[contextly_auto_sidebar]

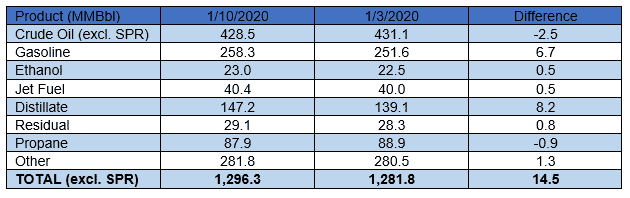

US crude oil stocks posted a decrease of 2.5 MMBbl. Gasoline and distillate inventories increased 6.7 MMBbl and 8.2 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 1.1 MMBbl alongside gasoline and distillate builds of 3.2 MMBbl and 6.8 MMBbl, respectively. Analysts, to the contrary, were expecting a crude oil draw of 0.5 MMBbl. Total petroleum inventories posted a very large increase of 14.5 MMBbl.

US crude oil production increased 100 MBbl/d last week, per EIA. Crude oil imports were down 0.18 MMBbl/d last week to an average of 6.6 MMBbl/d. Refinery inputs averaged 17.0 MMBbl/d (76 MBbl/d more than last week’s average).

Front month WTI futures for February delivery ticked up a modest $0.15/bbl in Tuesday trading to settle at $58.23/bbl. After tumbling from last week’s high of $64.27/bbl as tensions between the United States and Iran went back to a low simmer, market sentiment has regained footing recently thanks in part to the imminent signing of the “Phase One” trade deal between the United States and China. The actual text of the agreement has yet to be made public and will not be released until after Wednesday’s formal signing ceremony. So far, the only thing that is known is that there will be no reduction in tariffs.