[contextly_auto_sidebar]

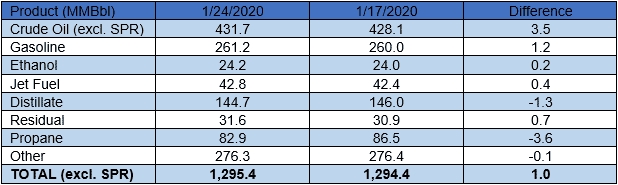

US crude oil stocks posted an increase of 3.5 MMBbl. Gasoline inventories increased 1.2 MMBbl and distillate inventories decreased 1.3 MMBbl. Yesterday afternoon, API reported a crude oil build of 4.3 MMBbl alongside a gasoline build of 3.3 MMBbl and a distillate draw of 0.14 MMBbl. Analysts were expecting a smaller crude oil build of 0.5 MMBbl. Total petroleum inventories posted an increase of 1.0 MMBbl.

US crude oil production remained unchanged last week, per EIA. Crude oil imports were up 0.23 MMBbl/d last week to an average of 6.7 MMBbl/d. Refinery inputs averaged 15.9 MMBbl/d (0.93 MMBbl/d less than last week’s average).

March WTI was up $0.34/bbl on Tuesday to settle at $53.68, breaking a five-day stretch of price declines. Nevertheless, this was still near a three-month low and demand destruction concerns related to the spread of coronavirus continue to linger. Indeed, prices are already down this morning. First quarter inventory builds were predicted to be large even after the OPEC+ agreement to deepen production cuts, and so far inventory high-frequency inventory data from the United States are confirming this. The threat to Asian demand from the slowdown in economic activity caused by efforts to control the spread of coronavirus may make these builds larger than anticipated.