[contextly_auto_sidebar]

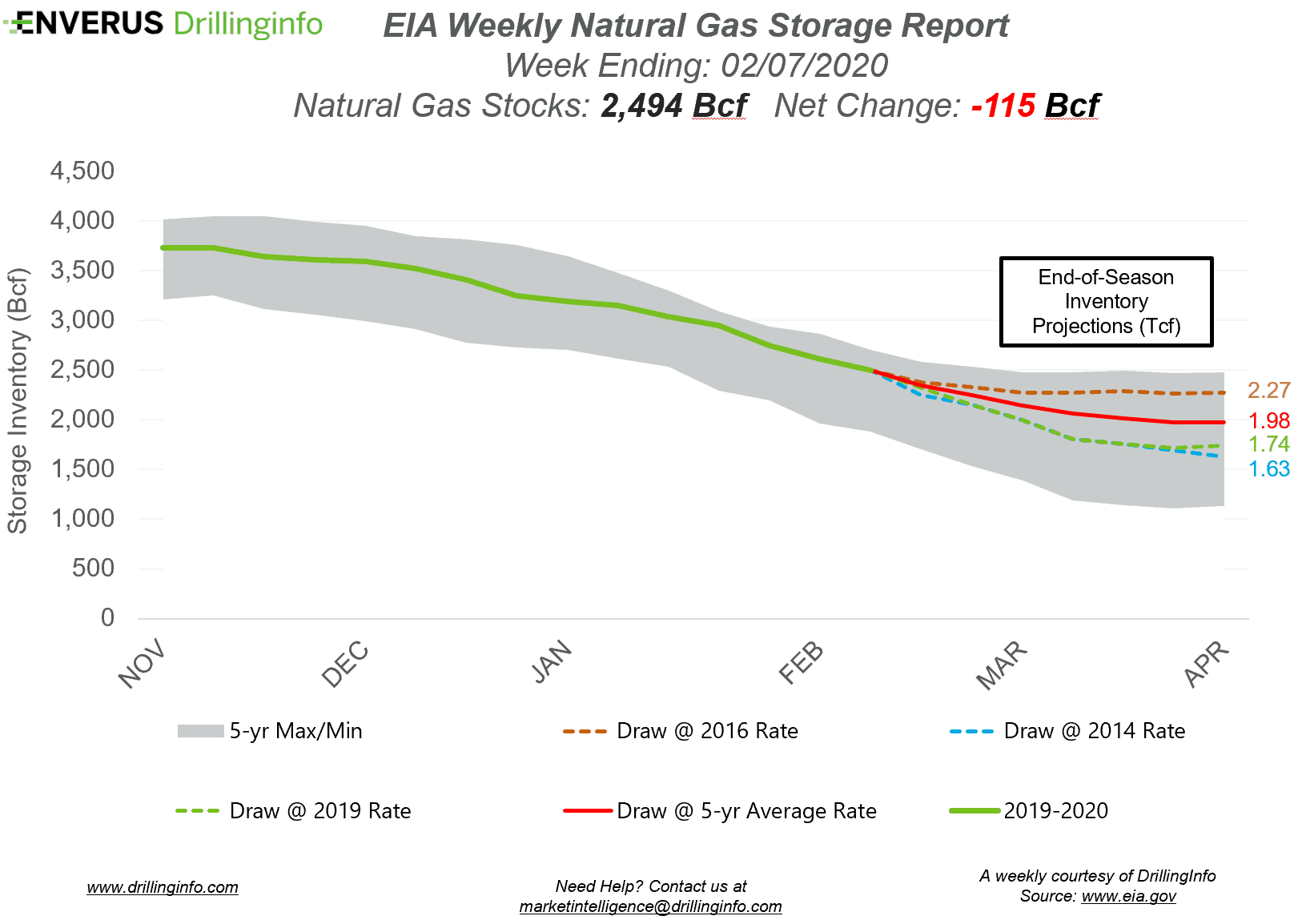

Natural gas storage inventories decreased 115 Bcf for the week ending February 7, according to the EIA’s weekly report. This was more than the expected draw of 110 Bcf.

Working gas storage inventories now sit at 2.494 Tcf, which is 601 Bcf above inventories from the same time last year and 215 Bcf above the five-year average.

Prior to the storage report release, the March 2020 contract was trading at $1.856/MMBtu, roughly $0.012 above yesterday’s close. After the release of the report, the March 2020 contract was trading at $1.844/MMBtu.

Prices opened the week lower on weather forecasts changing over the weekend to show warmer temperatures. The drop to open the week was mostly recovered yesterday as updated forecasts showed colder temperatures in the North Midcontinent region through the East Coast in the near term (1-to-5-day). The price run was limited, however, as the cold shot is expected to be short-lived.

Current weather forecasts from NOAA’s Climate Prediction Center show the 6-to-10-day forecast with below-average temperatures from Texas to Arizona and north through the Rockies; above-average temperatures are expected from the Southeast region north to the Midwest and all the way up the East Coast. The 8-to-14-day forecast shows the below-average temperatures subsiding in Texas and the Rockies, while the Northern Midcontinent and California add to the above-average temperature regions.

See the chart below for projections of the end-of-season storage inventories as of April 1, the end of the withdrawal season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending February 13.

Supply:

- Dry production increased 0.58 Bcf/d on the week. Most of the increase came from the South Central (+0.47 Bcf/d), supported by increases from the Pacific (+0.08 Bcf/d), the Mountain region (+0.06 Bcf/d), and the Midwest (+0.01 Bcf/d). The East is the only region that saw a decrease (-0.03 Bcf/d).

- Canadian net imports increased 0.22 Bcf/d.

Demand:

- Domestic natural gas demand increased 5.07 Bcf/d week over week. Res/Com demand accounted for the majority of the increase, rising 3.65 Bcf/d on the week. Power and Industrial demand also increased, rising 1.04 Bcf/d and 0.38 Bcf/d, respectively.

- LNG exports decreased 0.93 Bcf/d, mainly due to scheduled maintenance on Creole Trail, a pipeline that feeds Sabine Pass. Mexican exports increased 0.27 Bcf/d.

Total supply increased by 0.80 Bcf/d, while total demand increased 5.07 Bcf/d week over week. With the increase in demand outpacing the increase in supply, expect the EIA to report a stronger draw next week. The ICE Financial Weekly Index report is currently expecting a draw of 134 Bcf. Last year, the same week saw a draw of 177 Bcf; the five-year average is a draw of 145 Bcf.