[contextly_auto_sidebar]

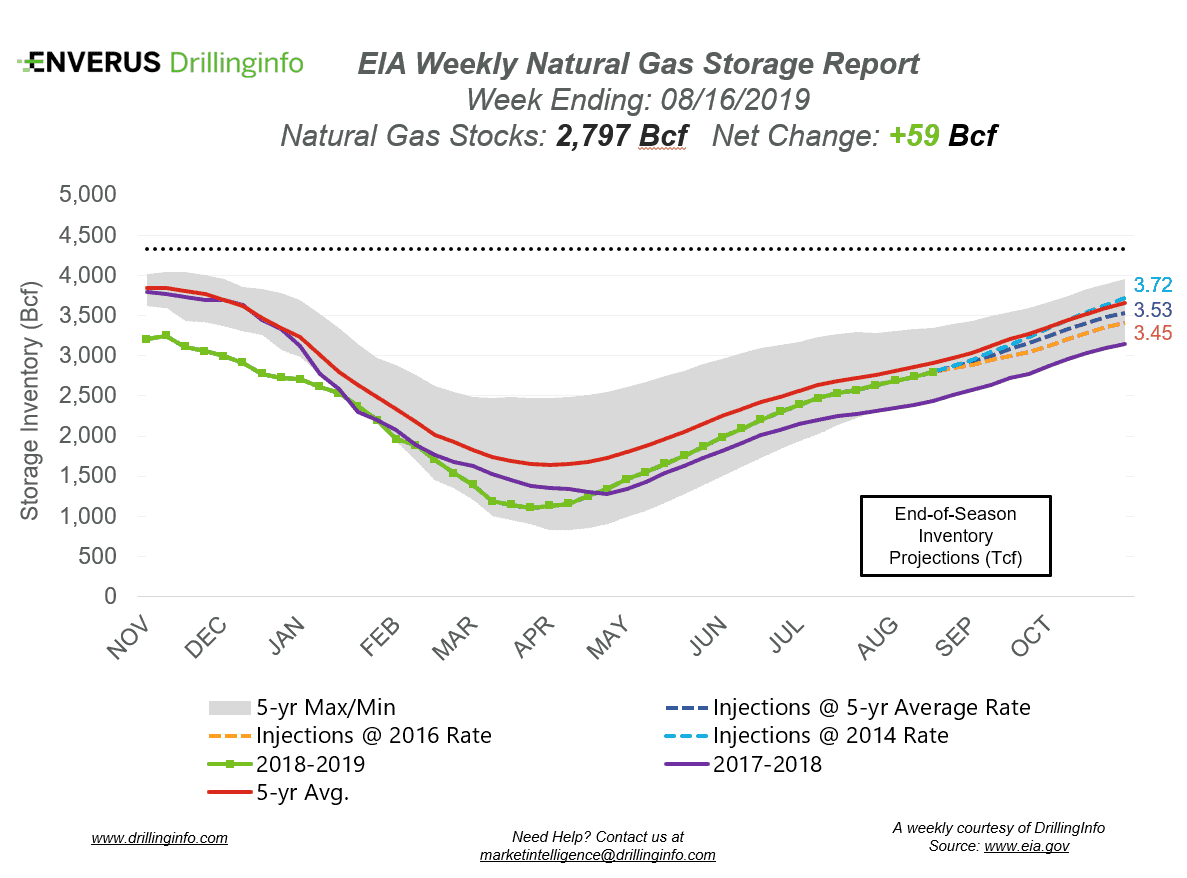

Natural gas storage inventories increased 59 Bcf for the week ending August 16, according to the EIA’s weekly report. This is below the market expectation, which was an injection of 65 Bcf.

Working gas storage inventories now sit at 2.797 Tcf, which is 369 Bcf above inventories from the same time last year and 103 Bcf below the five-year average.

At the time of writing, the September 2019 contract was trading at $2.177/MMBtu, roughly $0.007 higher than yesterday’s close and $0.055 lower than last week’s.

Weather forecasts for the coming two weeks show above-average temperatures in the early part of the forecast, but show a gradually declining curve into the back half of the forecast, as temperatures are expected to cool. Should forecasts turn warm for the remainder of the summer, injections will be impacted. However, end-of-summer weather will have only minimal impacts on injections, and injections are still expected to be somewhere between average and above average for the remainder of the season.

See the chart below for the projections of the end-of-season storage inventories as of November 1, the end of the injection season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending August 22, 2019.

Supply:

- Dry gas production increased 0.29 Bcf/d on the week.

- Canadian net imports increased this week, gaining 0.47 Bcf/d.

Demand:

- Domestic natural gas demand increased 0.47 Bcf/d week over week. Power demand led the increase, gaining 0.28 Bcf/d, while Res/Com and Industrial demand increased 0.10 and 0.08 Bcf/d, respectively.

- LNG exports ramped back up this week, gaining 1.03 Bcf/d, as Sabine Pass maintenance has been completed. Mexican exports also increased, gaining 0.23 Bcf/d.

Total supply is up 0.76 Bcf/d, while total demand increased 1.76 Bcf/d week over week. With demand outpacing the gain in supply, expect the EIA to report a weaker injection next week. The ICE Financial Weekly Index report is currently expecting an injection of 60 Bcf. Last year, the same week saw an injection of 70 Bcf; the five-year average is an injection of 65 Bcf.