercial liftoff. Enverus Intelligence® Research (EIR) anticipates a wide range of project outcomes as this nascent industry attempts to scale and believes that defensible business models must demonstrate access to superior asset quality, robust innovation ecosystems and supportive partners. We explored the topic in detail, including evaluations of individual projects, in our inaugural 45-slide Hydrogen Fundamentals deck released last month.

Proximity to abundant, low-cost resource is crucial to project costs. For example, we model 40% lower unsubsidized green hydrogen costs in Texas compared to Appalachia based on higher solar and wind capacity factors and lower electricity costs. Subsidies enable a 46% median reduction in green hydrogen production costs, but the technology still trails behind subsidized blue economics without additional cost reductions, green premiums or additional funding. Our modeling suggests that blue projects are competitive with gray after tax credits and deserve more attention.

Mobility, power and alternative fuels are the most cited use cases for clean hydrogen in the U.S., although only 30% of developers disclosed offtakers among tracked projects. We believe that the lowest-risk projects are those with access to gray-for-clean substitution opportunities. Furthermore, there is significant potential for unlocking substantial overseas offtake, particularly in Europe and Asia.

Research Highlights

LCFS price forecast – Fool’s gold rush – A deep dive into the volatile California Low Carbon Fuel Standard (LCFS) credit market, including our forward pricing forecast and the impact it will have on capital investment and equities in the low carbon fuels sector.

U.S. gas-fired generation – Fanning the flame – EIR presents an updated view on the future of U.S. natural gas-fired generation after an outlier step change in 2023.

Geothermal anywhere – Prioritizing non-conventional project locations – New drilling technologies are enabling geothermal projects to be sited outside of traditional areas in the Western U.S., expanding the market for this renewable energy source. This report provides an overview of key drivers of project economics and identifies which locations might be optimal for future expansion.