[contextly_auto_sidebar]

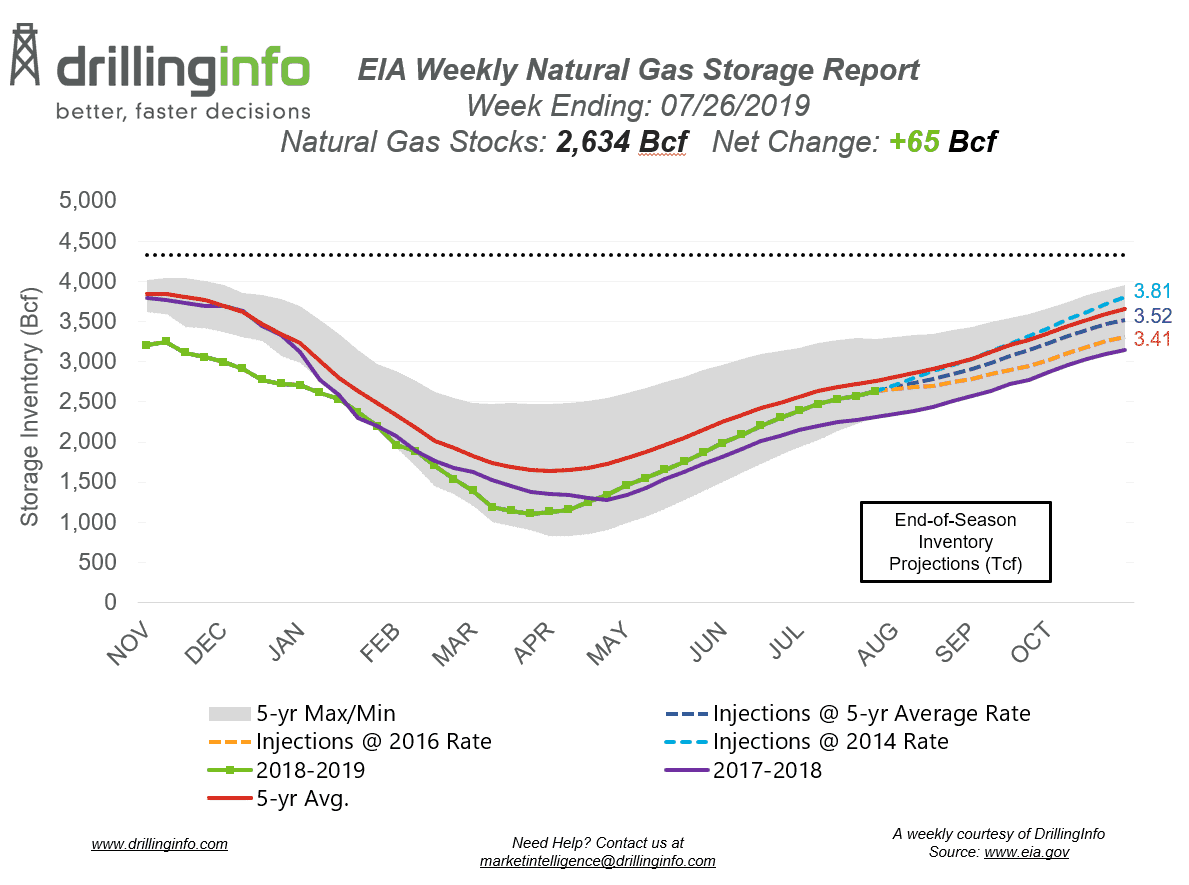

Natural gas storage inventories increased 65 Bcf for the week ending July 26, according to the EIA’s weekly report. This is slightly above the market expectation, which was an injection of 60 Bcf.

Working gas storage inventories now sit at 2.634 Tcf, which is 334 Bcf above inventories from the same time last year and 123 Bcf below the five-year average.

At the time of writing, the September 2019 contract was trading at $2.240/MMBtu, roughly $0.007 higher than yesterday’s close. The August 2019 contract closed earlier this week at $2.141/MMBtu.

On expiration, the August contract was down early in the day but rallied and added a couple of pennies to close at $2.141/MMBtu. Since August expiration, the September contract was up as much as ~$0.16. However, this rally wasn’t fully weather related. During the early morning of August 1, an explosion on Texas Eastern occurred near Lexington, Kentucky. This explosion has taken off ~2.0 Bcf/d of pipeline capacity by taking the operating capacity at the Danville compressor to zero. During July, the Danville compressor station averaged ~1.64 Bcf/d of gas flowing south toward the Gulf. This incident will likely put upward pressure on Gulf prices, as seen prior to the inventory release this morning, and potentially put downward pressure on Northeast basis prices, as the gas will need to find an alternate route to get out of the region until TETCO returns to operations. The timing of the Danville compressor coming back online is currently unknown.

With the explosion on TETCO, prices rallied and were up ~0.07 this morning, but could not hold. The bearish inventory release sent prices back down near the close of yesterday of $2.233 and currently sit near $2.24.

See the chart below for projections of the end-of-season storage inventories as of November 1, the end of the injection season.

This Week in Fundamentals

The summary below is based on Bloomberg’s flow data and DI analysis for the week ending August 1, 2019.

Supply:

- Dry gas production saw an increase of 0.98 Bcf/d week over week. Once again, the South Central/Gulf region accounted for nearly all the increase, gaining 0.95 Bcf/d, as production has fully recovered from Hurricane Barry.

- Canadian net imports increased this week, gaining 0.11 Bcf/d.

Demand:

- Domestic natural gas demand increased 1.19 Bcf/d week over week. Power demand saw the biggest increase on the week as temperatures heated up, gaining 1.08 Bcf/d. Res/Com demand showed a slight gain of 0.03 Bcf/d, while Industrial demand gained 0.09 Bcf/d.

- LNG exports saw a slight decline during the week, falling 0.16 Bcf/d, while Mexican exports were flat.

Total supply is up 1.09 Bcf/d, while total demand gained 1.14 Bcf/d week over week. With this week’s supply and demand numbers being tight, expect the EIA to report a similar to slightly weaker injection next week. The ICE Financial Weekly Index report is currently expecting an injection of 60 Bcf. Last year, the same week saw an injection of 46 Bcf; the five-year average is an injection of 50 Bcf.