[contextly_auto_sidebar]

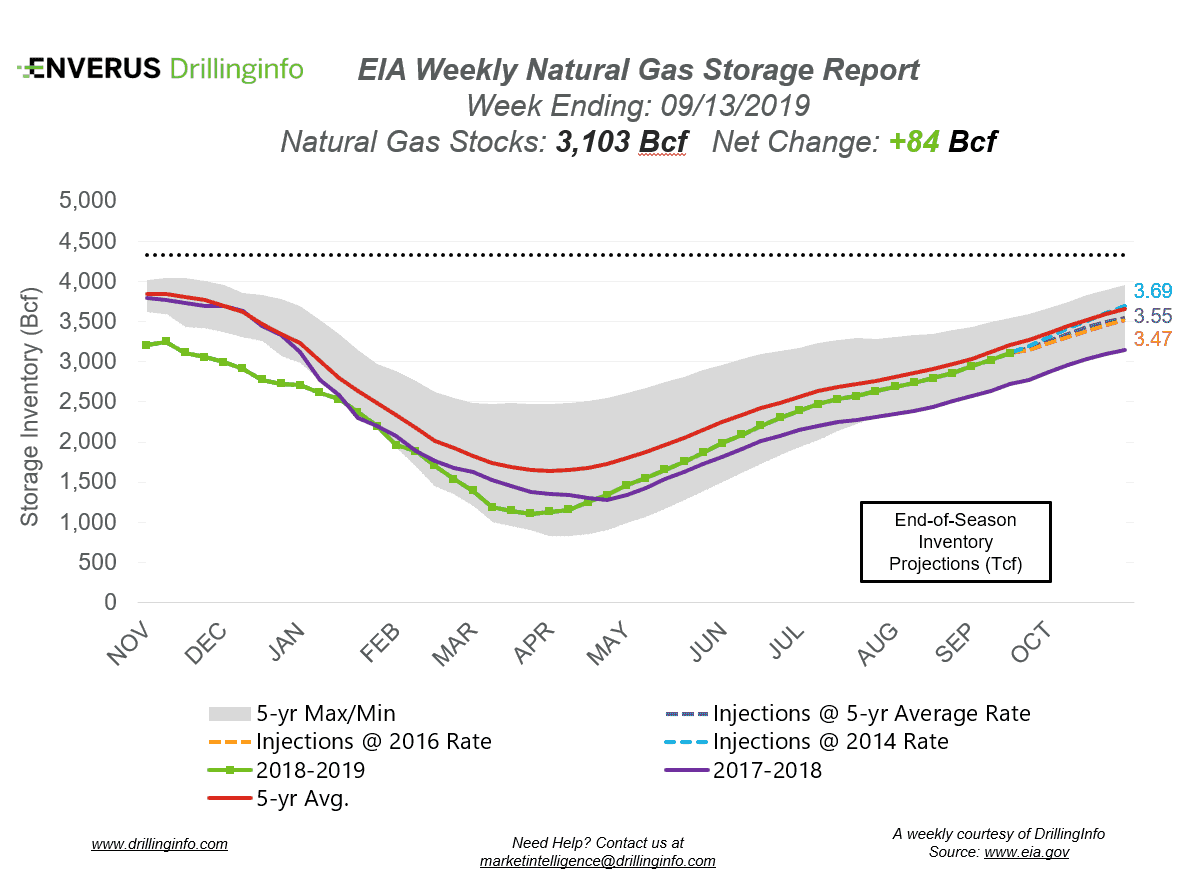

Natural gas storage inventories increased 84 Bcf for the week ending September 13, according to the EIA’s weekly report. This is higher than the market expectation, which was an injection of 81 Bcf.

Working gas storage inventories now sit at 3.103 Tcf, which is 393 Bcf above inventories from the same time last year and 75 Bcf below the five-year average.

Prior to the storage report release, the October 2019 contract was trading at $2.593/MMBtu, roughly $0.048 lower than yesterday’s close. At the time of writing, post report, the October 2019 contract was trading at $2.540/MMBtu.

Last week, storage inventories topped 3 Tcf, and the end of injection season is in sight, with six weeks remaining until the change of season. October weather is currently expected to be above average in terms of temperature, creating a bearish sentiment in the market. Historically, October is when temperatures turn colder, increasing HDDs and Res/Com demand. However, above-average temperatures will cause fewer HDDs, creating less heating demand. This is also a time when CDDs fall off, as the season changes from summer to winter. Should forecasts hold true and October have above-average temperatures, a low-demand period will likely occur during October. Based on Enverus’s supply and demand and current weather forecasts, Enverus anticipates ending season inventories to be ~3.7 Tcf. This level is right in line with the five-year average.

See the chart below for the projections of the end-of-season storage inventories as of November 1, the end of the injection season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending September 19, 2019.

Supply:

- Dry production decreased 0.65 Bcf/d on the week. Most of the decrease came from the South Central (-0.41 Bcf/d), where Texas production dropped 0.21 Bcf/d.

- Canadian imports decreased 0.07 Bcf/d on the week.

Demand:

- Domestic natural gas demand dropped 2.09 Bcf/d week over week. Power demand accounted for most of the decrease, falling 2.01 Bcf/d. Res/Com demand increased 0.11 Bcf/d, while Industrial demand decreased 0.19 Bcf/d.

- LNG exports increased 0.75 Bcf/d, mainly due to increased exports at Sabine Pass. Mexican exports increased 0.03 Bcf/d.

The ICE Financial Weekly Index report is currently expecting an injection of 83 Bcf. Last year, the same week saw an injection of 46 Bcf; the five-year average is an injection of 69 Bcf.