[contextly_auto_sidebar]

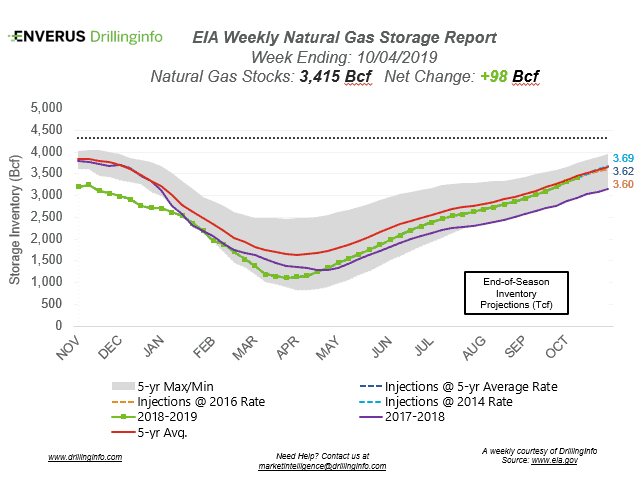

Natural gas storage inventories increased 98 Bcf for the week ending October 4, according to the EIA’s weekly report. This is slightly lower than the market expectation, which was an injection of 101 Bcf.

Working gas storage inventories now sit at 3.415 Tcf, which is 472 Bcf above inventories from the same time last year and 9 Bcf below the five-year average.

Prior to the storage report release, the November 2019 contract was trading at $2.258/MMBtu, roughly $0.024 higher than yesterday’s close. At the time of writing, post-report, the November 2019 contract was trading at $2.246/MMBtu.

This week’s injection fell just short of the 100 Bcf mark with EIA reporting 98 Bcf. Currently, 2019 is one 100+ Bcf injection behind 2014. According to the ICE Financial Weekly Index report, the next two weeks are expected to yield 100+ Bcf injections, giving 2019 a chance to become the record holder. Enverus expects inventories to end injection season around 3.7 Tcf.

See the chart below for projections of the end-of-season storage inventories as of November 1, the end of the injection season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending October 10, 2019.

Supply:

- Dry production decreased 0.21 Bcf/d on the week. Most of the decrease came from the East (-0.20 Bcf/d) and the South Central (-0.19 Bcf/d), with an offset coming from the Mountain region (+0.22 Bcf/d).

- Canadian imports decreased 0.30 Bcf/d on the week.

Demand:

- Domestic natural gas demand decreased 2.31 Bcf/d week over week. Power demand accounted for most of the decrease, falling 4.50 Bcf/d. Res/Com demand increased 1.92 Bcf/d, while Industrial demand increased 0.27 Bcf/d.

- LNG exports increased 0.16 Bcf/d, while Mexican exports increased 0.28 Bcf/d.

Total supply decreased 0.50 Bcf/d, while total demand decreased 1.95 Bcf/d week over week. With the decrease in demand outpacing the decrease in supply, expect the EIA to report a stronger injection next week. The ICE Financial Weekly Index report is currently expecting an injection of 110 Bcf. Last year, the same week saw an injection of 81 Bcf; the five-year average is an injection of 77 Bcf.