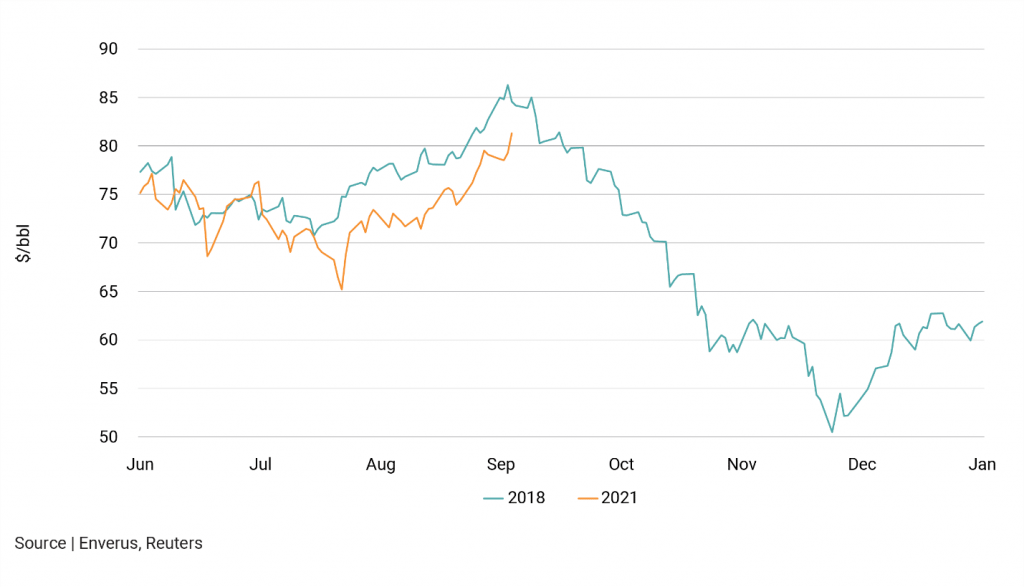

Low inventories, recovering demand and a muted supply response are behind surging energy prices and rising stock values of producers. Today’s picture looks similar to late 2018, when Brent spiked to ~$85/bbl and prompted bullish calls for $100/bbl oil. But that year, a wave of OPEC and U.S. supply growth hit and U.S./China trade tensions undercut demand expectations. Stock markets sold off heavily and oil prices collapsed into the $50s (Figure 1).

Are high oil prices sustainable this time around? We don’t think so for several reasons. First, OPEC still has plenty of spare production capacity to bring back. Sanctioned Iran has spare capacity in spades. Iraq and the UAE are still pursuing upstream growth plans. Whether through consumer pressure or self-interest, high oil prices will mean more OPEC supply at some point. Second, while the post-COVID-19 recovery is well underway, it’s a bumpy affair. Roughly 70% of populations in emerging economies remain unvaccinated, meaning the pandemic remains a threat to demand recovery. A new wave of infection looks more probable than a colder-than-normal winter. Last, high oil prices will accelerate the transition away from oil to alternatives such as electric vehicles.

So, where are oil prices headed? Forecasting is as much art as science, but we don’t believe $100/bbl is attainable, let alone sustainable. The combination of OPEC+’s effective management of supply and a more disciplined U.S. producing sector suggests a supply-driven collapse that mimics 2018 is unlikely. In conclusion, we think this time around is different. Oil will fall, but barring catastrophic COVID-19 news, the decline should be a soft landing rather than a belly flop.

Learn more about Enverus’ Intelligence solutions here.

FIGURE 1 | Oil Prices in 2018 Versus 2021

![]()