[contextly_auto_sidebar]

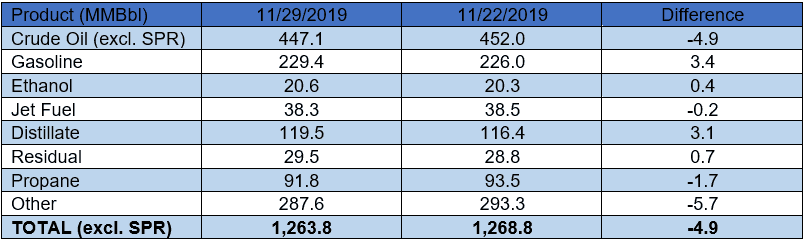

US crude oil stocks decreased by 4.9 MMBbl. Gasoline and distillate inventories increased 3.4 MMBbl and 3.1 MMBbl, respectively. Yesterday afternoon, API reported a crude oil draw of 3.72 MMBbl alongside gasoline and distillate builds of 2.93 MMBbl and 0.79 MMBbl, respectively. Analysts were expecting a crude oil draw of 1.79 MMBbl. Total petroleum inventories posted a decrease of 4.9 MMBbl.

US crude oil production remained unchanged last week, per EIA. Crude oil imports were down 0.20 MMBbl/d last week, to an average of 6.0 MMBbl/d. Refinery inputs averaged 16.8 MMBbl/d (0.46 MMBbl/d more than last week’s average).

After last Friday’s heavy selling that sent January WTI to a low of $55.02/Bbl, trading on Monday managed to stage a small comeback thanks to Chinese PMI data showing a modest expansion of November manufacturing activity. Tuesday trading was somewhat choppy, with a mix of bearish and bullish news sending prompt futures to a low of $55.35/Bbl and reaching a high of $56.80/Bbl later in the session (settling at $56.10/Bbl). Hopes for an easing of US-China trade tensions were largely dashed after President Trump suggested that a trade deal may not be reached until after the 2020 election. The president’s comments contradicted recent assertions from the administration that negotiations were going well. Renewed trade war concerns were only mollified by renewed talk of deeper production cuts by OPEC and allied non-OPEC oil-producing countries that will be meeting in Vienna later this week. The minimum expectation among market participants is for an extension of the existing agreement beyond its current March expiration, with some upside potential if cuts are increased by another 400 MBbl/d, as is currently being discussed.