NAVIGATE TODAY’S TOUGHEST MARKET CHALLENGES TO BUILD YOUR STRONGEST FUTURE ENERGY STRATEGY

Labor shortages continue to restrict operator’s ability to ramp production, inflation is driving up costs, investors now prioritize businesses with a sustainability strategy, and securing quality inventory is paramount. The market rewards operators who prove they have an accredited portfolio management strategy, make smart development plans, operate efficiently and learn from their experiences.

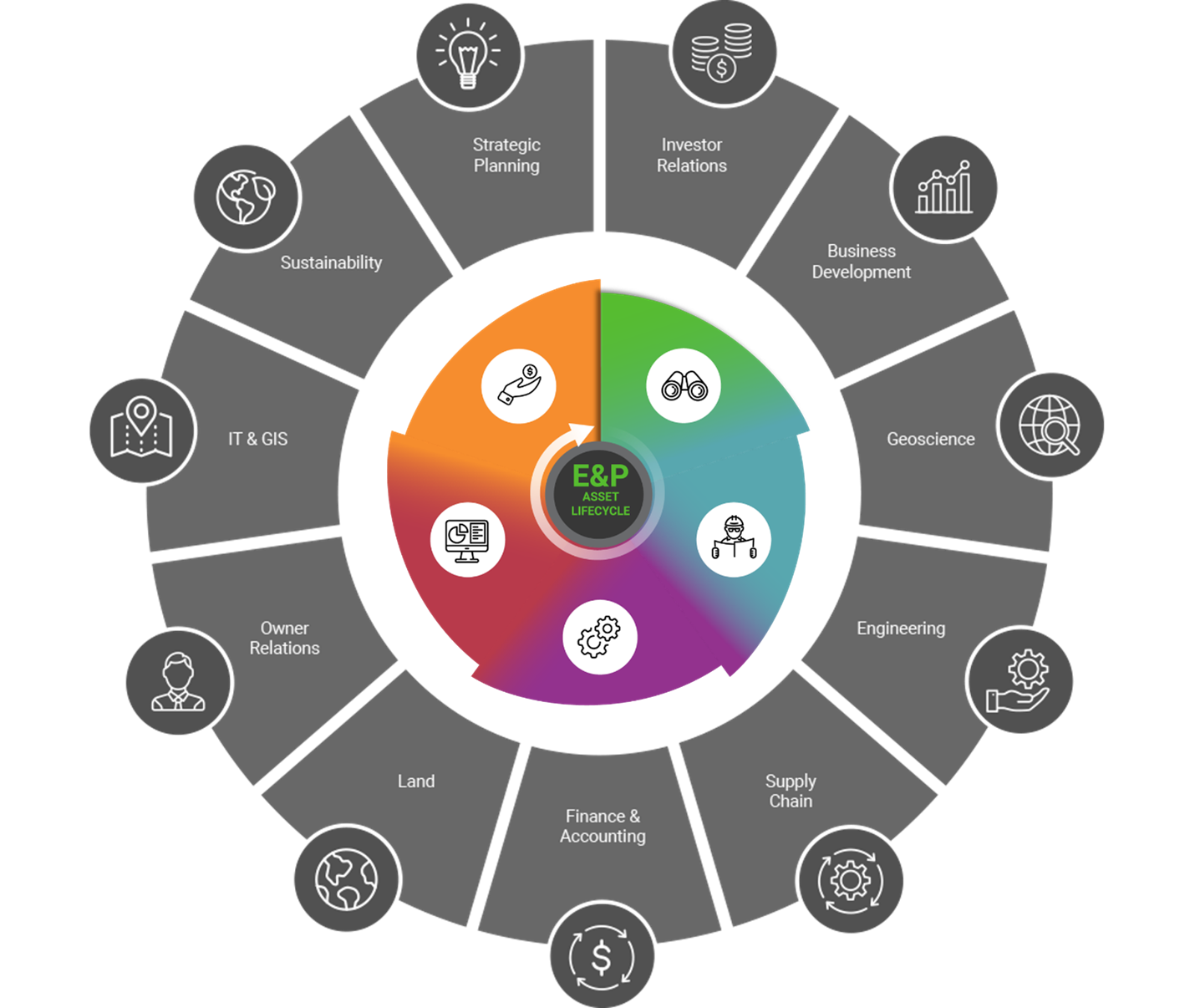

Investing in technology is a proven way to improve efficiency and boost returns across a company. Below we highlight the most common challenges faced by operators through each phase of the asset lifecycle and provide the solution.

PHASE 1: EVALUATE AND ACQUIRE

Challenge: There are so many factors that influence asset value, making thorough technical analysis tricky when you are on tight deadlines. When you need to evaluate multiple assets quickly, you either sacrifice technical due diligence for speed or miss out on opportunities because you’ve spent too much time evaluating the wrong ones or not accounting for all the factors that influence performance.

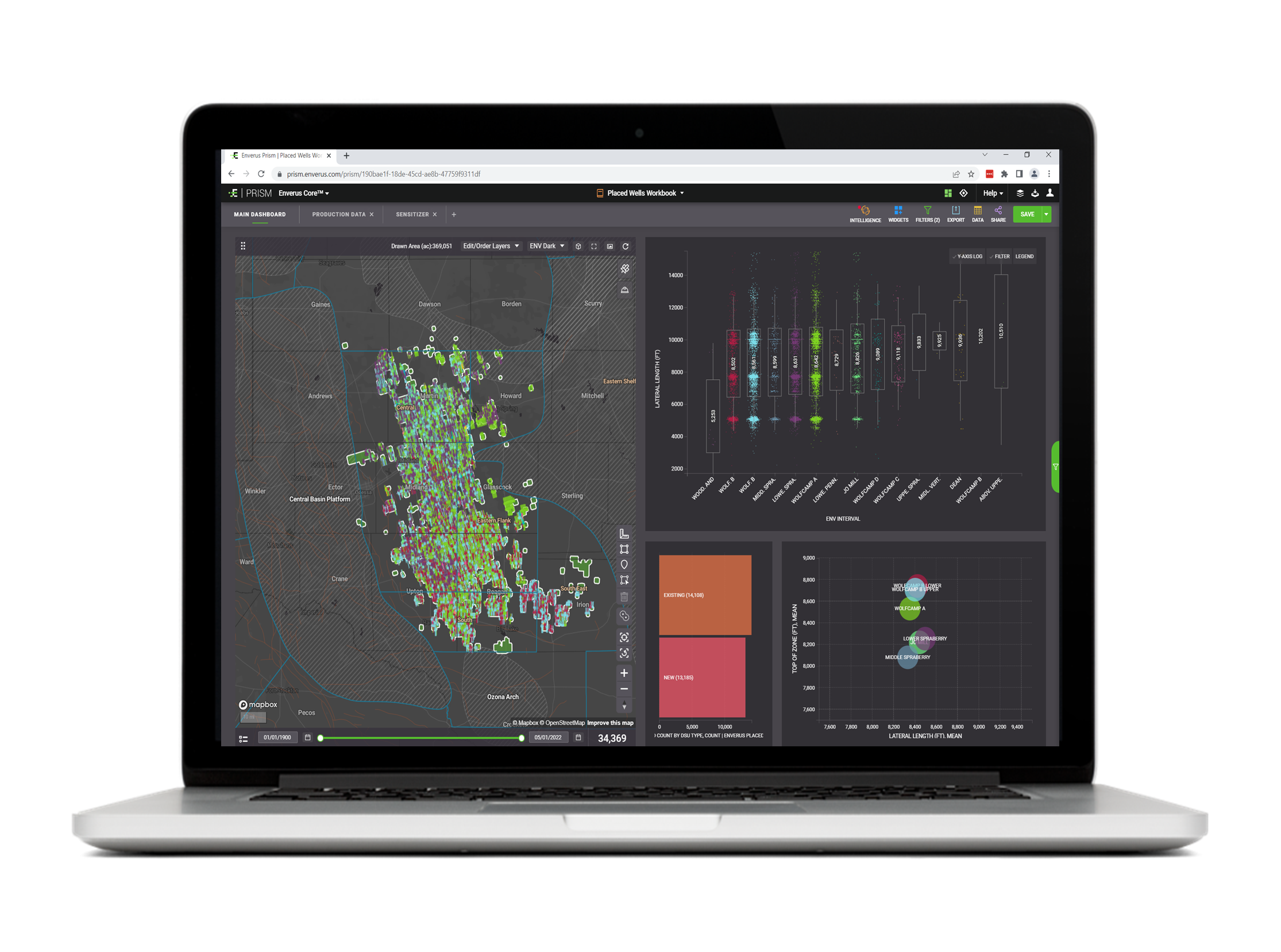

Solution: Operators in this stage of the asset lifecycle should focus on a solution that allows them to benchmark future inventory and forecast existing well performance using insights like geological models, spacing, completion designs and ESG metrics in one place. This makes technical analysis of multiple assets much faster, allowing you to uncover more opportunities and value them with confidence to de-risk capital investments.

PHASE 2: DESIGN & DEVELOP ASSETS

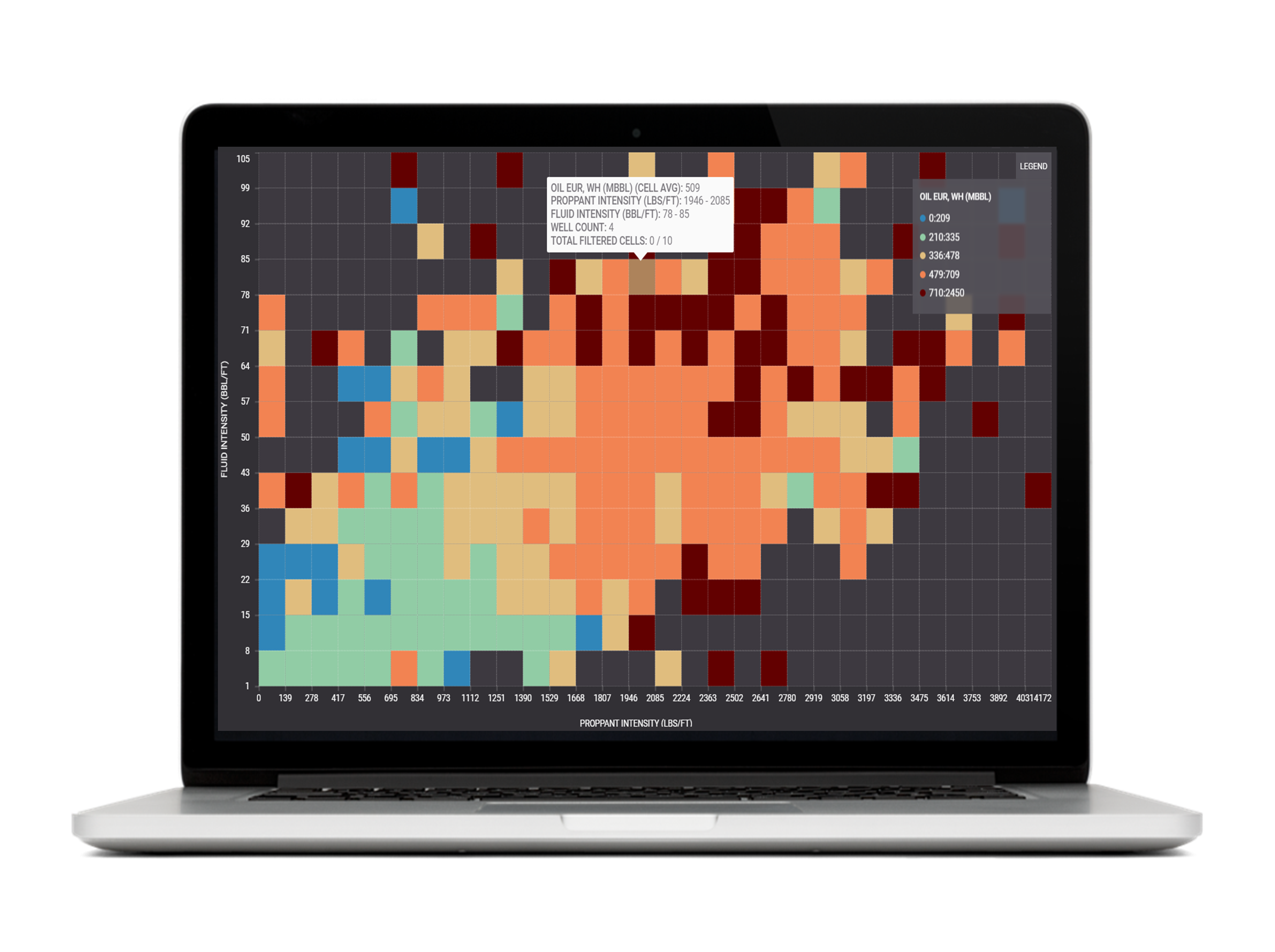

Challenge: In this stage of the asset lifecycle, it is vital to understand what is driving the productivity of current producing wells to optimize designs and lower risk. To do this, you need to validate potential design scenarios before you drill using your own proprietary data. Many operators say they spend too much time moving data between various platforms, across teams, and merging mixed datasets to analyze real-time production with historical data. The difficulty in this task exponentially increases when updating and maintaining models with new data.

Solution: The only way to eliminate risks quickly, before putting money in the ground, is to run simulations and understand the impact from different variables on productivity, using nearby historical data. Model future developed locations before you drill by quickly loading your own proprietary production data with robust Enverus production data in PRISM. This saves you the headache of having to import Enverus data into your reserves software and increases forecast accuracy and helps you inform capital spending decisions on drilling plans.

PHASE 3: SOURCE & EXECUTE OPERATIONS EFFICIENTLY

Challenge: Efficient and cost-effective sourcing of materials and services and streamlined processes are critical during drilling and completion operations so your projects stay on time on budget. Real-time cross-team collaboration and communication between field operations and supply chain and accounting teams on during these processes can be difficult.

Solution: Digitalizing your sourcing, ordering, fulfillment and invoicing on one platform allows you to make operations much more efficient because you can automate some of the workflows, cutting down on wasted time. Improving spend management becomes second nature as operations gets a near-real time view of incurred spend for more accurate project forecasts and budget tracking, supply chain can negotiate win-win price contracts with suppliers and finance and accounting gets timely, high-quality reporting.

PHASE 4: MONITOR AND OPTIMIZE PERFORMANCE, ENSURING OPTIMAL RESULTS

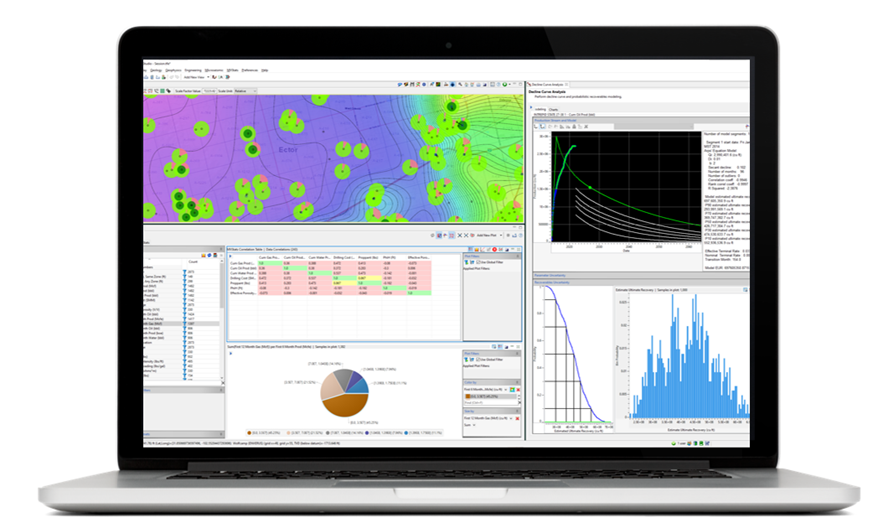

Challenge: Being able to access and analyze up-to-date well performance metrics is critical to make sure you’re getting the best results from your designs. Many operators prefer to use their own proprietary data for the technical workflows required to make these decisions, but this is only part of what is needed to effectively manage your assets. While your proprietary data may be your competitive edge, sometimes that data can still contain gaps. To be confident in your decisions, you need to be able to benchmark your conclusions against a trusted third party source.

This is where operators run into a data workflow gap. A lot of our customers say they spend too much time and money moving data between various platforms and that it’s difficult to easily share findings across teams.

Solution: Enverus solved this issue, making it quick and easy to integrate proprietary data with trusted Enverus data in PRISM, so you can effectively monitor your designs in near-real time, and increase confidence in these critical decisions. This capability, combined with Enverus ESG

Analytics, allows you to quickly understand performance so you can quickly intervene with underperforming wells to maximize upside.

STAGE 5: P&A AND DIVEST

Challenge: Being able to analyze shut-in wells to find P&A targets, figure out the upside of shut-in wells and which wells could be recompleted in an economic, sustainable way can be difficult without the right data.

Solution: Evaluate the production profiles and different designs of wells and ESG land use efficiency to find the most economic next step.

Navigating today’s market is tough, but with a technology partner with solutions for every stage of the asset lifecycle, you will accelerate evaluation and development of operating and non-operating assets, de-risk investments, maximize capital efficiency and deliver returns, faster. This full lifecycle perspective into your business empowers you to break down information silos across teams, helping them work quickly and well together to better manage capital.

Most Enverus customers have long known that we are helpful with understanding how investors view them, the acquisition and divestiture of producing assets, benchmarking performance against peers, and monitoring industry activity. However, few of them know how much we can impact the daily operations of an oil and gas company. This includes asset development planning, staying ahead of the drill bit after the plan is underway, and managing development and operating costs effectively. So, when it comes to the everyday business of running oil and gas companies, Enverus can help you add value across the asset’s lifecycle, making us the most essential partner an operator can have.

Request more information about how Enverus can help you optimize your asset management by filling out the form below.