[contextly_auto_sidebar]

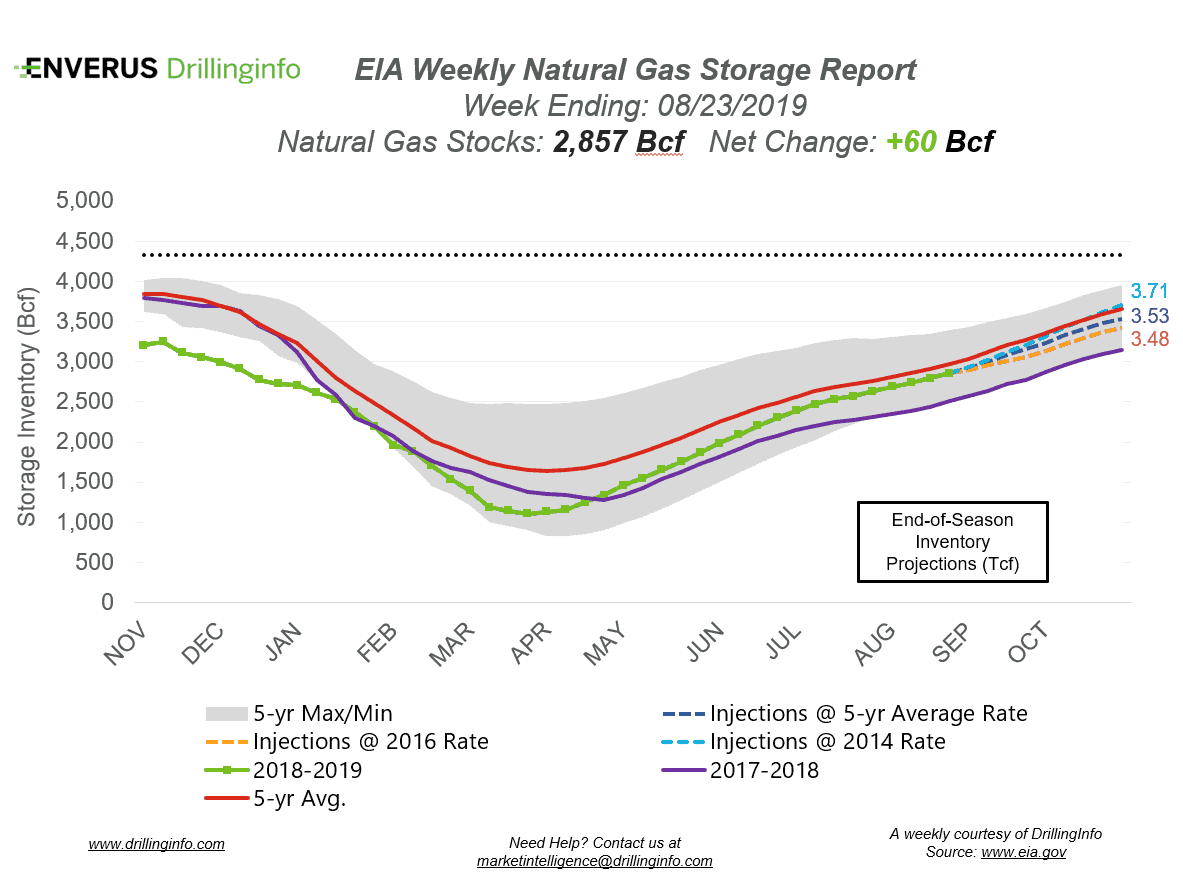

Natural gas storage inventories increased 60 Bcf for the week ending August 23, according to the EIA’s weekly report. This is spot on with the market expectation, which was an injection of 60 Bcf.

Working gas storage inventories now sit at 2.857 Tcf, which is 363 Bcf above inventories from the same time last year and 100 Bcf below the five-year average.

At the time of writing, the October 2019 contract was trading at $2.275/MMBtu, roughly $0.053 higher than yesterday’s close. The September 2019 contract expired yesterday, rallying to close at $2.251/MMBtu, up $0.049 from the prior day’s close.

Hurricane Dorian is headed toward the lower 48, but recent forecasts for the storm show that it is expected to hit the eastern part of Florida and stay away from the Gulf. With this current path, production isn’t expected to be impacted. However, should the forecasted path take a turn toward the Gulf, crews will be evacuated, and production will decrease for a short period of time. This path change must happen soon for production to be impacted, as Dorian is expected to hit the eastern coast of Florida this weekend. Additionally, should the hurricane path stay true, production will stay near current levels and demand will decrease, pressuring prices lower.

See the chart below for the projections of the end-of-season storage inventories as of November 1, the end of the injection season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending August 29, 2019.

Supply:

- Dry production decreased 0.30 Bcf/d on the week. Most of the decrease came from the South Central (-0.44 Bcf/d), where Texas production dropped 0.23 Bcf/d and GoM production fell 0.11 Bcf/d. To slightly offset the decrease, the East region gained 0.12 Bcf/d.

- Canadian imports decreased 0.64 Bcf/d, largely due to decreased imports in the Midwest.

Demand:

- Domestic natural gas demand fell 5.24 Bcf/d week over week. Power demand saw the largest decrease, falling 5.03 Bcf/d, which accounts for nearly the entire decrease in domestic demand. Res/Com demand fell 0.41 Bcf/d, while Industrial demand gained 0.21 Bcf/d on the week.

- LNG exports gained 1.39 Bcf/d, mainly due to Sabine and Corpus ramping back up to full export capacity. Mexican exports remained relatively flat on the week, gaining only 0.01 Bcf/d.

Total supply decreased 0.93 Bcf/d, while total demand decreased 4.01 Bcf/d week over week. With the drop in demand outpacing the drop in supply, expect the EIA to report a stronger injection next week. The ICE Financial Weekly Index report is currently expecting an injection of 80 Bcf. Last year, the same week saw an injection of 62 Bcf; the five-year average is an injection of 63 Bcf.