Austin, Texas (April 13, 2022) — Enverus, the leading energy data analytics and SaaS technology company, is releasing its summary of 1Q22 M&A activity. As the M&A market marched into the new year, $14 billion in deals were announced during the first quarter of 2022. The $6 billion transacted in January 2022 was the strongest M&A market launch in five years. However, the last significant transaction occurred in early March before a spike in commodity prices temporarily halted activity.

“All the factors that kept upstream deals resilient in 2021 carried over into the new year,” said Andrew Dittmar, director at Enverus. “That included a need for inventory by public companies, ready private sellers and favorable pricing. However, the volatility in energy prices caused by Russia’s invasion of Ukraine stalled nearly all deals in March.”

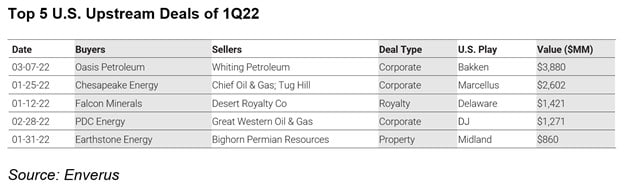

Overall, deals were most active in the Rockies region (more than 50% of total 1Q22 value) driven particularly by buyer interest in North Dakota’s Williston Basin and Colorado’s DJ Basin. The always consistent Permian Basin captured a bit under 30% of deal value and one big deal in the Marcellus drove the roughly 20% of value allocated to the Eastern region. A lack of deals in the previously active Haynesville and a continued slow pace in the Eagle Ford meant transactions in Ark-La-Tex and the Gulf Coast were sparse.

Private company exits remained a primary theme accounting for four of the five largest deals of the quarter. Chesapeake continued its buildout of core gas-focused inventory in the northeast Marcellus by acquiring private Chief Oil & Gas and associated Tug Hill interests in a $2.6 billion transaction. While that deal was more focused on building inventory runway and Chesapeake was willing to pay for it, other buyers like Earthstone Energy in the Midland Basin and PDC Energy in the DJ Basin sought acquisitions that could be purchased solely for the value of existing production while still adding future drilling locations.

“Buyers have been cautious about raising the offer price in deals to match the rise in commodity prices. Even before the latest bout of volatility, upstream assets were pricing cheaply on most metrics relative to historical averages,” Dittmar said. “The quick surge in commodity prices that accompanied the war in Ukraine has particularly blown out the gap between what buyers are willing to pay and sellers expect to get. And because they are so far apart, we have seen a pause in upstream deals.”

One of the deal types less susceptible to commodity pricing risk is the so-called corporate mergers of equals. In these mergers, two public companies of similar size combine with little to no premium paid to the acquired company. These types of deals, targeted at creating a larger and hopefully more stable platform for investors, were more common in the early innings of the post-COVID market. The combination of Oasis Petroleum and Whiting Petroleum in the Bakken in early March was a return to this type of transaction and the first public-public company merger since August 2021. The two mid-sized producers are likely hopeful that a larger company will give them the scale to better pursue further consolidation and add inventory in the maturing Bakken.

“There should still be plenty of upstream deals to be had,” Dittmar said. “Those can come from further private exits, non-core sales by the big producers like ConocoPhillips and ExxonMobil, or the remaining smaller E&Ps finding merger partners. We just need some stability in commodity pricing and an acquisition or two to benchmark deals to reignite what should be an active market.”

Members of the media can contact Jon Haubert to request a copy of the full report or to schedule an interview with one of Enverus’ expert analysts.

About Enverus

Enverus is the leading energy SaaS company delivering highly-technical insights and predictive/prescriptive analytics that empower customers to make decisions that increase profit. Enverus’ innovative technologies drive production and investment strategies, enable best practices for energy and commodity trading and risk management, and reduce costs through automated processes across critical business functions. Enverus is a strategic partner to more than 6,000 customers in 50 countries. Learn more at Enverus.com.