On Jan. 2, the United States ended, forever, Qassem Soleimani’s tenure as the director of Iran’s Quds Force. As of Monday, Jan. 6, oil prices have gained about 3% as traders attempt to sort out how increased tensions in the Middle East will affect Brent and WTI prices.

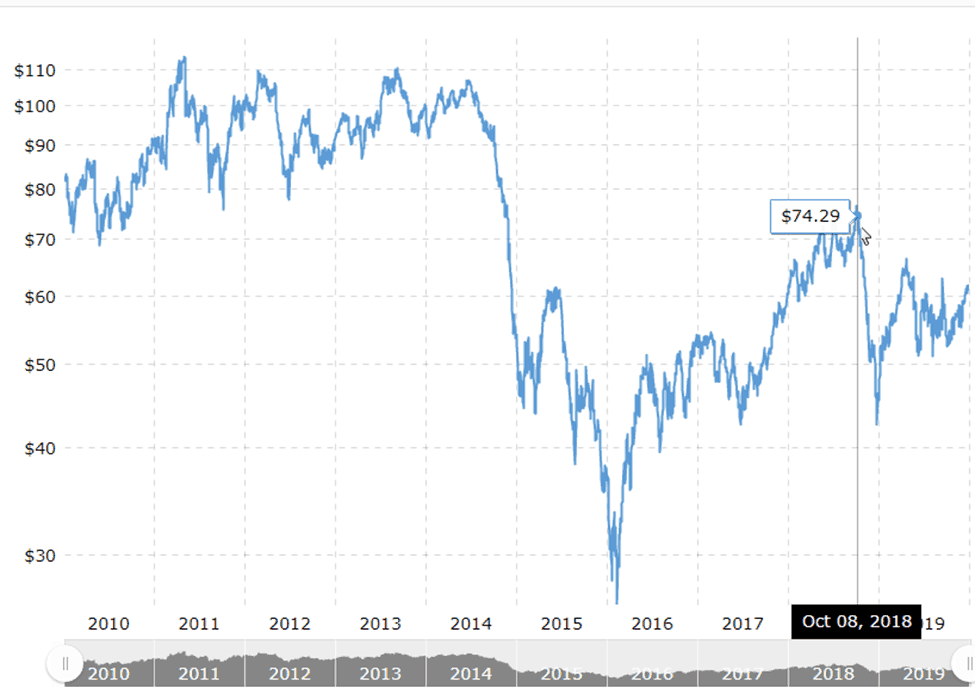

It’s worthwhile to look at recent oil price history.

At current pricing of $62.68, oil is still trading about $13 per barrel lower than it was at its most recent high on Oct. 1, 2018 (EIA Cushing, Oklahoma, Spot FOB—$75.37).

Analysts trying to read the unsettled tea leaves have opined that should Iran close the Strait of Hormuz, Brent crude could top $150 per barrel, doubling the price of our most essential commodity and causing widespread economic disruption. Given that 21 MMBD moves through the Strait of Hormuz, any attempt to throttle this supply would be met, we would think, with an overwhelming international response.

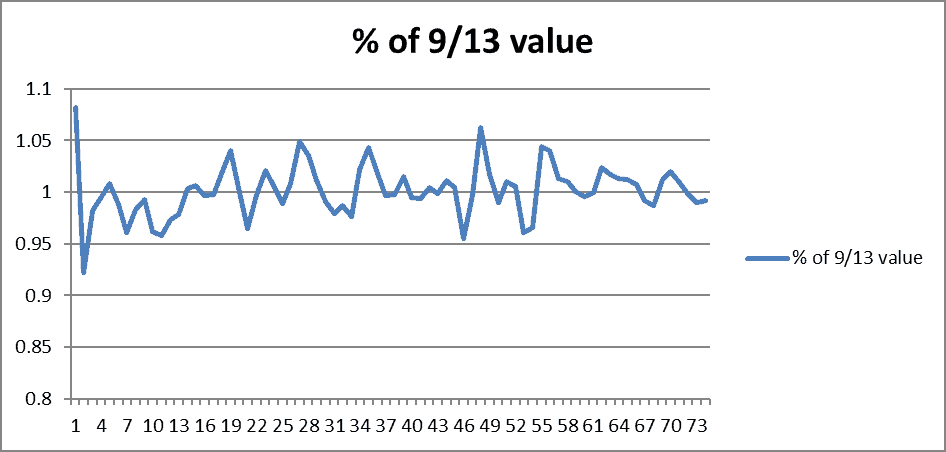

Skeptics will probably cite the price impact of the Sept. 14, 2019, attack on Abqaiq and Khurais as a guide to where prices go from here.

Prices spiked nearly 13% from the settlement in trading on Friday, Sept. 13, 2019, to Monday, Sept. 16, 2019, but the aftershock was not hugely profound.

Sept. 13, 2019–Jan. 2, 2020

But this is probably different. While Iran retaliated Wednesday by firing several missiles at Iraqi bases where U.S. troops are housed, there are still several ways they could potentially carry out revenge.

As noted before, Iran could attempt to close the Strait of Hormuz in an attempt to disrupt the worldwide traffic in oil. This would send prices skyrocketing.

One of the major beneficiaries would be the U.S. oil patch. An increase to more than $70 per barrel would rescue a lot of marginal shale players, shore up loan covenants on a bunch of gnarly debt that’s due, and may improve the creditworthiness of bond issuers across the industry.

Some of that profit windfall will make it into 2021 CAPEX budgets, which should only grow production output from domestic U.S. operations, which in the long run, depress prices and ultimately hurt Iran.

It’s possible that a price windfall would dampen the demand and desire for capital restraint and earnings growth now demanded by Wall Street, and might ultimately sow the seeds of the next pricing downturn as production growth born of the desire to reap quick cash from elevated prices leads to a return of growth-at-all-costs business plans.

A prolonged period of oil price inflation will damage many economies. China buys about 10% of Iran’s oil production, and if prices for those transactions, and transactions with other suppliers climb to reflect open market pricing, the Chinese economy would be put under further pressure. Given the size of their economy, it’s probable the worldwide demand growth for oil would also moderate.

So, would Iran really want to put money in the pockets of U.S. producers, or hurt their oil export revenues when—and if—things got back to “normal”?

It may be more likely that Iran may attempt to exact their revenge through cyber warfare by targeting important infrastructure, or with targeted attacks on U.S. diplomatic infrastructure.

Where does this leave our industry?

Riding, again, the tiger of the news cycle.

“Knot” Your Father’s Oil Patch

The U.S. oil & gas industry has made good progress in becoming more efficient with its upstream and even its midstream operations.

New technologies will inevitably displace current workflows. A report published in the journal Nature earlier this month showed Google’s DeepMind artificial intelligence (AI) platform did a better job of diagnosing breast cancer than trained radiologists. Its AI engine used 29,000 random X-ray images to train itself to spot cancerous lesion image anomalies, the study showed (Nature, Vol. 577, Jan. 2, 2020).

It doesn’t take a great leap for this kind of image pattern recognition to be applied to LAS files, subsurface maps, seismic data, and other spatial information. If so, then what becomes of the trained geologists, geophysicists, engineers, and other knowledge workers within our industry?

Perhaps we go into the coming decade prepared to ramp up our curiosity to start adapting data from disciplines well outside the normal oil & gas arena.

A recent study at MIT examined what makes a knot strong.

I’m a sucker for crazy analogies that attempt to tie together wildly different systems, so the language below, from a recent article in ScienceNews, got me to thinking:

“Patil and colleagues then found that three characteristics could explain a knot’s strength. First, the more times the strands cross, the stronger the knot. And the twisting of strands as they cross one another also plays a role: If the strands are twisted in opposite directions, the twist balances out, locking the knot into place. Finally, if adjacent strands slide in opposing directions as a knot is tightened, that also strengthens the knot.”

What if we applied these characteristics of knots to the structure and organization of E&P companies?

The knot could be our supply chains—we study them as knots to either improve their dependability or to unlock why they are at risk?

Or they could be workflow inefficiencies that prevent timely decision-making in field development work, or worse, prevent any decisions being made at all?

What if we’ve found a corporate behavior that is providing excellent returns on capital and we want to strengthen its persistence across our company? Perhaps we can use knot knowledge to reverse engineer what we’ve done to understand its structure and adapt it across the organization.

Going even further out on a limb, consider that Harvard chemists were able to use lasers to study chemical interactions of ultracold reactions, and were surprisingly able to see the intermediate processes in a chemical reaction.

Quoting a few lines from a recent Popular Mechanics article:

“Imagine if you sneezed in a very cold room and your half-second sneeze extended to 139 hours. … If we slow particles enough, can we identify why observing them changes their outcomes or even stop that from happening?”

Could the process of slowing down our analytical or business processes allow us to develop fresh, useful insight into how we achieve—or don’t achieve—the metrics that guide our company’s growth?

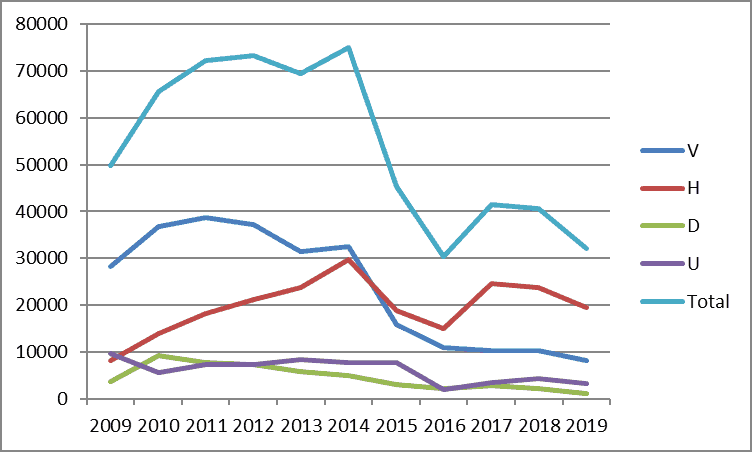

Who knows, but given the drop in U.S. permit activity over the past 10 years and the current economic constraints that, for now, restrain growth in the upstream sector, we should be thinking as creatively as possible.

No thinking outside the box, but doing away with the box forever.

Thoughts? Please contact me at [email protected].

I’d love to know what you think.