With the IEA’s projection of a 1,300%-5,100% increase in lithium demand by 2040 because of the growing battery market for electric vehicles and power storage, lithium spot prices have surged nearly eightfold since 2020 to $35,000 per tonne of lithium carbonate equivalent (LCE). High lithium demand and high prices have caused a land grab in parts of North America, marking a renaissance of early prospecting but this time for lithium-rich brine. Contenders looking to capitalize on the opportunity are turning to direct lithium extraction (DLE), a short-cycle method of lithium production capable of extracting the resource from low-concentration lithium brines.

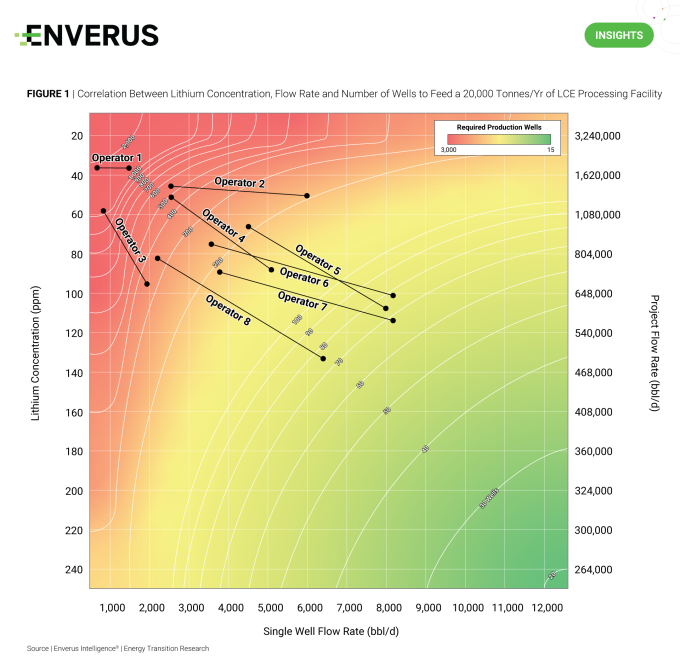

The prospectivity of a lithium brine resource is a function of the lithium concentration and the flow rate from the producing formation, primarily dictated by porosity and permeability. As shown in Figure 1, increasing lithium concentration or flow rate will reduce the number of wells required to produce a desired lithium output, decreasing project expenditures. In this case, Enverus Intelligence® | Research output assumes 20,000 tonnes/year of LCE, similar to disclosed DLE projects but less than 20% of Australia’s Greenbushes mine at 115,000 tonnes/year of LCE. Higher concentrations of lithium are preferred as increased flow rates ultimately require a larger processing facility.

To learn more about securing domestic supply of lithium click here.

Note | Ranges represent P90-P99 values of lithium concentration and single-well flow rate

Source | Enverus Intelligence® Research

Highlights from Energy Transition Research

- ETR Treasure Chest – Fusion-Ready Analytics 2Q23T – The Energy Transition Research (ETR) team creates and uses a variety of analytics datasets to produce our insights. Many are best consumed integrated with our PRISM solutions and some will ultimately become part of established analytics products.

- CCUS Midstream – Who’s making the connection in southern Louisiana? – This report examines which midstream operators are most exposed to low-breakeven emissions and high-capacity CO2 storage in southern Louisiana, which operators have announced partnerships in CCUS projects and which are strategically located near CCS projects without disclosed midstream partners.

- The economic reality of long-duration energy storage – A bird without wings? – This report analyzes the economics of long-duration energy storage under current power market designs..

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.