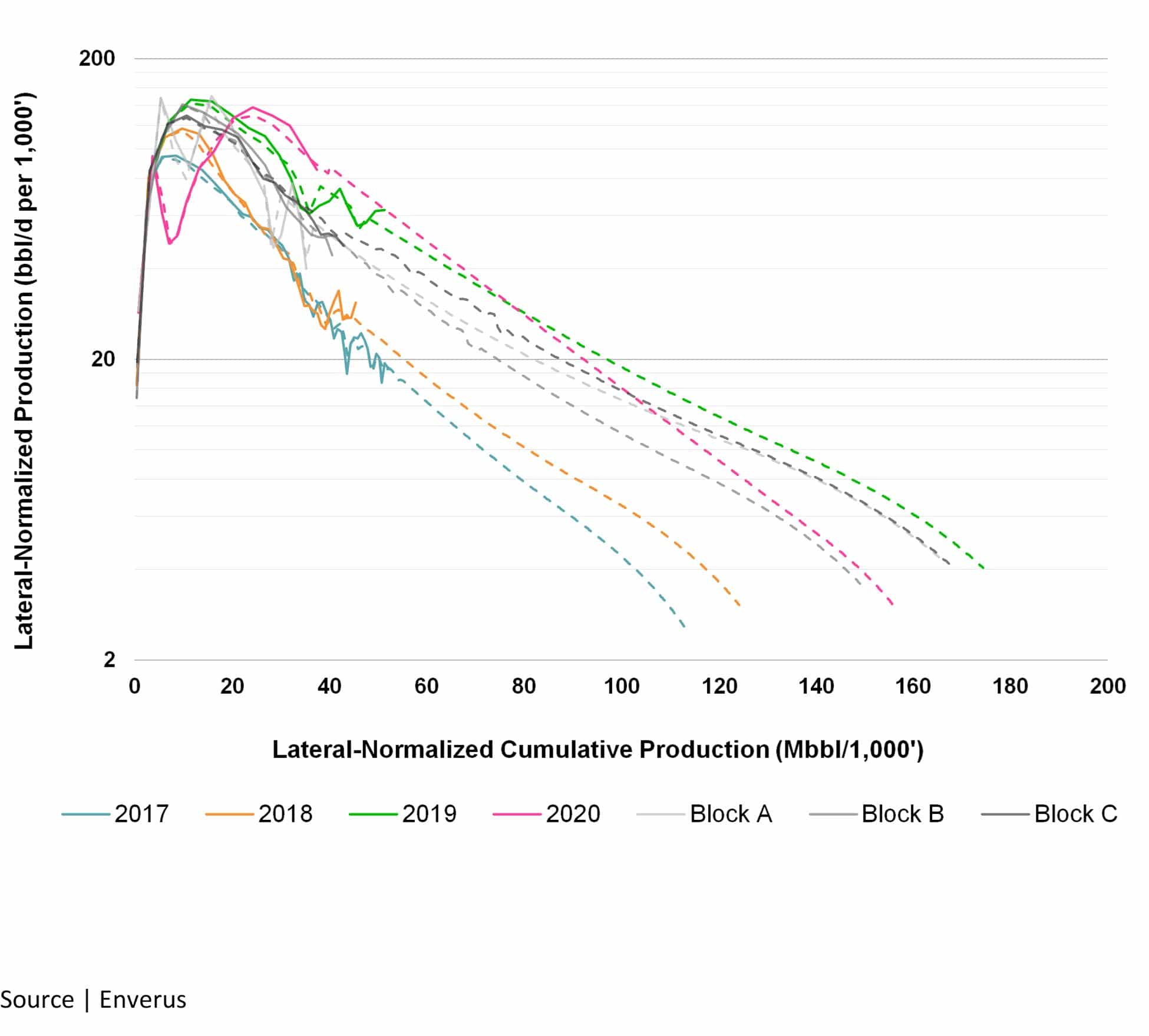

Over the last five years, oil production from the Vaca Muerta has increased a staggering 600%, all while total Argentine oil output has decreased by 5%. Ramping investments in the shale play — from not only YPF and supermajors, but also SMID and private operators — have nearly been able to stymie historical conventional declines. Loma Campana (YPF 50%, CVX 50%), the provenance of the play, currently has more than 500 producing wells (~40% horizontals), totaling an output of ~45 Mbbl/d. Since a shift from vertical to horizontal well developments in 2016, lateral-normalized EURs for the joint venture have increased 10-20% annually (Figure 1) in part due to increased proppant intensities, fluid intensities and tighter stage spacing.

While Loma Campana has long been considered the core of the play, neighboring operators have shown that the world-class oil productivity extends beyond YPF’s and CVX’s acreage, where recoveries of 140-170 bbl/ft are observed (Figure 1) making the assets competitive with any U.S. shale play. Using Enverus’ PRISM solution, clients can readily benchmark completion and productivity trends not only between Vaca Muerta assets, but also with U.S. shale analogues. Performing these analyses drives insights for clients investigating the growth of the Argentine play, while utilizing the past learnings of developments in the Lower 48.

Figure 1 | Loma Campana Well Type Curves by Vintage Compared to Neighboring Blocks