[contextly_auto_sidebar]

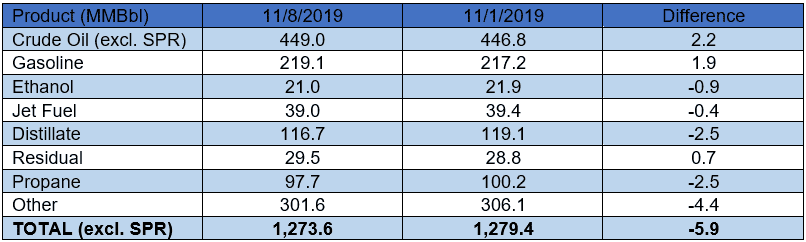

US crude oil stocks increased by 2.2 MMBbl. Gasoline inventories increased 1.9 MMBbl while distillate inventories decreased 2.5 MMBbl. Yesterday afternoon, API reported a crude oil draw of 0.5 MMBbl alongside gasoline and distillate builds of 2.3 MMBbl and 0.8 MMBbl, respectively. Analysts, to the contrary, were expecting a crude oil build of 1.6 MMBbl. Total petroleum inventories posted a decrease of 5.9 MMBbl.

US crude oil production increased 200 MBbl/d last week, per EIA. Crude oil imports were down 0.37 MMBbl/d last week, to an average of 5.8 MMBbl/d. Refinery inputs remained low, averaging 15.9 MMBbl/d (0.15 MMBbl/d more than last week’s average), which was a factor behind the crude build.

Front month WTI moved slightly higher on Wednesday (settling at $57.40/Bbl) as traders digest mixed macroeconomic and fundamental outlooks, with prices remaining rangebound as a result. Despite Fed Chairman Jerome Powell’s comments on Wednesday citing a healthy US job market and favorable projections for continued economic expansion, trade war concerns continue to linger. Indeed, President Trump’s recent threat to raise tariffs on Chinese goods “very substantially” is raising questions about whether the administration’s efforts to negotiate an interim trade deal are moving forward as well as advertised. Doubts are also starting to emerge about OPEC’s commitment to deeper production cuts, but so far these concerns have been tempered by lower expectations for US production growth next year.