[contextly_auto_sidebar]

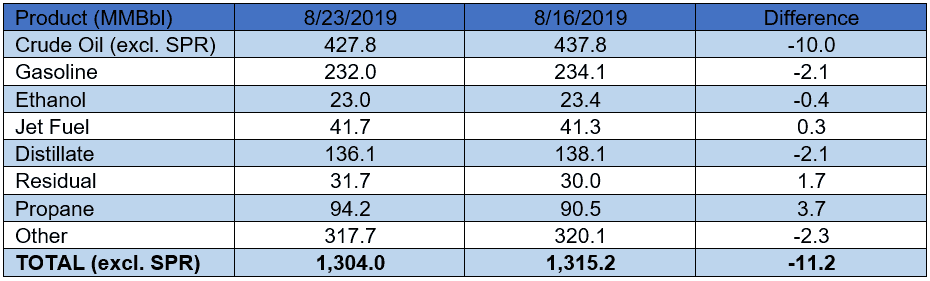

US crude oil stocks posted a very large decrease of 10.0 MMBbl from last week. Gasoline and distillate inventories both decreased by 2.1 MMBbl. Yesterday afternoon, API reported a very large crude oil draw of 11.1 MMBbl, while reporting gasoline and distillate draws of 0.35 MMBbl and 2.5 MMBbl, respectively. Analysts were expecting a much smaller crude oil draw of 2.1 MMBbl. The most important number to keep an eye on, total petroleum inventories, posted a significantly large decrease of 11.2 MMBbl. For a summary of the crude oil and petroleum product stock movements, see the table below.

US crude oil production increased 200 MBbl/d last week, per the EIA. Crude oil imports were down 1.3 MMBbl/d last week, to an average of 5.9 MMBbl/d. Refinery inputs averaged 17.4 MMBbl/d (0.3 MMBbl/d less than last week’s average), leading to a utilization rate of 95.2%. The report is bullish due to significantly large crude oil and total petroleum stocks withdrawals. The increase in prices yesterday due to API’s report continued today, following the bullish EIA report. Prompt-month WTI was trading up $1.06/Bbl, at $55.99/Bbl, at the time of writing.

Prices saw a sharp increase on Tuesday due to a significantly large crude oil draw reported by API and the expectation of a similar drop from today’s report by EIA. The sharp increase in prices came despite the news from the G7 summit where France’s president lifted hopes for a deal between the US and Iran, which could mean Iran ramping up production, and despite the concerns about a recession and uncertainty around the lingering US–China trade wars

The developments around the US–China trade war continue to drive price movements in both directions, and the sentiment on the issue is changing rather fast, although no resolution and no deal between the world’s two largest economies seem to be possible anytime soon. Prices in the last two weeks have swung in both directions on this issue. Prices got some support the previous week from US President Donald Trump’s statement that he would be talking with his Chinese counterpart to discuss trade issues. Prices were further bolstered by the US stating it would extend a reprieve that permits China’s Huawei Technologies to buy components from US companies. The bullish sentiment from this news was short-lived as China last Friday announced it would impose retaliatory tariffs on $75 billion worth of imports from the US, which include crude oil. This announcement was followed by President Trump’s twitter posts in which he said he said he would be imposing higher tariff rates on some Chinese imports.

Monday brought more volatility to prices due to uncertainty and confusion about the US–China trade dispute. Prices first moved higher as both the US and China made statements and appeared to be willing to ease the rising tensions – first, with Trump stating that China was seeking a trade deal and that US officials had received calls from Chinese negotiators to return to discussions, and second, comments by China’s trade negotiator, Vice President Liu He, saying that Beijing hopes to resolve the trade war through “calm” negotiations without escalating the tensions any further. The hopes for a possible round of discussions perhaps a trade deal increased the bullish sentiment; however, news that Beijing did not confirm the phone call mentioned by Trump between Chinese and US officials reversed the sentiment and once again increased the doubts and concerns over whether any progress will be made regarding the US–China trade disputes.

Prices have had trouble consistently trading above the $56/Bbl level in the last couple of weeks and market remains in the range of $50 to $58 as bearish sentiment is slowly taking over the market while tensions in Middle East prevents any significant decline in prices. At this point the only catalyst that could break the resistance and take prices close to the $60/Bbl range would be tensions in the Middle East drastically intensifying or a large reduction in output by OPEC. Prices can be further pressured in the near term if the US and Iran make any progress toward a deal and if US–China trade tensions worsen and further deteriorate global economic and demand growth. There also remains the possibility of China ignoring the bans on buying Iranian crude (in place of US crude) as a retaliatory posture, likely pressuring prices below $50. This event could flood the global crude market going into an already over-supplied 2020.