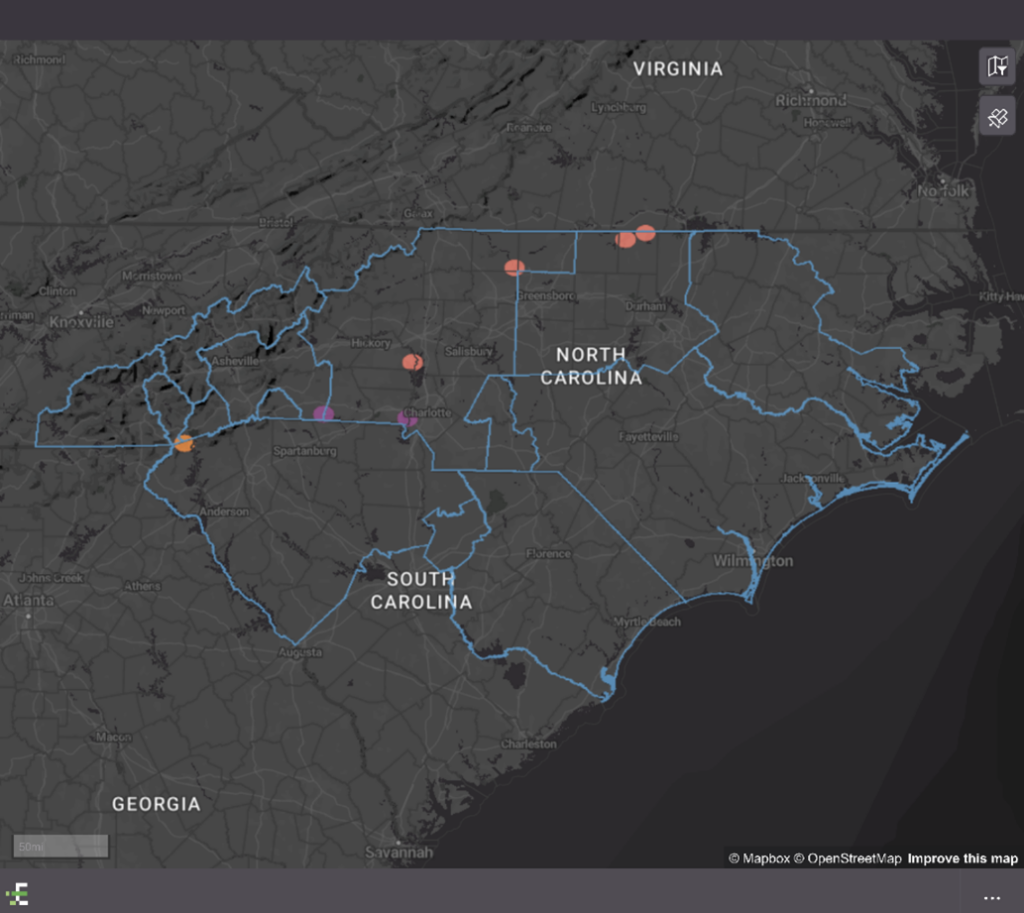

The energy landscape is rapidly evolving, driven by the urgent need to transition from fossil fuels to renewable energy sources, while also managing an increase in demand associated with the region’s population growth. In this dynamic context, integrated resource plans (IRPs) provide valuable insights into how utilities are adapting and shaping the future of energy generation. One such utility, Duke Energy Carolinas (DEC) has submitted a joint IRP with Duke Energy Progress, with whom they are set to merge in 2027. This comprehensive plan is designed to facilitate a transition from emissions-producing power generation to a more sustainable and renewable energy portfolio in the next 20 years, all while accommodating the anticipated surge in energy demand in the area. Let’s take a closer look at DEC’s plan and how it reflects the ongoing transformation of the energy sector.

The phasing out of coal

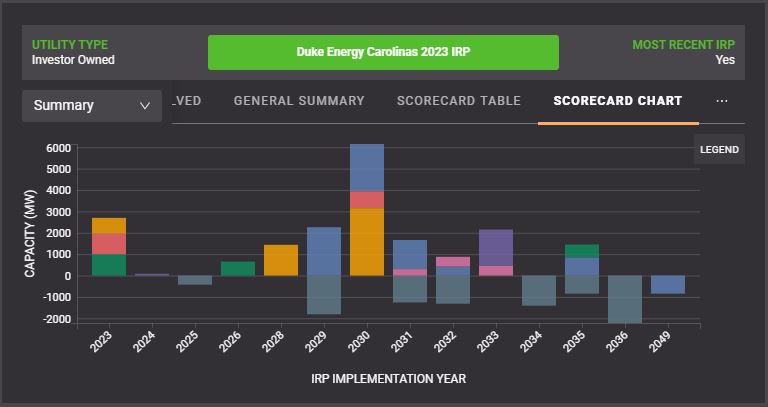

DEC’s 2023 IRP is grounded in a commitment to reducing carbon emissions and mitigating the risks associated with coal-fired generation. Their recommended portfolio sets a remarkable target of achieving a 70% reduction in carbon dioxide (CO2) emissions from 2005 levels by 2035.

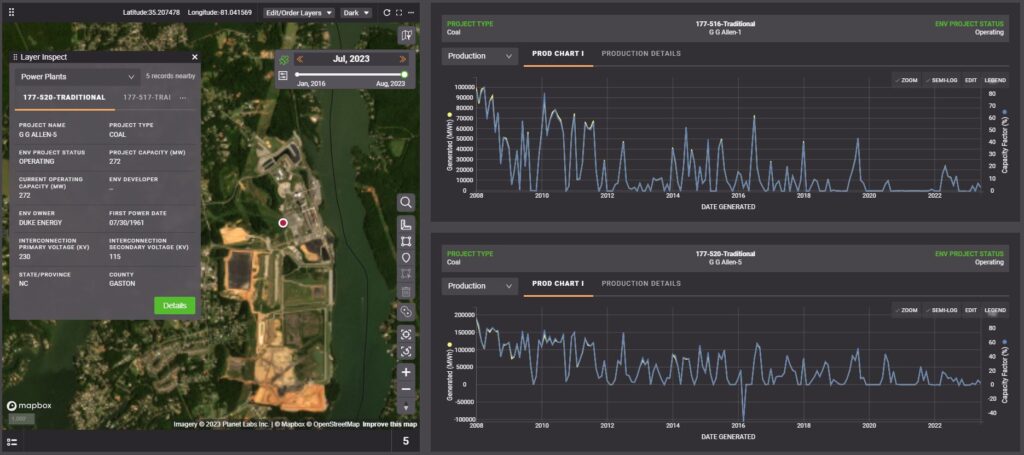

DEC’s journey away from coal begins with the planned retirement of Allen units 1 and 5 by 2025. These units have seen limited summer activity in recent years, signaling a shift away from coal-dependent generation. In their place, DEC plans to convert Roxboro Unit 1 with 1,360MW and Marshall units 1 and 2 with 900MW to natural gas capacity by 2029, with additional 1,360 MW CC units coming online in 2030 and 2031.

Mayo Unit 1 and Cliffside Unit 5 will be retired by 2031, further reducing the utility’s coal reliance. Marshall units 3 and 4 and Roxboro units 3 and 4 are set to follow suit by 2032 and no later than 2034, with potential replacements in the form of 425MW combustion turbine units, pending approval. Cliffside Unit 6 will undergo a conversion to natural gas in 2035 before eventual retirement in 2049.

Embracing nuclear energy

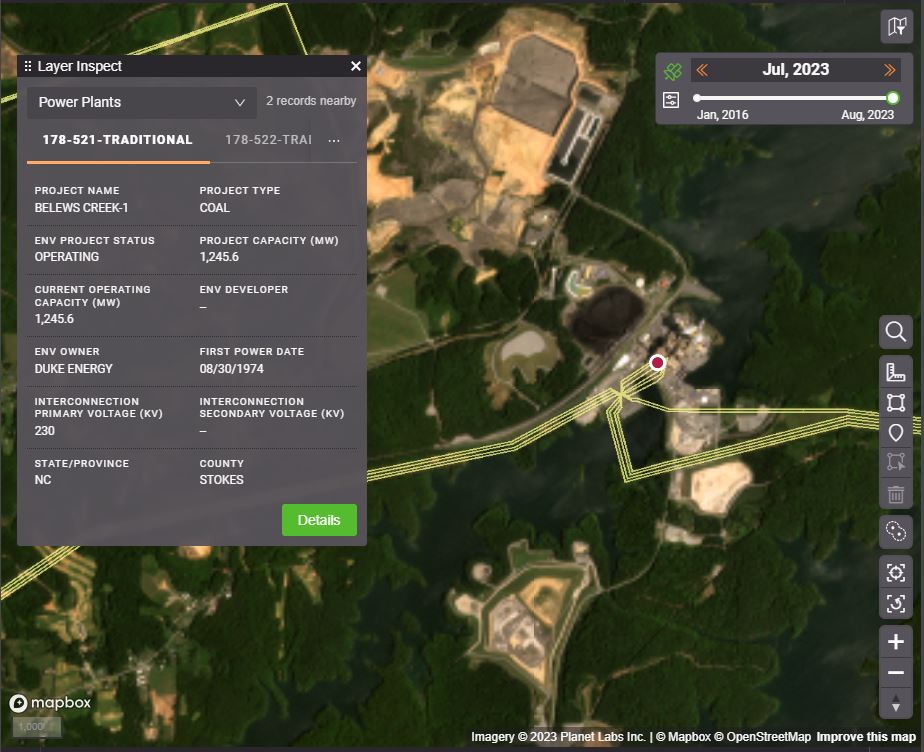

DEC is not just shedding its coal assets; it’s also expanding its nuclear energy portfolio. Belews Creek units 1 and 2 are slated for retirement by 2036, but DEC is actively exploring advanced nuclear capacity. The utility plans to have 600MW of advanced nuclear capacity in service by 2035, with a focus on small modular reactors (SMRs). Early site permits are being developed, and construction timelines suggest a promising future for nuclear energy in the DEC region.

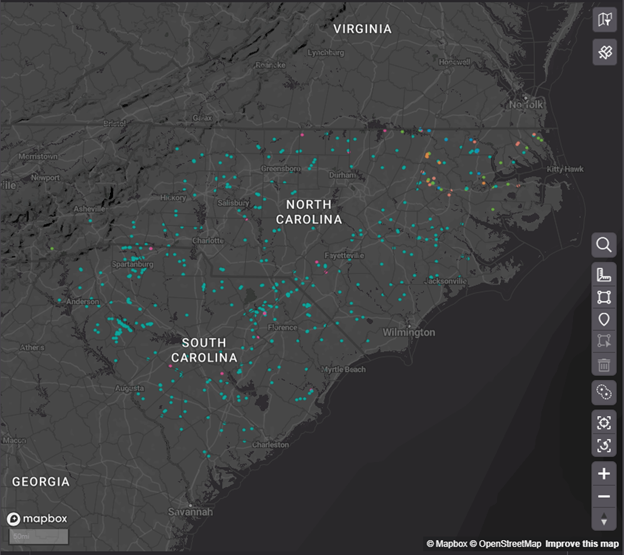

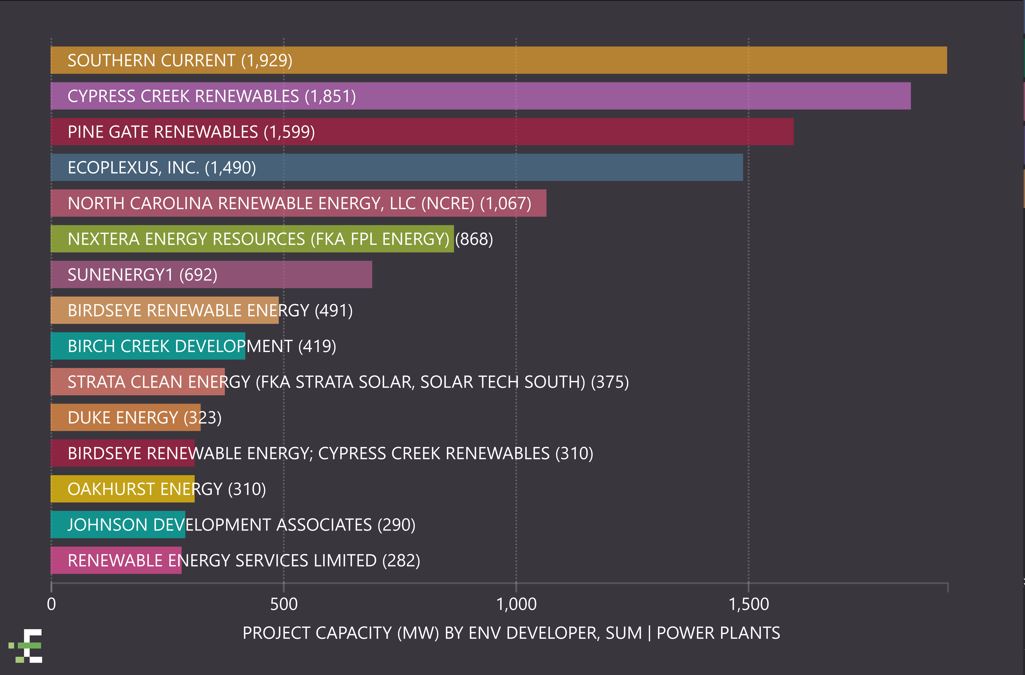

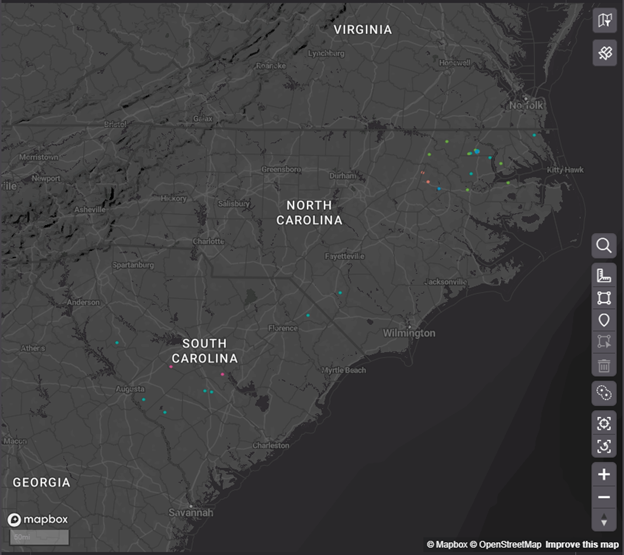

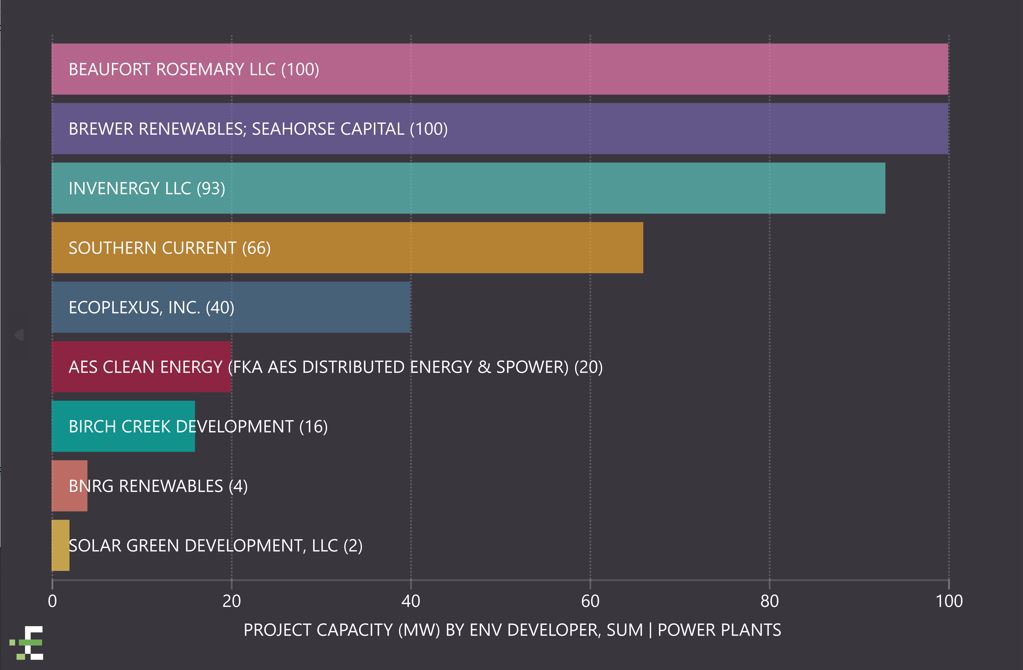

Harnessing solar and storage

Solar power plays a pivotal role in DEC’s sustainable future. The utility expects to operationalize 1,435MW of solar capacity in 2023, including a substantial hybrid facility. Further procurements are planned for 2025 and 2026, targeting between 2,700 and 3,150MW of solar or solar and storage capacity by 2030, including an additional 790MW hybrid system between 2024 and 2026. While specific projects are not yet named, these investments reflect DEC’s commitment to renewable energy.

A windy outlook

DEC is also looking to the winds for clean energy generation. Plans are underway to develop 300MW of onshore wind by 2031, with additional increments of 450MW by 2032 and 450MW by 2033. The utility is closely monitoring market conditions for offshore wind development, indicating its readiness to embrace this promising technology when the time is right.

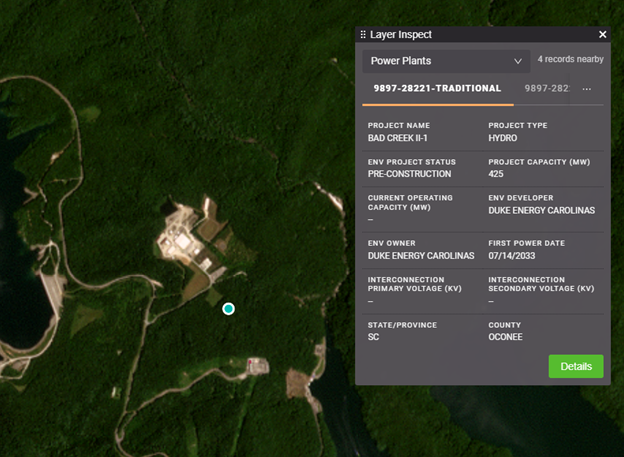

Hydro

DEC is making strides in hydroelectric power, with an uprate of Bad Creek Unit 4 in 2024 and the launch of the Bad Creek II pumped hydro project in 2027, expected to be in service by mid-2033.

The utility is also prioritizing battery storage, with a 1,000MW project set to be interconnected by the end of the year, and an additional 650MW project in development between 2024 and 2026.

Building a resilient grid

A critical component of DEC’s IRP is the expansion and enhancement of its transmission infrastructure. The utility aims to complete 13 of its 14 Red Zone Expansion Projects by the end of 2026, with the final project scheduled for service in 2027.

Conclusion

Duke Energy Carolinas’ 2023 IRP showcases a comprehensive and forward-thinking approach to energy transition. By retiring coal-fired generation, expanding nuclear and renewable energy capacity, and investing in grid resilience, DEC is positioning itself at the forefront of the “great transition” from fossil fuels to renewable energy sources. This visionary plan not only benefits the environment but also empowers customers with energy efficiency and demand response options.