Since the beginning of 2018, the Permian has seen a notable number of billion dollar plus corporate mergers such as Concho Resources’ $9.5 billion deal for RSP Permian; Diamondback Energy’s $1.2 billion buy of Ajax Resources and $9.2 billion buy of Energen; and Cimarex Energy’s acquisition of Resolute Energy for $1.6 billion. Much of the drive for the Occidental Petroleum-Anadarko Petroleum and Callon Petroleum-Carrizo Oil & Gas deal is related to Permian assets. Now in Q4, another Permian merger has been proposed with Parsley Energy offering $2.27 billion for Delaware Basin-focused Jagged Peak Energy. Before getting into the deal breakdown, it’s instructive to look at what each company achieved operationally in the latest reported quarter.

Jagged Peak holds 78,100 net acres (88% contiguous; 97% operated) primarily in Pecos, Reeves, and Ward counties, in Texas, that is contiguous to Parsley’s operations. Q2 production was sequentially flat at 38,300 boe/d (76% oil). Jagged Peak is running five rigs and one-to-two frac crews in 2019 to turn online 54 wells.

The company brought online 11 operated wells during Q2, for an H1 total of 23 wells turned to sales; 17 additional wells were in progress at the quarter’s end.

Jagged Peak’s Q2 operational highlights included bringing online the first Wolfcamp A well in the central fairway of its Big Tex acreage in Ward County, Texas. The company called the State Big Tex South 7673-8 11-H’s early results encouraging, with a two-stream peak IP30 of 104 boe/d per 1,000 lateral ft and 90-day cumulative production of ~7,500 boe per 1,000 ft. This compares favorably to the company’s previous Big Tex wells, which have had average two-stream peak IP30s of 88 boe/d and 90-day cumulative production of ~6,300 boe per 1,000 ft. The 11-H well is currently on artificial lift and continues to show a robust production profile after 130 days of production. Its most recently reported seven-day average oil rate was 1,077 bo/d.

Jagged Peak also turned online a successful Woodford well on the southeast portion of its Big Tex position during Q2. The Chimera 3601-142 61H was drilled with a 6,400-ft lateral 100% in zone and delivered a two-stream peak IP30 of 294 boe per 1,000 lateral ft (50% oil).

Operators in the Permian and across U.S. shale plays have focused on improving capital efficiency, lowering costs, and being cash flow neutral or positive. Compared to its peers, Jagged Peak has lagged behind in these respects. While Parsley is on track to be cash flow positive in H2, Jagged Peak wasn’t going to hit that mark this year and outspent cash flow by $149.5 million in H1. In addition, by the end of Q2 Parsley had surpassed its capital efficiency goal, setting a company record with average lease operating expenses of $3.35/boe, whereas Jagged Peak’s Q2 LOEs rose to the upper end of guidance. Parsley lowered its FY19 LOE guidance to $3.40-$3.90/boe from $3.50-$4.50/boe, while Jagged Peak increased its by $0.25/boe to $4.15/boe. However, Jagged Peak did lower Q2 drilling, completion, and equipment costs 15% versus 2018 to $1,250 per lateral ft. It also improved lateral footage completed per day, per crew, to a YTD average of 1,385 ft compared to 758 ft in FY18. Total feet drilled per day, per rig, increased 11% versus 2018 to 830 ft YTD.

Parsley plans to place 135-140 wells on production in 2019. It drilled 41 operated wells and brought online 39 in Q2, with laterals averaging 9,750 ft. Activity was focused on the Midland Basin, where 33 of the wells were turned to sales, with the remainder in the Delaware. Operational achievements include an 8% improvement in feet drilled per day versus Q1, at ~850 ft. This allowed the company to drop from 12 rigs to 11 in mid-June. Parsley plans to maintain 11 active rigs through year’s end.

A number of notable Parsley wells were drilled during Q2 in Upton County, Texas. Three Wolfcamp B wells on the Hanks Family lease were drilled with 6,500-ft laterals and fracked with upsized proppant loads of 2,400 lb per lateral ft. Parsley says early results are promising, with initial 30-day peak rates per well averaging 1,342 boe/d (74% oil), or 207 boe/d per 1,000 lateral ft. During H1 the company brought online 25 wells in Upton County, and these wells in aggregate are exhibiting 8% higher oil productivity than comparable 2018 wells.

By combining with Jagged Peak, Parsley will increase its net Permian acreage 41% to 267,000 net acres (55% Midland, 45% Delaware) and increase its pro forma Q2 net production 27% to 115,700 boe/d and oil output 34% to 75,200 bo/d. The all-stock deal would give Jagged Peak shareholders 0.447 shares of Parsley Class A common stock for each Jagged Peak share, which values Jagged Peak’s shares at $7.59 based on Oct. 11 closing prices. This represents a mere 1.5% premium to Jagged Peak’s 30-day volume weighted average price and an 11.2% premium to Jagged Peak’s closing price on Oct. 11.

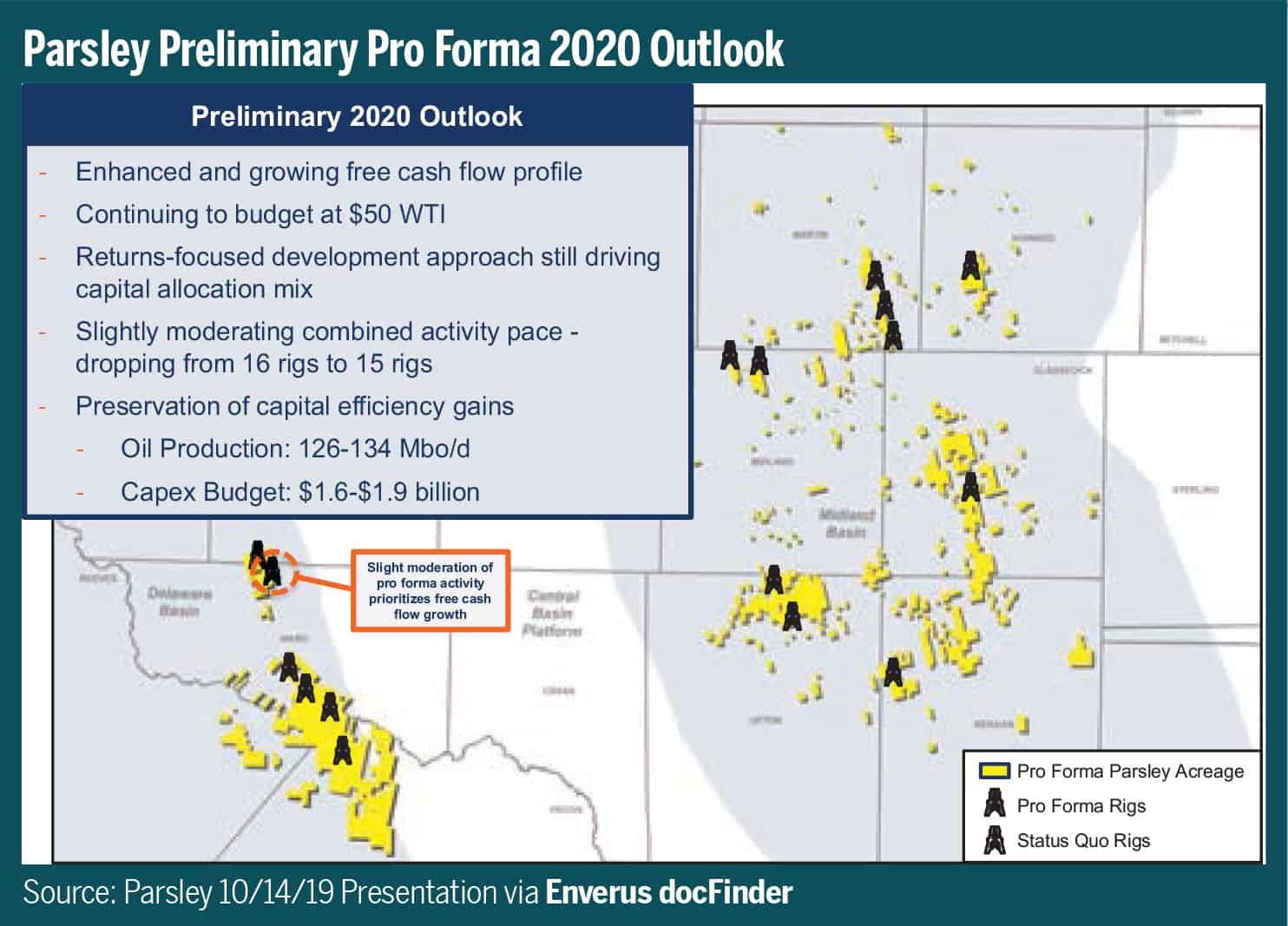

The transaction combines two low-cost, high-margin producers that expect further margin expansion from $40 million-$50 million in annual G&A and operational synergies. Parsley expects additional synergies from applying its Delaware Basin cost metrics to the Jagged Peak inventory, land synergies from overlapping acreage, developmental pace flexibility that will allow it to drop one rig in 2020, ongoing combined water infrastructure initiatives, and lower cost of capital from a possible move to an investment-grade credit profile. As a result, Parsley expects the transaction to be accretive to 2020 cash flow per share, free cash flow per share, cash return on capital invested, and net asset value.