[contextly_auto_sidebar]

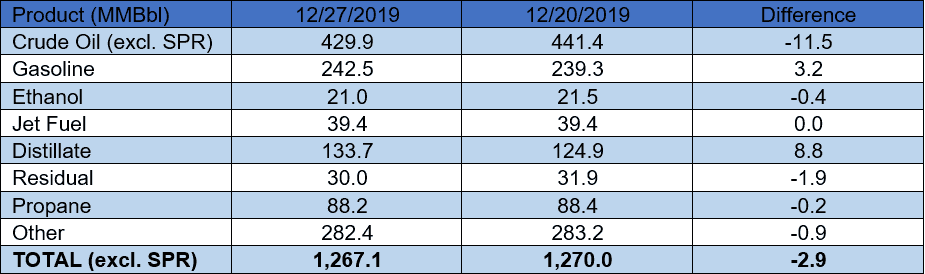

US crude oil stocks posted a very large decrease of 11.5 MMBbl. Gasoline and distillate inventories increased 3.2 MMBbl and 8.8 MMBbl, respectively. Yesterday afternoon, API reported a large crude oil draw of 7.8 MMBbl alongside a gasoline draw of 0.78 MMBbl and a distillate build of 2.8 MMBbl. Analysts were expecting a smaller crude oil draw of 3.1 MMBbl. Total petroleum inventories posted a decrease of 2.9 MMBbl.

US crude oil production remained unchanged last week, per EIA. Crude oil imports were down 0.46 MMBbl/d last week to an average of 6.4 MMBbl/d. Refinery inputs averaged 17.3 MMBbl/d (0.30 MMBbl/d more than last week’s average).

Crude oil futures were up sharply in after-hours trading yesterday evening as news spread of the assassination of Islamic Revolutionary Guard commander Qasem Soleimani by US forces in Iraq. The assassination represents a major escalation in hostilities between the United States and Iran, and is not likely to be the last. Indeed, Iran’s Supreme Leader Ali Khamenei has already vowed for revenge. The question at this point is not whether the Iranians will retaliate, but how and where. Iraq is the most likely venue, as direct confrontation with US forces in the Strait of Hormuz would end badly for Iran. Meanwhile, Iranian-backed militias and IRGC advisors are present throughout Iraq and were behind the recent storming of the US embassy in Baghdad. While we can expect the number of attacks against US forces and interests in the country to increase, oil markets are watching to see if heightened instability leads to a major supply disruption as Iraq teeters on the edge.