Explore 2025 renewable energy trends, solar growth and challenges in RatedPower’s report. Insights on investments, innovations and market outlook.

Over the last year, the clean energy transition has continued at pace despite facing economic and geopolitical headwinds. The International Energy Agency calculated that global energy investments exceeded $3 trillion for the first time, with a record-breaking $2 trillion (or almost 70%) flowing into renewables, EVs and nuclear power.

Clean energy has eclipsed fossil fuel funding by a factor of two, and solar PV now exceeds combined investments in all other power generation technologies. Infrastructure and storage upgrades have also surged as more renewable sources integrate into the utility network. This was underpinned by a 666 GW increase in installed renewable energy capacity in 2024, with China and the European Union leading the way as the largest growth markets.

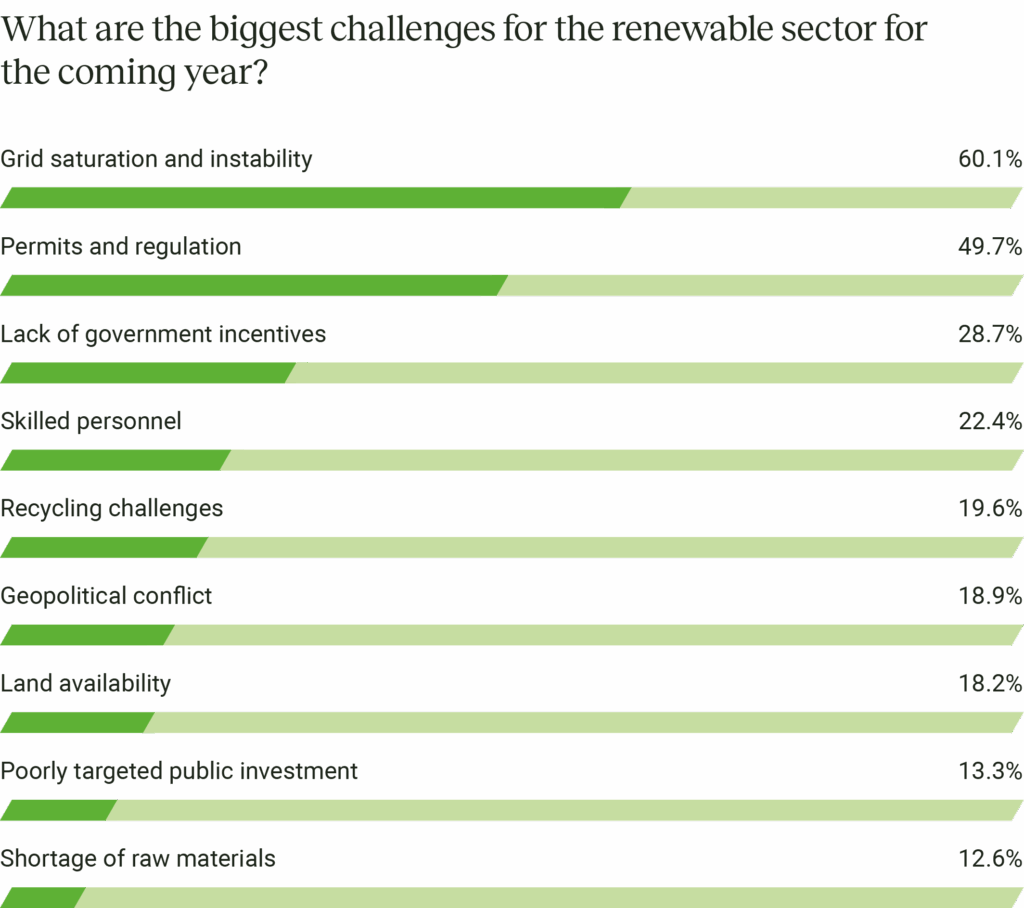

But while the outlook is optimistic, the industry still faces several challenges, such as grid saturation causing energy curtailment, the need for streamlined legislation, and the demand for skilled renewable technology professionals outpacing supply. Investment distribution also remains uneven, with emerging markets and developing economies outside China receiving only 15% of global clean energy spending.

Geopolitical factors have also impacted the energy landscape. Although the private sector remains the largest investor in low-carbon projects, government policies and incentives still determine where and how capital flows. Uncertainties have emerged as leadership changes and priorities shift. In the U.S., the new administration is expected to pivot national energy policy, slowing the U.S. clean-energy boom, while European energy markets still face volatility amid continued geopolitical tensions and potential supply chain disruptions. Globally, interest rates remain high, putting further pressure on renewable investments.

Despite these complexities, the industry remains steadfast. Advanced grid solutions, cutting-edge storage and smarter systems are making renewable energy much more efficient and scalable. Digitalization is also streamlining utility plant design and operations with more robust design software, predictive maintenance and real-time monitoring.

What might the next year look like for solar and renewables in general? This RatedPower report presents insights from our latest industry survey and the trends we’ve observed from usage patterns on our platform. The findings are insightful and encouraging: the industry is clearly capitalizing on innovation and optimism to shape a cleaner, more sustainable energy future.

VP Power & Renewables, Enverus and CEO & co-founder of RatedPower

The energy sector is speeding towards renewables. By 2030, clean sources are predicted to power 46% of the electricity sector (up from 30% in 2023) and green electricity generation will reach 17,000 TWh globally (an almost 90% leap from today). Solar is taking the lead, with UK think tank Ember estimating 593 GW of solar panels to be installed in 2024, an impressive 29% surge compared to last year.

This growth is encouraging, but it also creates challenges. Grid instability continues to strain progress, requiring $3.1 trillion in infrastructure investments by 2030 to mitigate, while energy inefficiencies still threaten to slow the renewable shift.

Green hydrogen is also touted as a solution to decarbonize hard-to-abate sectors like industry and transportation, but it is still battling with high prices.

Insights from our recent survey and platform usage data highlight the challenges and opportunities that may affect the renewable energy sector in the next year:

Regulatory challenges are gradually diminishing: workforce development is closing skill gaps and cost pressures are finding equilibrium. While grid investment is increasing, integration and stability issues continue to impede scalability. Insufficient public incentives risk stalling industry momentum and secondary challenges such as negative power prices, supply chain disruptions, social resistance, funding gaps and high storage costs.

Industry confidence remains high, according to the survey U.S., Spain, China and Australia, alongside Brazil and India, are expected to be the top growth markets in 2025. New technologies are increasing flexibility and resilience. Advancements in battery storage, AI and digitalization are improving forecasting precision and optimizing grid management.

As in previous years, bifacial modules continue to dominate the market. String inverters continue to rise to prominence and tracker structures are increasingly deployed across global projects. We can attribute this largely because of their financial advantages. The combination of bifacial modules and trackers is the most widely chosen option due to its compelling cost-performance ratio. Tracker gains of 15-20% coupled with a bifacial gain of 2-20% continue to drive their popularity and reduce LCOE.

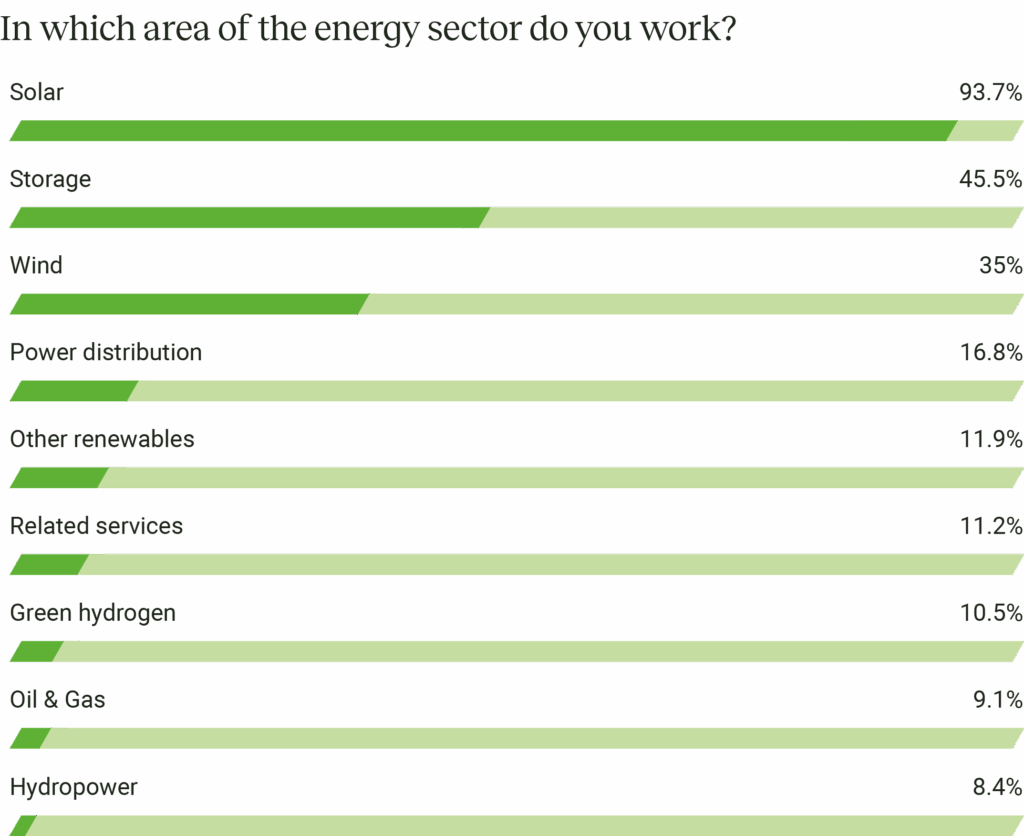

Most respondents (93.7%) are involved in solar energy, with others working in the storage, wind, power distribution and green hydrogen industries.

To ensure that the survey reflects interdisciplinary challenges and various perspectives on potential solutions, there were also responses from:

While progress has been made in addressing talent shortages and supply chain issues, persistent grid integration and permitting roadblocks continue to frustrate the industry. The sector is also grappling with dwindling public support and mounting financial risks, including negative power prices and high storage costs.

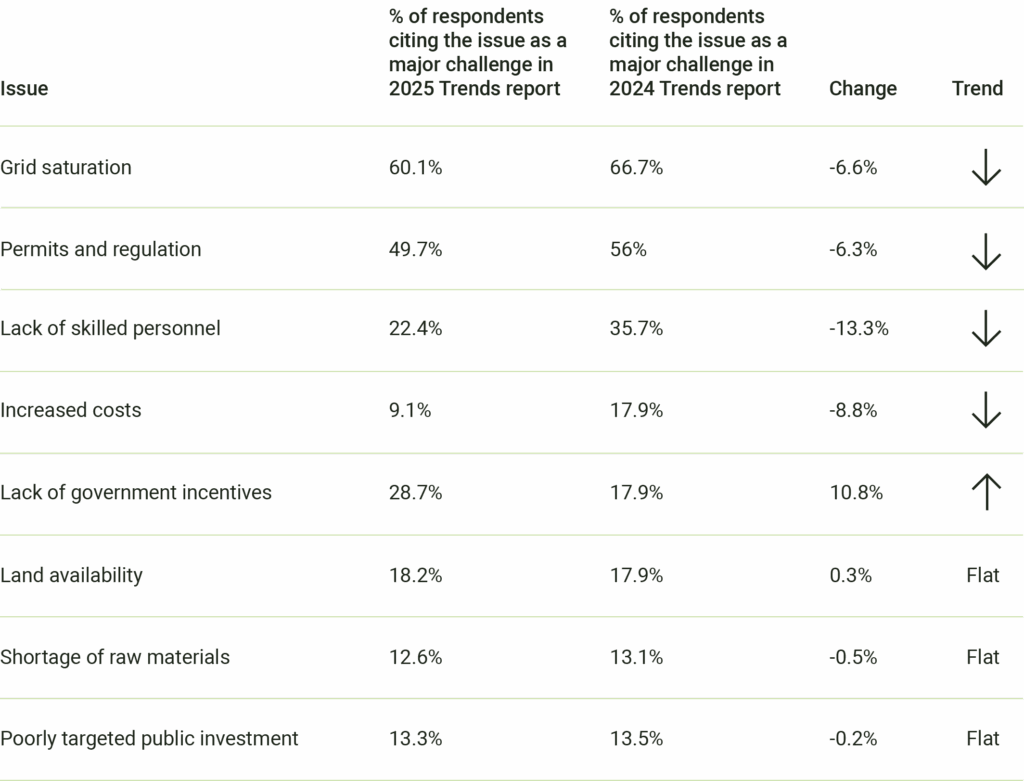

Most issues have improved year-over-year. Here’s a look at how industry concerns have shifted:

The percentage of respondents citing grid saturation and instability as the top issue has slightly decreased, indicating slight improvements in perception. However, delayed interconnection requests, limited grid capacity and outdated grid infrastructure still make it difficult to scale projects.

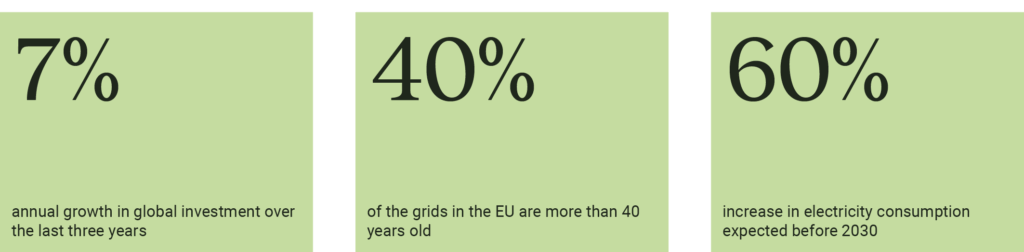

Global investment in the grid globally has grown by nearly 7% annually for the past three years, reaching record levels. Despite this, 40% of the grids in the EU are more than 40 years old, so the European Commission published the European Grid Action Plan that estimated that a total of €584 billion is required to keep up with the 60% increase in electricity consumption expected before 2030. On top of this, grid projects often take over ten years to complete due to complex processes, paperwork and permits.

7%

annual growth in global investment over the last three years

40%

of the grids in the EU are more than 40 years old

60%

increase in electricity consumption expected before 2030

Challenges with permitting and regulatory compliance persist, though the modest decline suggests that streamlining initiatives may be starting to bear fruit. Countries such as India and China have demonstrated a notable 8% improvement in their scores on the World Economic Forum’s Energy Transition Index (ETI) over the last ten years. Meanwhile, Sub-Saharan Africa has seen the most significant progress, achieving a 58% increase in the World Economic Forum’s regulation and political commitment scores.

In India, for example, recent developments include removing inter-state charges for solar and wind power projects commissioned before June 2025, along with facilitating up to 100% Foreign Direct Investment under the country’s automatic approval route. Long-standing policies such as the Solar Park Scheme, the Production-Linked Incentive (PLI) Scheme, and the Central Public Sector Undertaking (CPSU) Scheme continue to play a key role in accelerating the deployment of solar energy projects by developers while promoting domestic manufacturing.

Conversely, there’s a noticeable increase in concerns over insufficient public incentives. This spike parallels growing calls for stronger governmental support to bolster the sector’s momentum and mitigate financial risks.

This sentiment could be due to the uneven distribution of funds to support initiatives for domestic clean energy manufacturing and trade policies. Since 2020, governments have committed $2 trillion in direct investment to subsidize clean energy. However, some 80% of this is concentrated in just three regions: China, the EU and the U.S., leaving other parts of the world at a disadvantage.

The positive news is that other regions are following suit, with 35 countries passing new renewable energy regulations since 2023, some of which are rolling back fossil fuel-related policies.

Concerns over talent shortages have eased significantly, reflecting possible improvements in training programs and successful recruitment efforts.

However, the ongoing need for workforce development remains critical as the renewable energy sector faces growing demand. As nations worldwide strive to meet decarbonization goals, the demand for renewable energy will continue to rise, necessitating a workforce triple the size of 2020’s levels (38 million by 2030).

According to the 2024 US Energy & Employment Jobs Report (USEER), clean energy jobs are growing at more than double the average job growth rate in the rest of the U.S. economy. Yet, solar companies are facing a significant challenge in retaining experienced staff, with 88% of employees in the renewables sector considering job changes, many of them seeking opportunities in other energy industries.

To address these challenges, building an authentic employer brand, expanding talent pools and investing in training and development will be essential to meeting the increasing demands of the industry.

Interestingly, concerns over increased costs have nearly halved, suggesting a stabilization in materials and operational expenses. This sentiment is supported by solar module price drops of 35% to 9 cents/kWh and solar battery components such as lithium iron phosphate and nickel manganese cobalt becoming 30-50% cheaper. This also means getting more for your money as new developments in batteries could lead to them doubling their energy intensity over the next five years while using substantially less nickel and cobalt.

The difficulty of securing suitable space remains an obstacle, especially in areas with strict regulations and environmental concerns. This result matches a recent McKinsey analysis, which warns that land scarcity could impede Europe’s green energy goals. This could also be a factor driving the growth of agri-pv.

Despite this, within G20 countries, over 33 million km2 have been determined to have the potential for developing solar plants and 31 million km2 for wind energy, respectively. So, land has been identified; however, legislation pertaining to land use could be delaying and restricting renewable projects’ access to available areas.

Beyond the primary concerns, respondents highlighted a range of other issues affecting the sector:

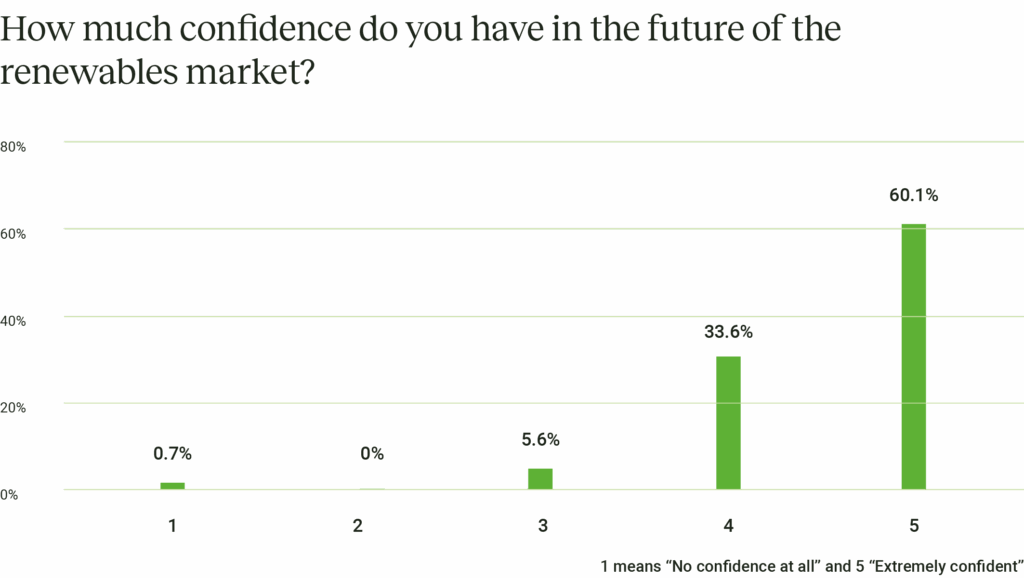

The renewable energy sector is optimistic. Respondents have a strong positive outlook, especially in key areas and regions poised for growth.

Around 60.1% of respondents rated their market confidence a perfect 5 out of 5, while another 33.6% gave it a solid 4. Respondents believe that increased investment, innovation and global demand will dramatically expand the renewable energy sector.

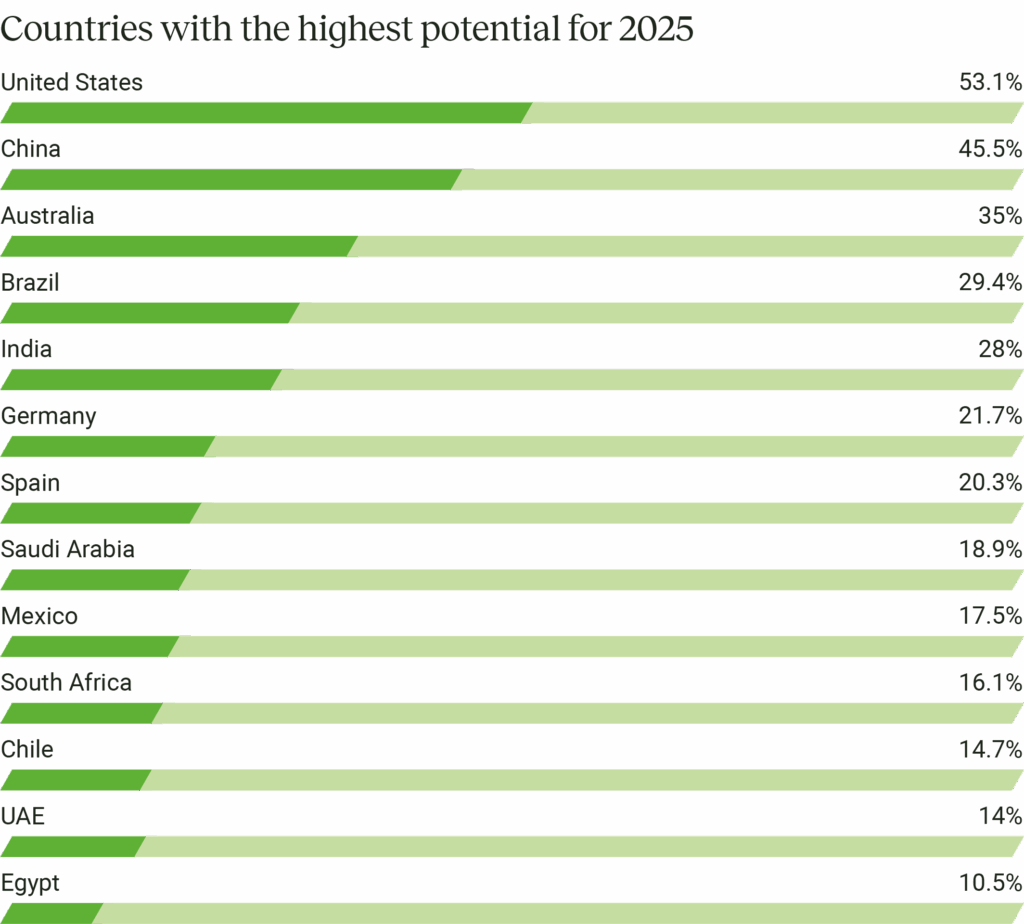

Survey participants have their eyes on several countries as growth markets for 2025.

The United States leads with 53.1% of respondents recognizing its potential, followed by China at 45.5% and Australia at 35%. Brazil and India are also rising contenders, with 29.4% and 28% acknowledging their growth potential, respectively.

Beyond these frontrunners, countries in North Africa (particularly Morocco), South America (especially Peru and Ecuador), and the Balkans are also emerging as promising growth regions.

These countries represent a diverse geographical spread, indicating widespread advancements in renewable energy across different regulatory and economic environments.

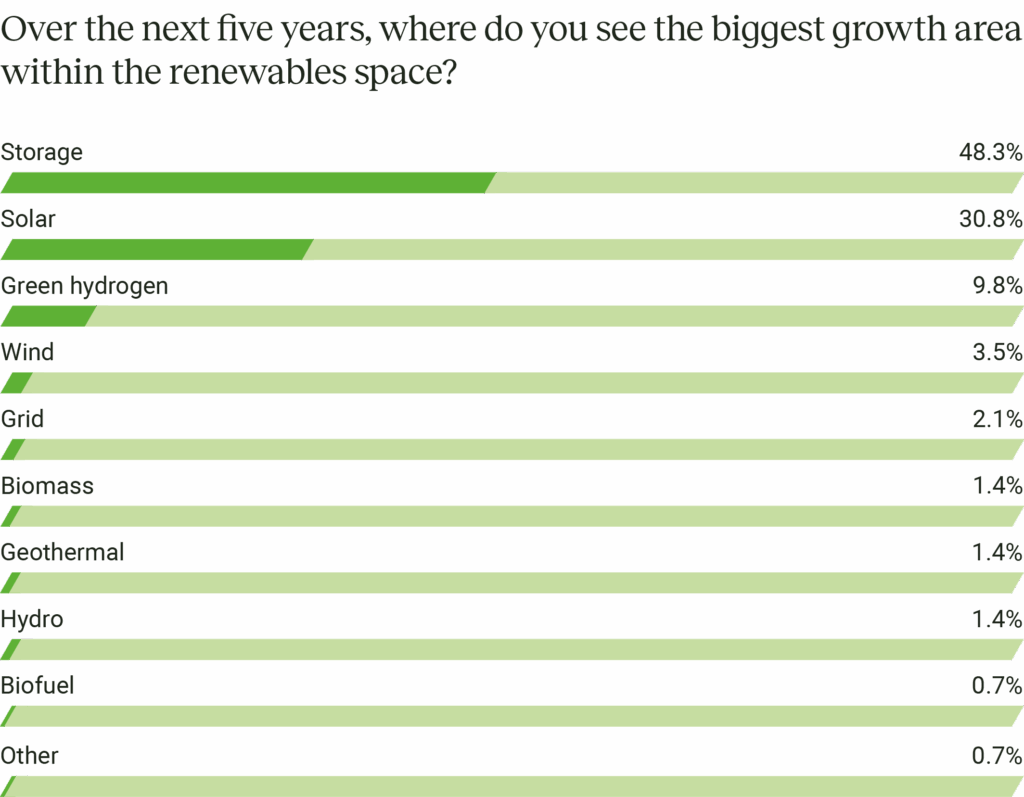

Looking ahead, over 48.3% of industry respondents predict storage will become the top growth area in the next five years.

Solar comes in second, with 30.8% of respondents noting its critical role in stabilizing intermittent renewable sources.

Green hydrogen isn’t far behind. Almost 9.8% of respondents see its potential to decarbonize critical sectors like transportation and heavy industry.

Survey respondents stated that to make energy storage systems more accessible, cost reduction is essential through lowering storage infrastructure and battery prices. Research and development (R&D) investment was labeled as crucial to advancing battery technology and exploring alternatives. Sustainable sourcing of raw materials and maximizing storage lifespan were also highlighted as critical for long-term success. On top of this, respondents called for clear and consistent regulatory frameworks to streamline permitting and support profitability. Government incentives, alongside advancements in grid technologies and financing options, were emphasized as key drivers to accelerate growth.

Nihal Waghmare

Soleos Solar Energy PVT.LTD.

Participants stressed the importance of swift approvals and streamlined permitting to accelerate the green transition. They advocate for tax credits and subsidies alongside clear and consistent regulations to attract investment and reduce project risk. Grid modernization driven by government mandates is crucial for integrating renewable sources and energy storage, ensuring reliability. Incentives for hybrid and storage projects were suggested to support energy balance. Additionally, phasing out fossil fuel subsidies and setting renewable targets were considered accelerators of the clean energy transition. They also supported decentralized solutions, R&D, and cross-border interconnections to enhance energy efficiency and sustainability.

Cutting-edge technologies like Agri-PV, floating solar and offshore wind are gaining traction.

For Agri-PV to maximize its potential, respondents stated that policies are needed to incentivize farmers through tax breaks, grants and adjusted agricultural subsidies. Optimizing solar panel designs for agricultural environments and developing compatible crops were labeled as key to maximizing energy yield while ensuring crop growth. Education and awareness programs were suggested to help farmers understand the benefits and feasibility of Agri-PV, as well as collaboration between agricultural groups, renewable energy companies and governments.

Despite the clear advantages, respondents stated that in order to make the most of floating PV systems, it is necessary to tackle high initial installation, maintenance and materials costs, which currently make them more expensive than traditional onshore PV. They also highlighted the importance of minimizing its environmental impacts, such as potential harm to aquatic ecosystems and biodiversity. They expressed how enhancing the durability of floating PV systems to tolerate harsh weather is vital to mitigate the increased risk of damage and corrosion. They also called for reductions in regulatory barriers and simpler permitting processes to free up suitable water bodies and increase deployment. Grid connectivity and infrastructure were presented as challenges, especially in remote locations. In the face of these concerns, survey respondents remained very optimistic about floating solar’s future potential.

Offshore wind energy offers plenty of advantages, including capitalizing on high and consistent wind speeds, minimal land use, and lower visual and noise impact since farms are located far from populated areas. Regarding its primary challenges, responses pointed to the high initial capital, operational costs and maintenance that offshore wind is subject to due to harsh marine environments.

Luis Guilherme Castro

Casa dos Ventos

The survey indicates that digitization, AI and machine learning are central in streamlining tasks such as site selection, grid management and energy forecasts. AI-powered predictive maintenance has the potential to reduce downtime and maintenance costs by identifying potential faults early. It also optimizes grid management and enables smart grid technologies, improving stability and energy dispatch. The survey comments also praised AI for its ability to enhance energy forecasting for renewable sources like wind and solar, optimizing yields and operations.

Haitham Mohamed

ACWA Power

Survey respondents listed the following innovations and trends as those they are most excited about for the year to come:

As extreme weather events become more frequent and intense due to climate change, project design and operations must adapt. Respondents advocate for resilient infrastructure, stricter building codes and innovative materials that can withstand new environmental stresses. Operations and maintenance costs are rising due to the need for frequent inspections and advanced monitoring to address wear from harsh conditions. Survey comments also expressed how climate change uncertainty complicates energy forecasting, driving the need for climate-proof site selection and long-term planning, while insurance costs and capital expenditures are also escalating.

Due to their geographic advantages and strategic policies, certain countries lead the global race to clean energy. Here are the top regions with the highest potential for renewable energy growth, according to survey respondents:

Government initiatives are driving Spain’s march toward energy security. The country’s optimal weather conditions and abundant renewable resources provide a solid foundation for expanding solar and wind capabilities.

Valentín Sastre

Greencells Group

Fueled by generous government incentives, India is aggressively investing in solar power parks, energy storage and green hydrogen. The country’s growing population and urbanization are driving increased energy demand and making a rapid shift to renewables even more urgent.

Nihal Waghmare

Soleos Solar Energy PVT. LTD.

The Chinese government is focused on coal reduction and solar expansion to tackle its pollution crisis. As a global energy storage manufacturing, electric transport and technology development hub, the country has access to abundant raw materials and the capacity to produce green power at lower costs.

Diego Lobo-Guerrero Rodriguez

SENS – Iqony Sustainable Energy Solutions GmbH

Hua Feng

Interenergy

The U.S. solar industry is booming on the back of supportive policies like IRA and substantial investments in renewables. The country, equipped with cutting-edge technology and vast tracts of land, is well-positioned to scale its low-carbon energy infrastructure.

Australia’s favorable climate and expansive land mass create an ideal environment for solar, wind and hydro resources. Strong governmental commitment to emissions targets and supportive policies are propelling its clean energy sector forward.

Vijay Pawar

Energy Vault

Isaac Ayodeji

Isaacsan Pty Ltd

According to the survey, Germany is one of the leading countries in Europe’s clean energy transition by phasing out nuclear power and embracing renewable energy, with a strong focus on green hydrogen and fuel cell technology, supported by long-term strategies like Energiewende and innovative advancements. Similarly, Saudi Arabia is diversifying its energy sources through substantial government investments and the development of new renewable energy plans, aiming to replace traditional fuel power plants with sustainable alternatives.

In Mexico, government initiatives have fostered a positive political environment for renewables, with the country constructing large-scale solar parks such as Tarafert La Laguna and Puerto Penasco. Brazil, driven by high energy costs, is capitalizing on its vast solar and wind resources while upgrading its grid infrastructure to support large-scale renewable energy projects. Meanwhile, South Africa is focusing on its solar and biomass potential to meet growing energy demand and reduce dependence on conventional power sources.

John Graham

Graham & Graham Ltda.

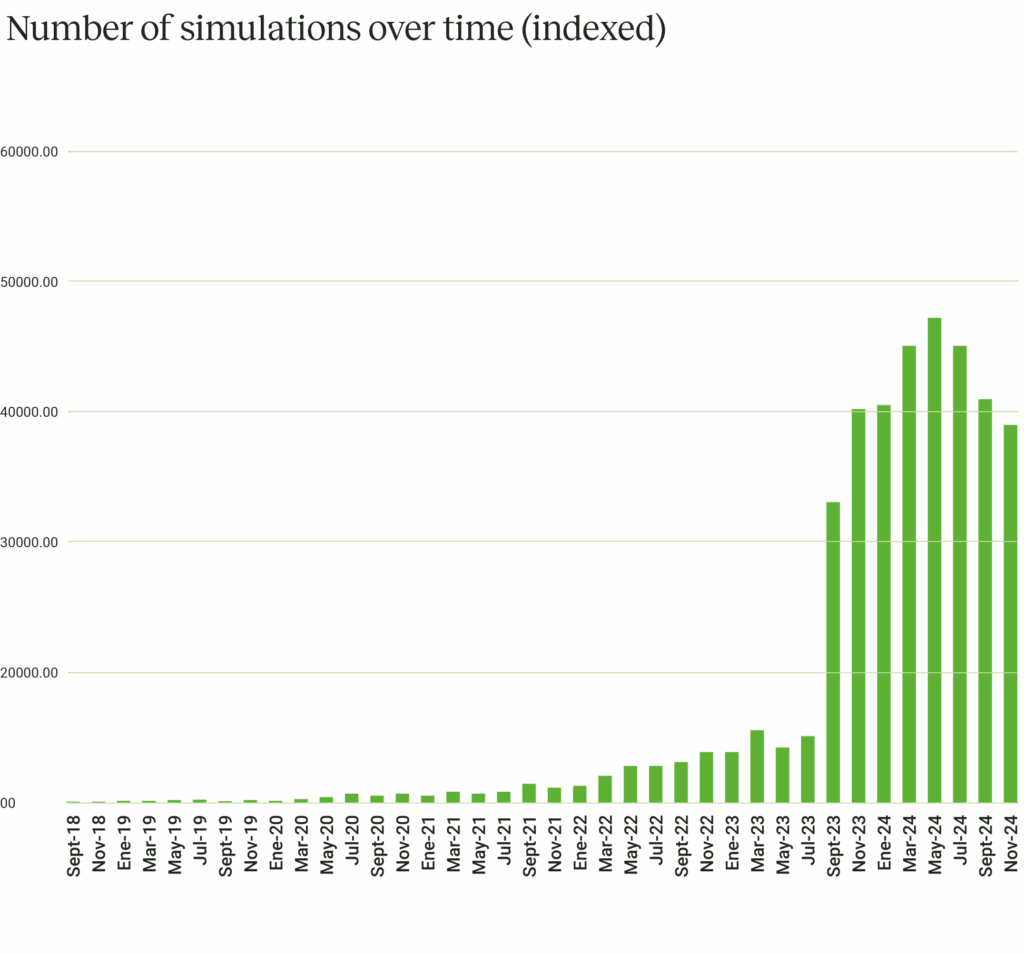

The continued surge in simulations over the course of this year reflects the renewable and solar energy sector’s growth and increasing use of advanced simulation tools to plan and manage complex projects.

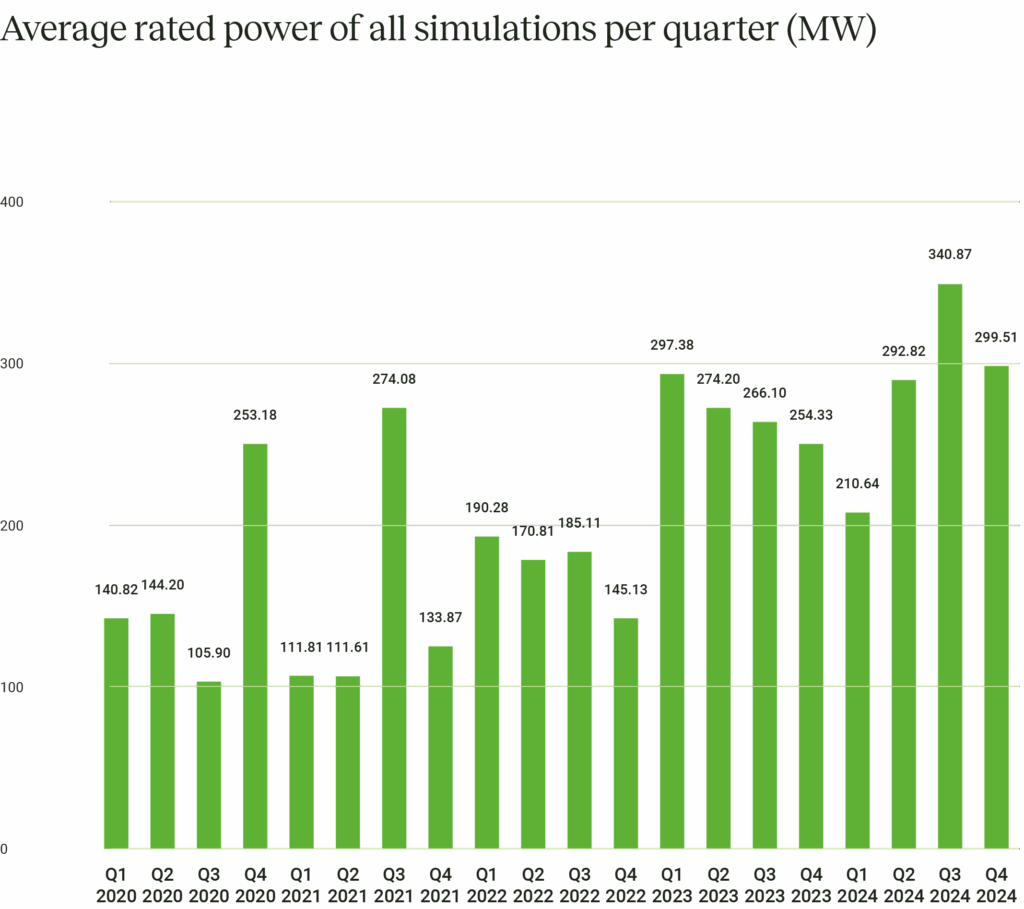

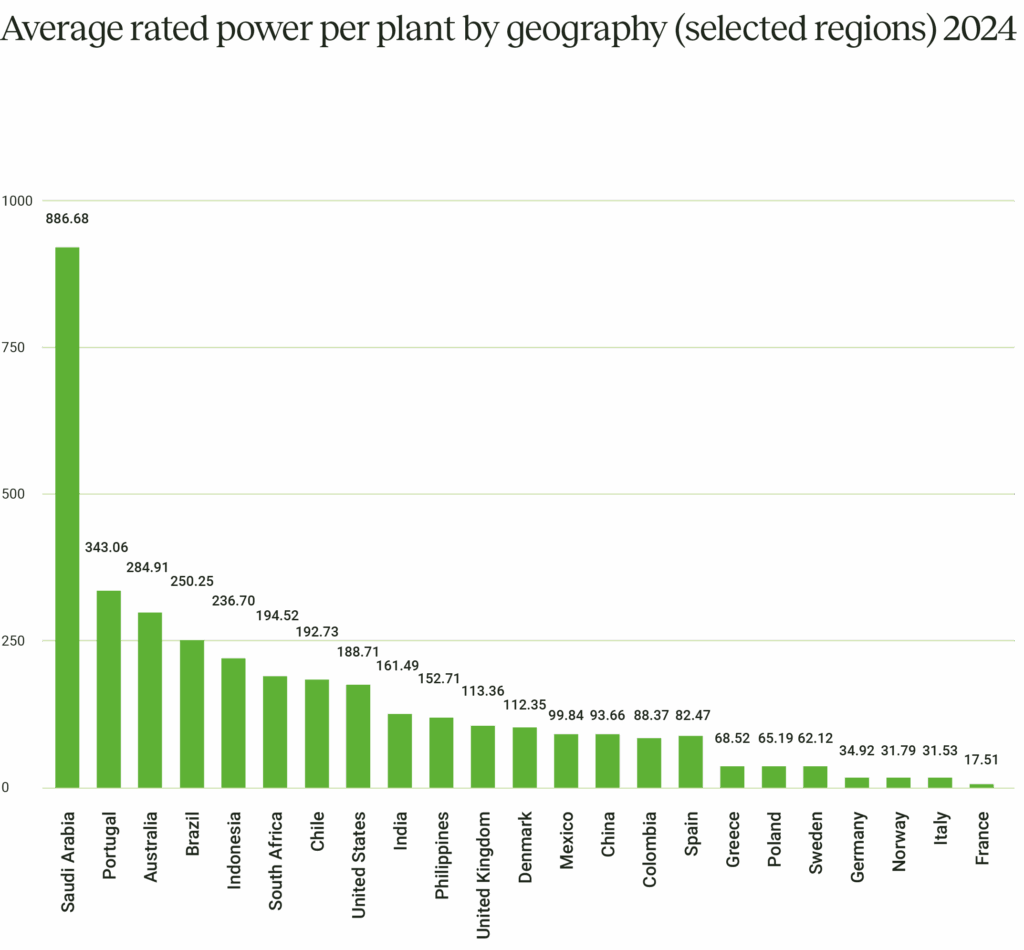

Global renewable energy projects are growing in scope and scale. The average rated power capacity per simulation reached 340 MW in Q3 2024. Saudi Arabia, Portugal, Australia and Brazil had the highest average rated power capacity per simulation in 2024, followed by Indonesia, South Africa, Chile, and the U.S.

Higher average rated power capacity simulations are expected for larger countries; however, the increase in the average rated power across all simulations combined with the rising number of simulations paints an optimistic picture for solar for the coming year.

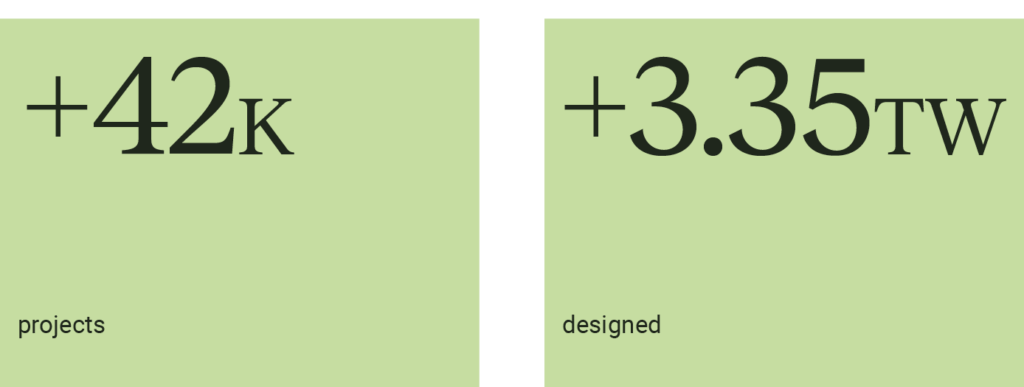

+42K

projects

+3.35tw

designed

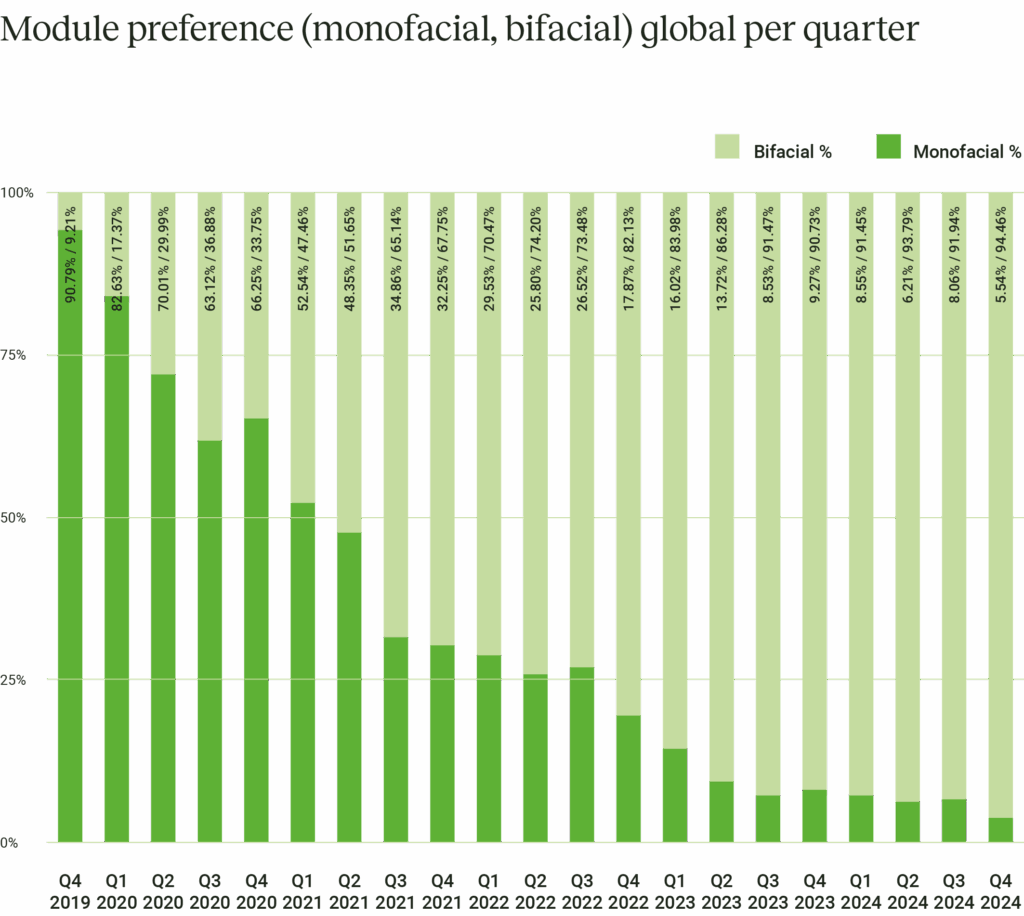

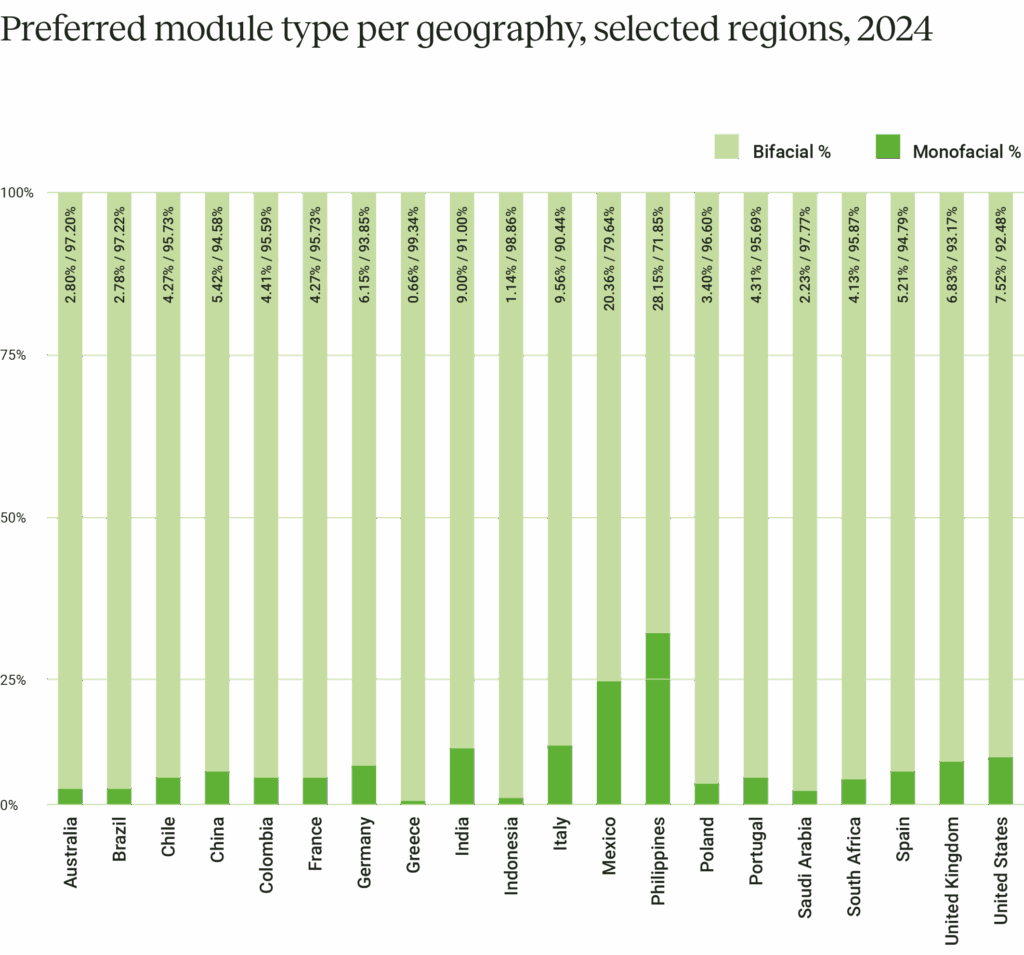

Technological advancements and evolving market dynamics are shifting module preferences and manufacturer dominance. Bifacial usage continues to grow, representing more than 90% of the module types used across the world in the last quarter of 2024.

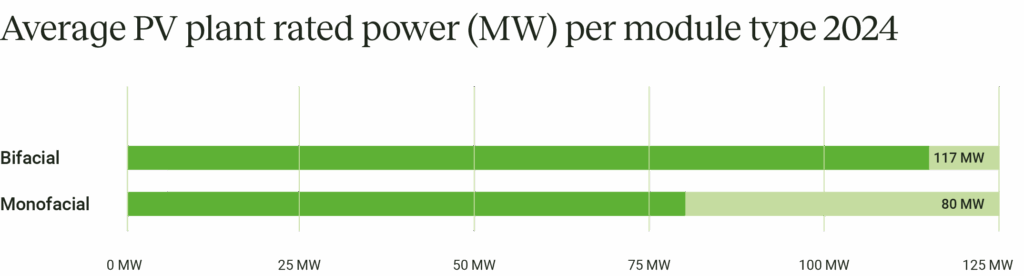

Known for their higher efficiency and adaptability to various environments, bifacial modules deliver improved energy output, especially in regions with high solar irradiance and reflective surfaces. On average, simulations using bifacial modules resulted in an average rated power output of 117 MW. In comparison, simulations using monofacial modules yielded a lower output of 80 MW — a difference of 32%.

Many regions, including Indonesia, Greece, Saudi Arabia, Brazil and Australia, have almost entirely shifted to using bifacial modules when modeling PV plants using RatedPower. Notably, Mexico, the Philippines, India and Italy still use monofacial modules for 10-28% of their simulations, though this may decrease as bifacial technology becomes more economically viable.

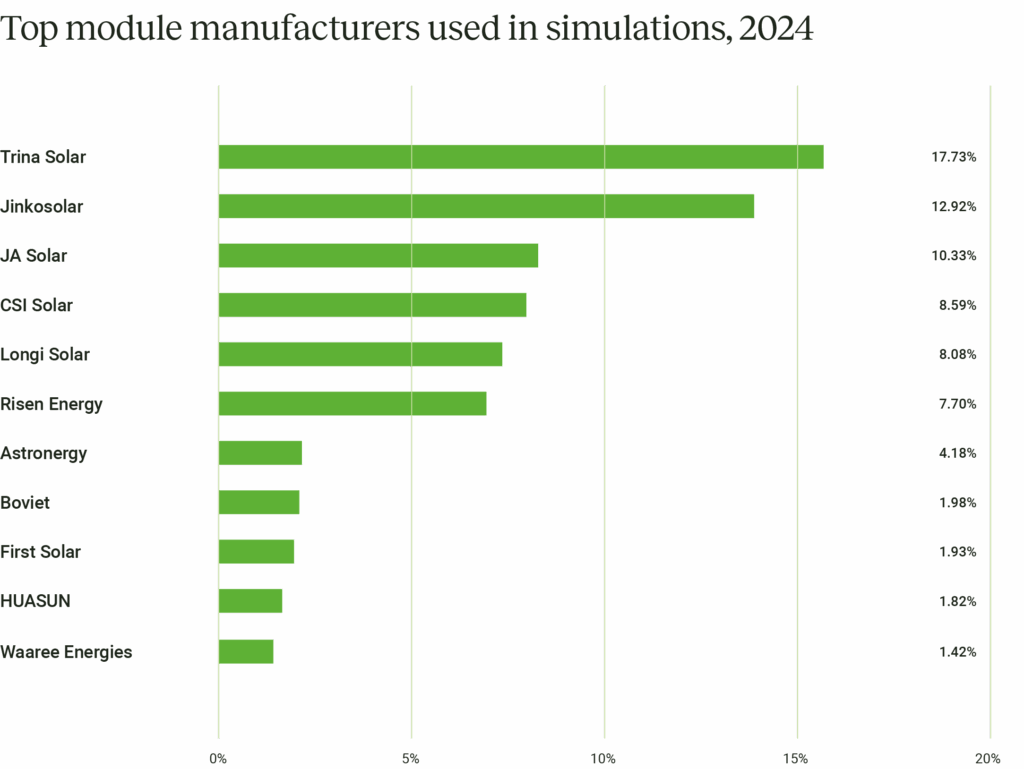

Trina Solar and Jinko Solar continue to lead as the most used module manufacturers. JA Solar, CSI Solar and LONGi Solar made up the top five this year. The manufacturers with the highest average rated power are Yingli Energy Development, Trina Solar, Emmvee Photovoltaic Power and Reliance New Solar Energy.

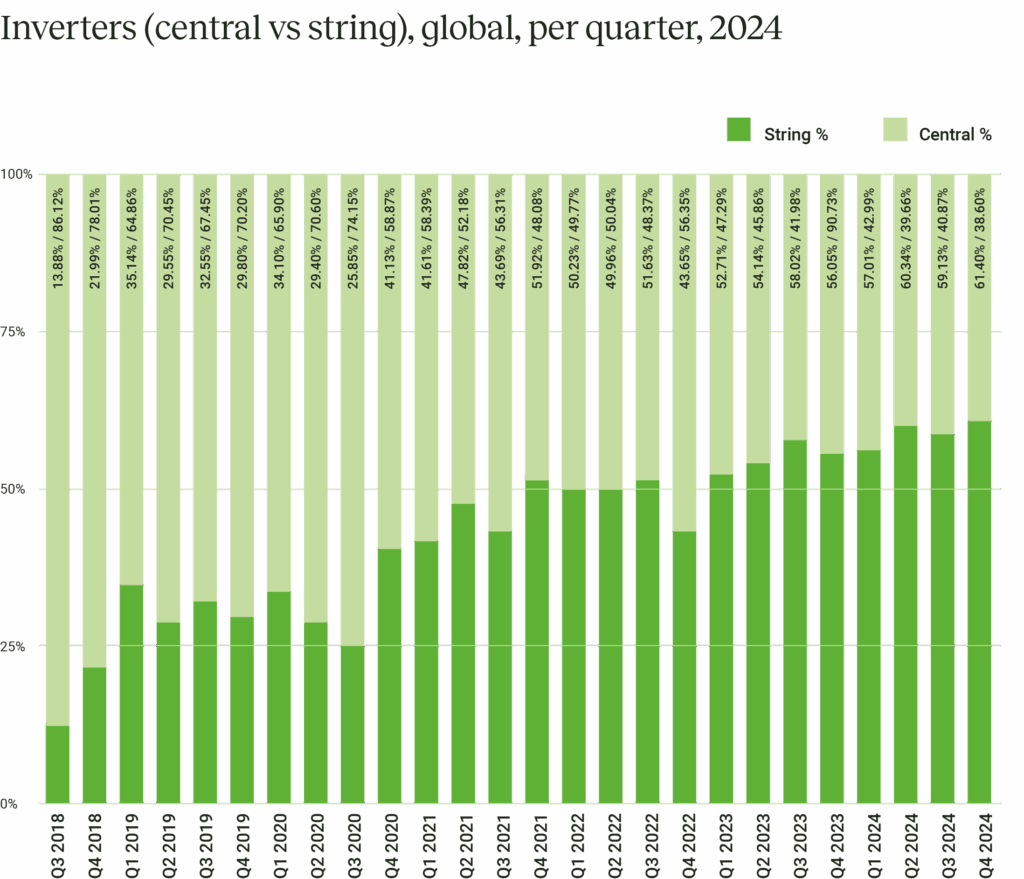

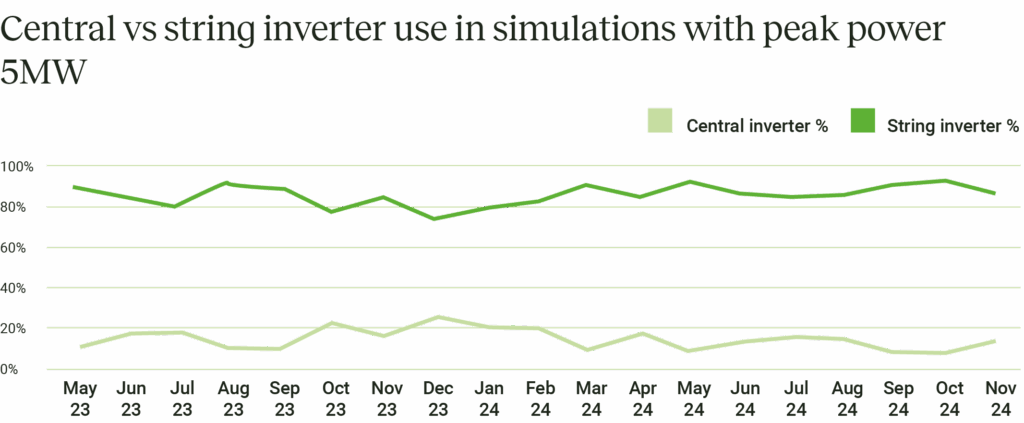

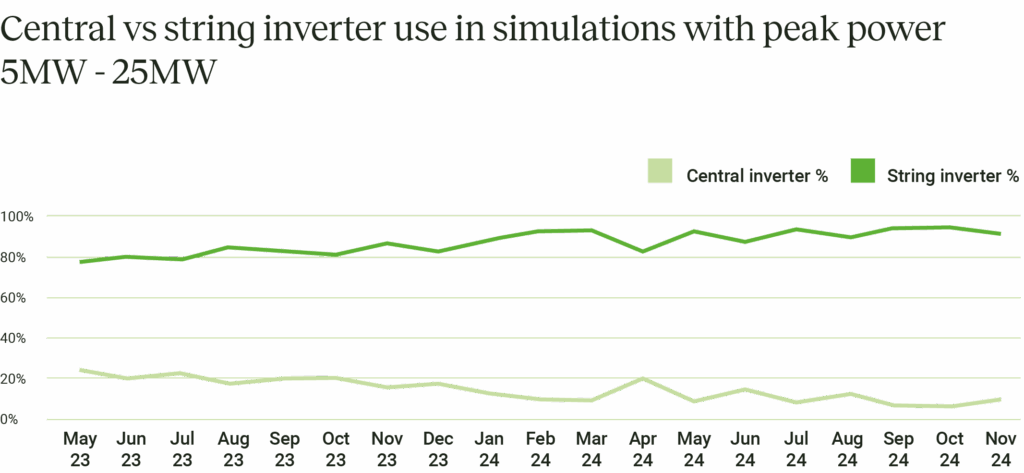

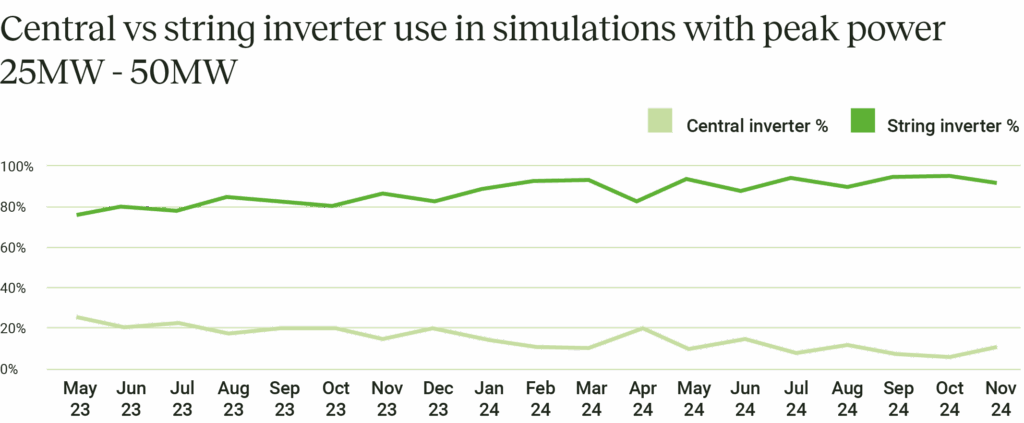

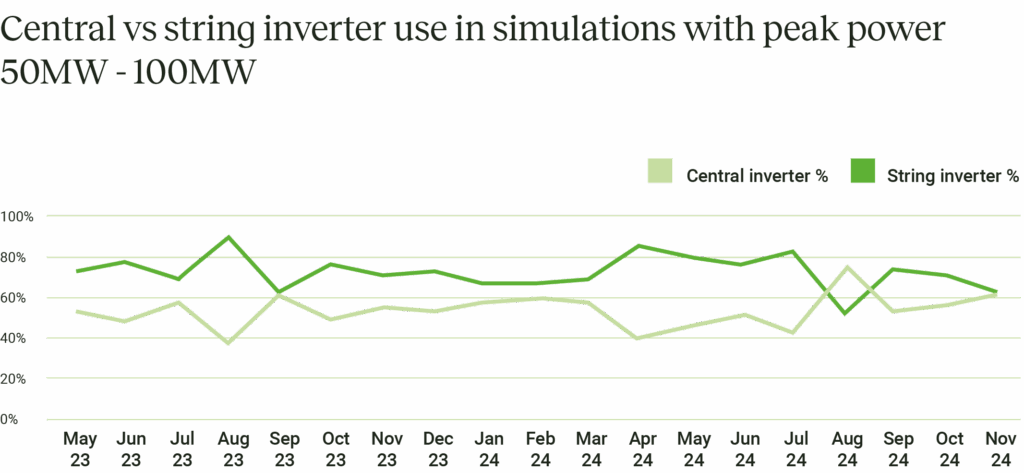

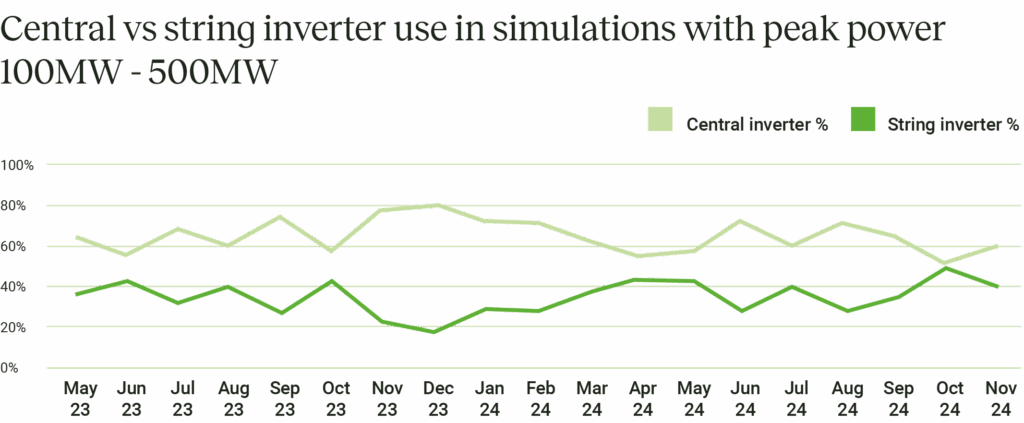

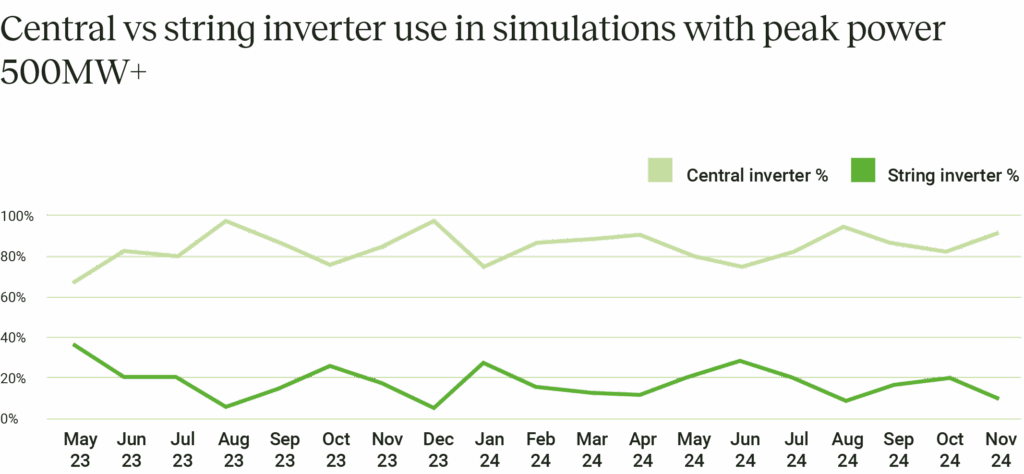

There is a growing trend in the global solar industry to adopt string inverters over central inverters. String inverters now account for around 60% of the simulations because of their increased suitability for large-scale utility projects.

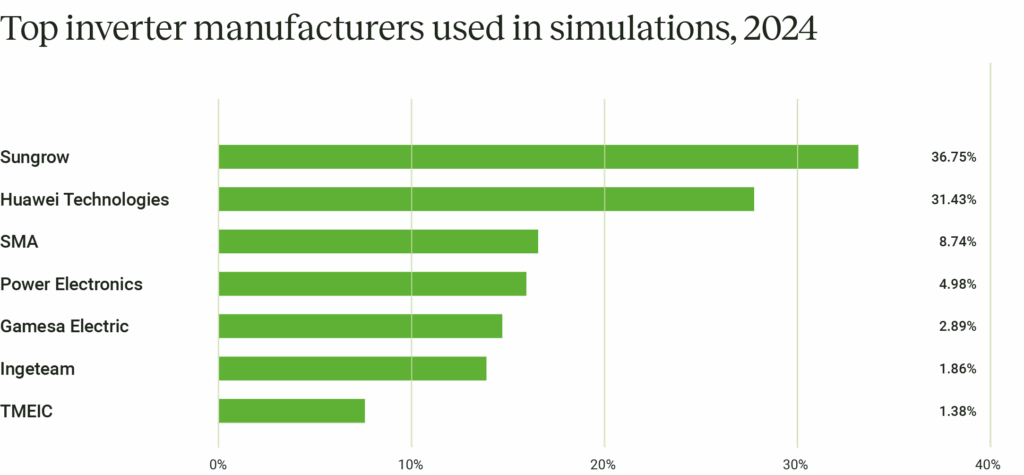

Sungrow, Huawei Technologies, SMA, Power Electronics and Gamesa Electric remain the most popular inverter choices for simulations in 2024. Sungrow leads the pack, followed closely by Huawei Technologies and SMA.

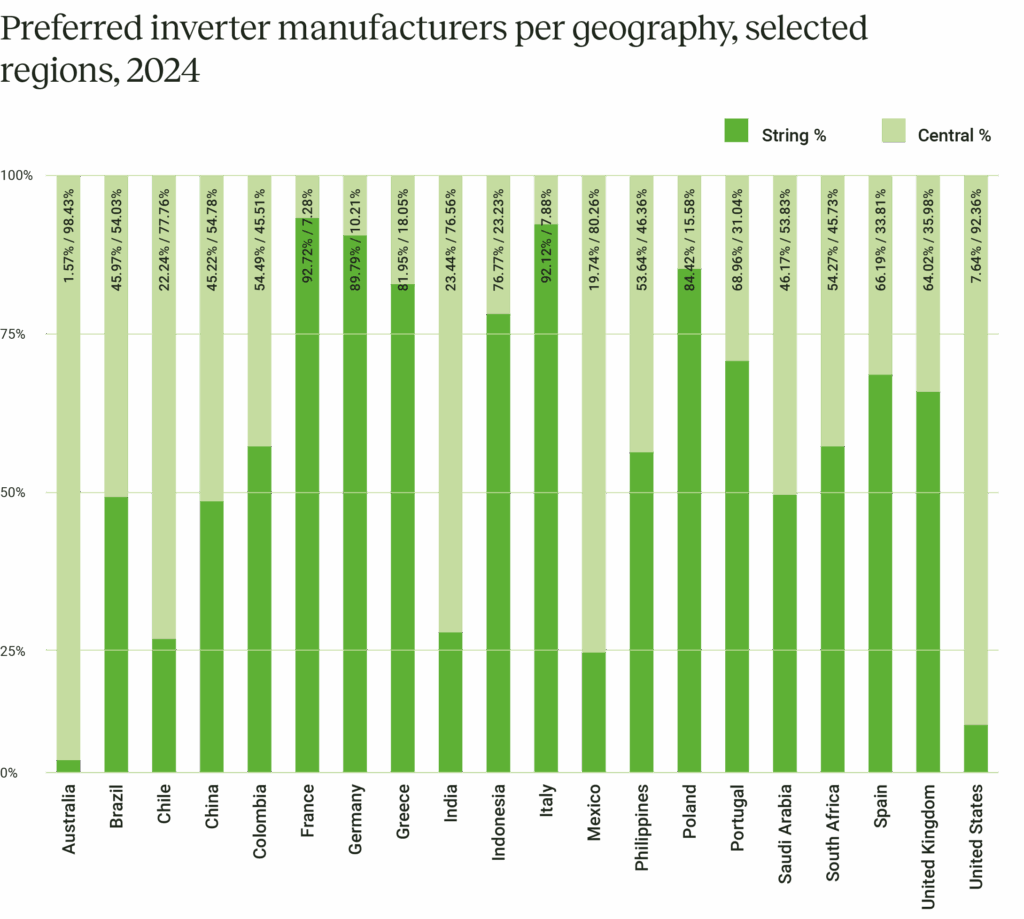

The choice between central and string inverters varies depending on regional energy goals and project-specific factors. Large-scale solar projects in Australia, the U.S., India, Chile, and Mexico typically favor central inverters due to their high power capacity and efficiency. In contrast, simulations for the UK, Spain, Portugal, Colombia and Brazil often use a mix of central and string inverters to accommodate various project sizes and specific technical requirements.

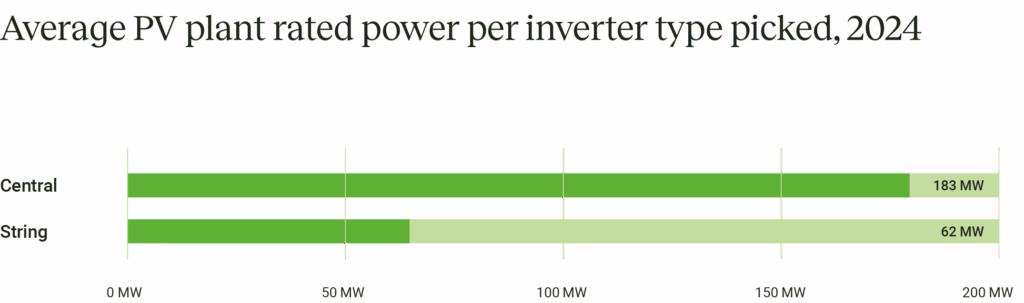

Central inverters are designed to handle significantly more power than string inverters. As a result, as expected, PV plant simulations using central inverters can reach average rated powers of approximately 180 MW, triple the 60 MW average for string inverter-based systems.

This gap, which has widened over the past year, indicates a continued preference of central inverters for large-scale solar projects that require high power output despite the rising popularity of string inverters.

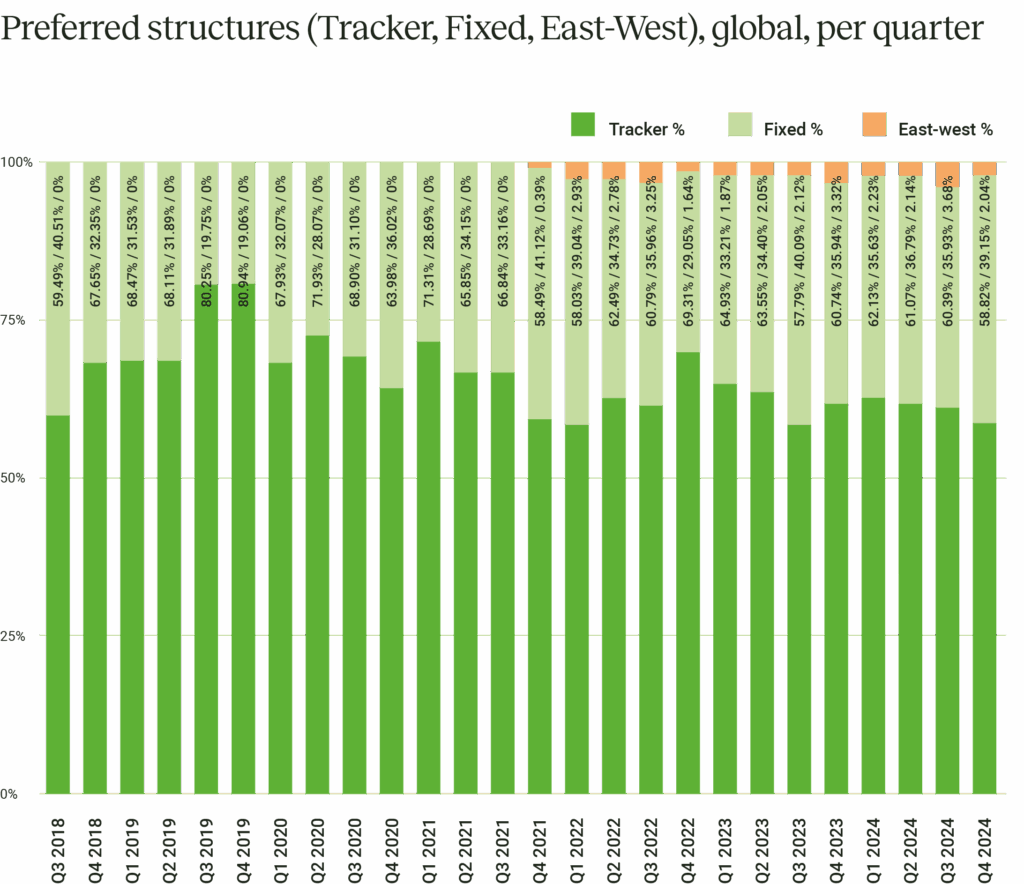

Globally, the split between fixed and tracker structures is relatively balanced, but trackers edge out with a larger share.

In Q4 2024, tracker structures accounted for approximately 60% of installations, compared to 38% for fixed and 2% for east-west configurations. This preference for trackers has remained consistent over the last few years.

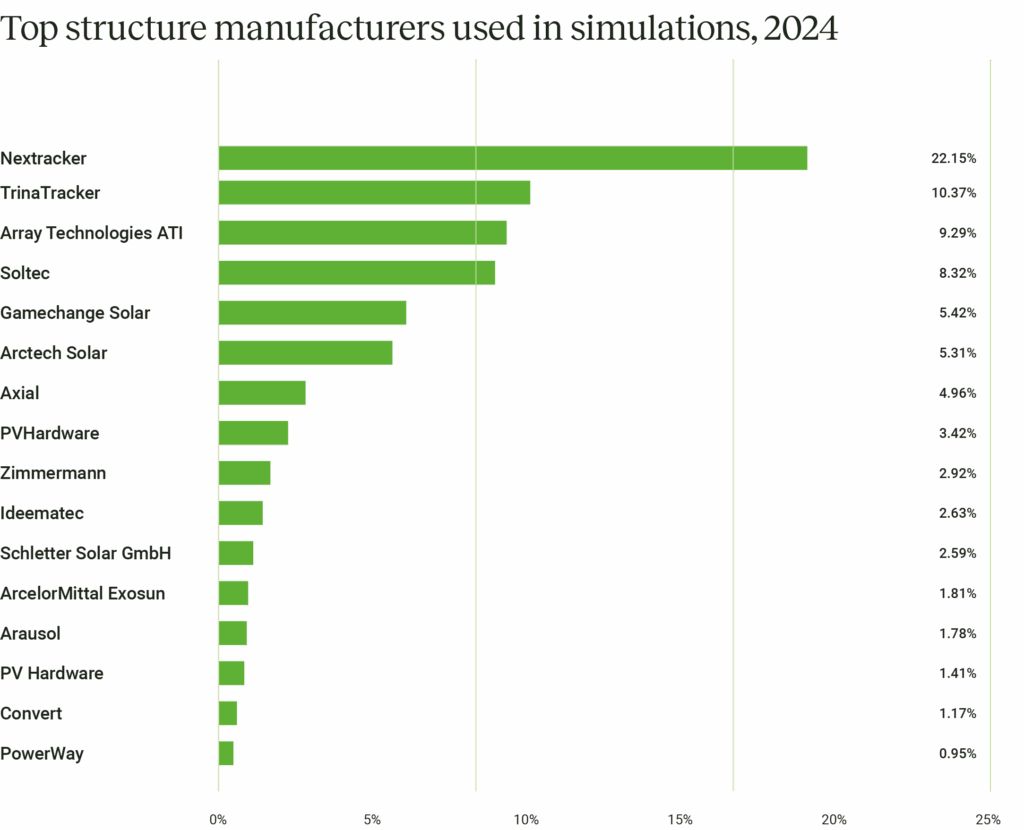

Nextracker continues to lead as the top structure brand chosen on the RatedPower platform, followed by TrinaTracker and Array Technologies. Soltec and Gamechange Solar round out the top five, showing a minor reshuffle in brand preferences compared to the previous year.

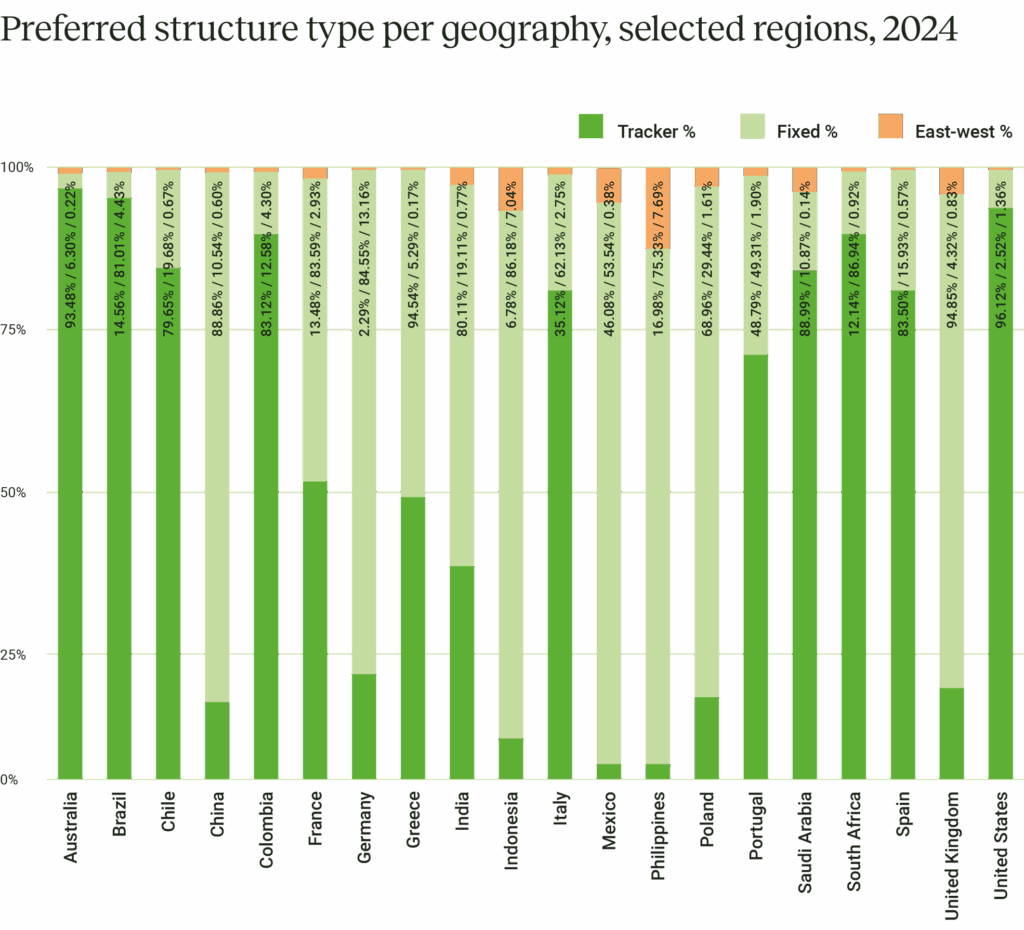

Fixed structures are more common in China, Germany, the UK and Indonesia. In contrast, countries like Australia, Brazil, Chile, Colombia, Italy and the U.S. favor tracker structures.

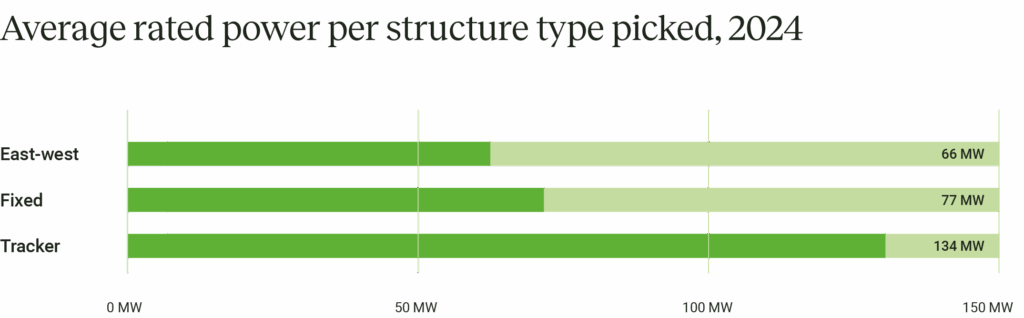

Tracker structures are becoming increasingly popular for large-scale PV projects requiring higher rated power. Simulations show that trackers are chosen for simulations that produce, on average, 1.7 times more power than those with fixed structures and twice as much as plants with east-west configurations.

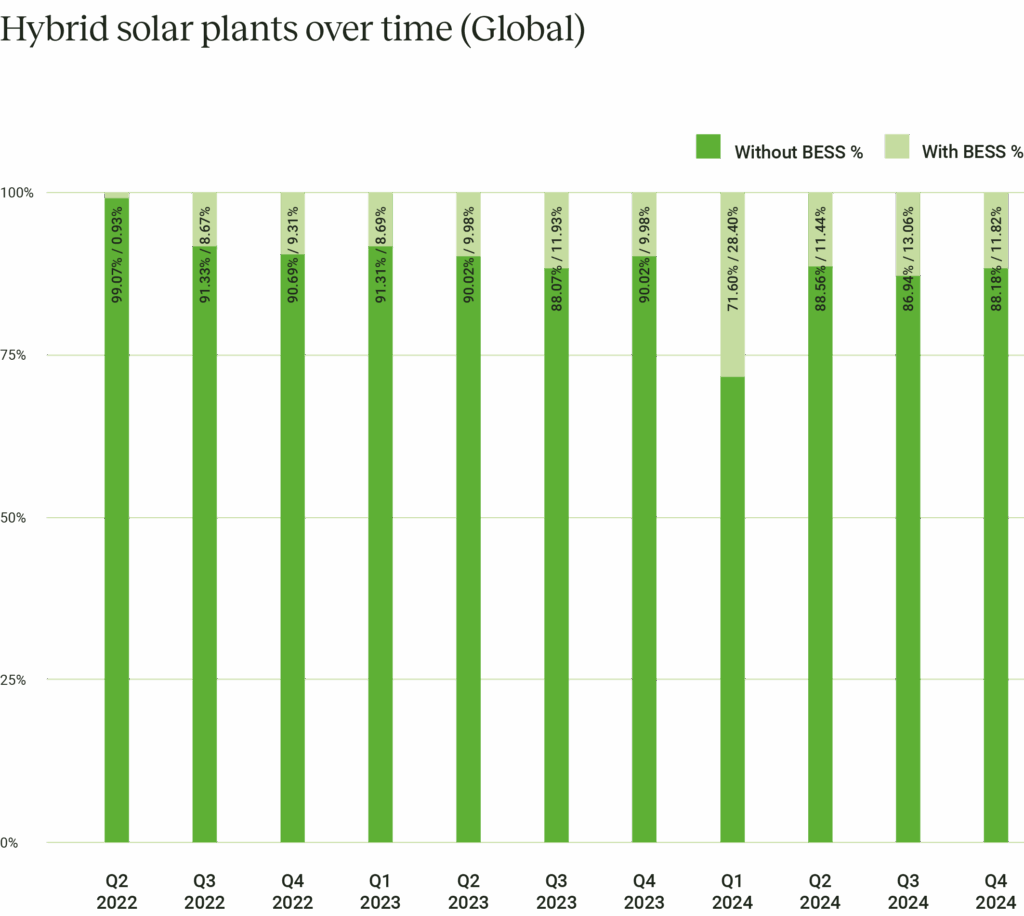

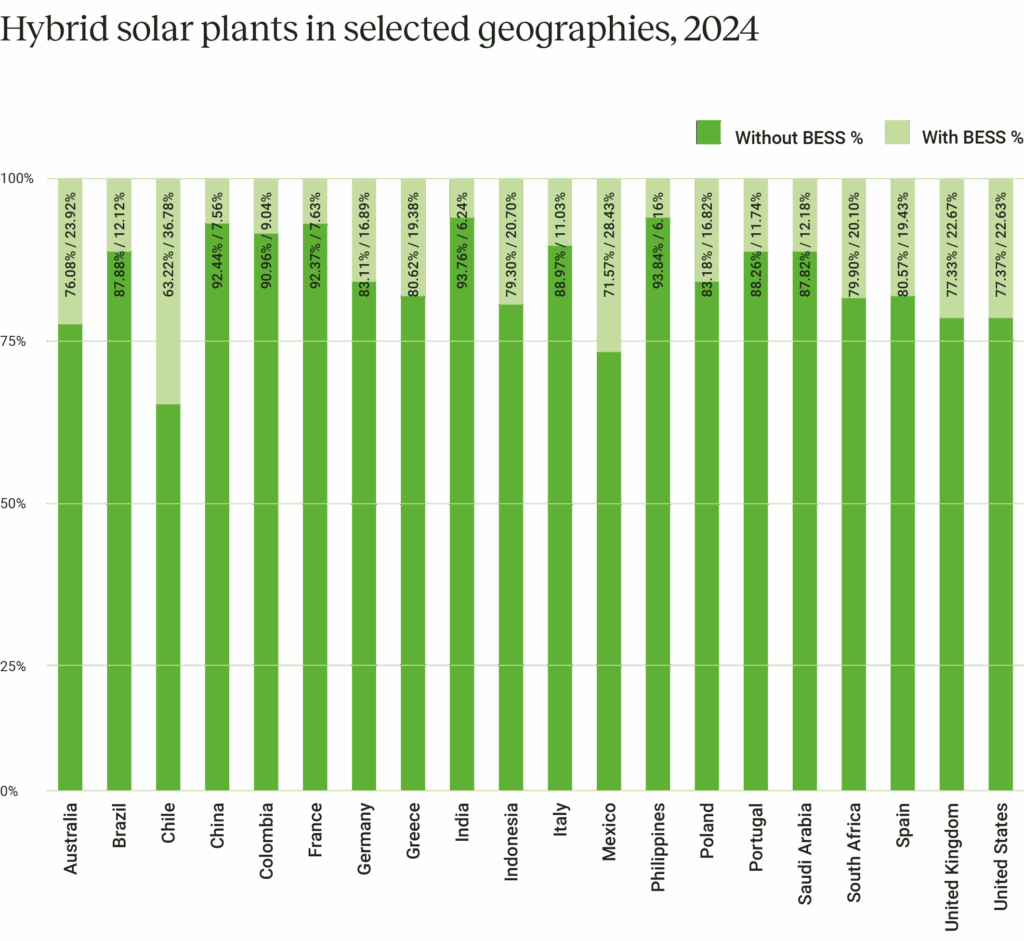

Similar to last year, platform data captured since 2022 shows that hybrid plants have made up around 10-13% of simulations on the RatedPower platform. Countries such as Indonesia, Chile, Mexico, Australia, the U.S. and the UK have comparatively more hybrid simulations than other countries, between 22% and 36%.

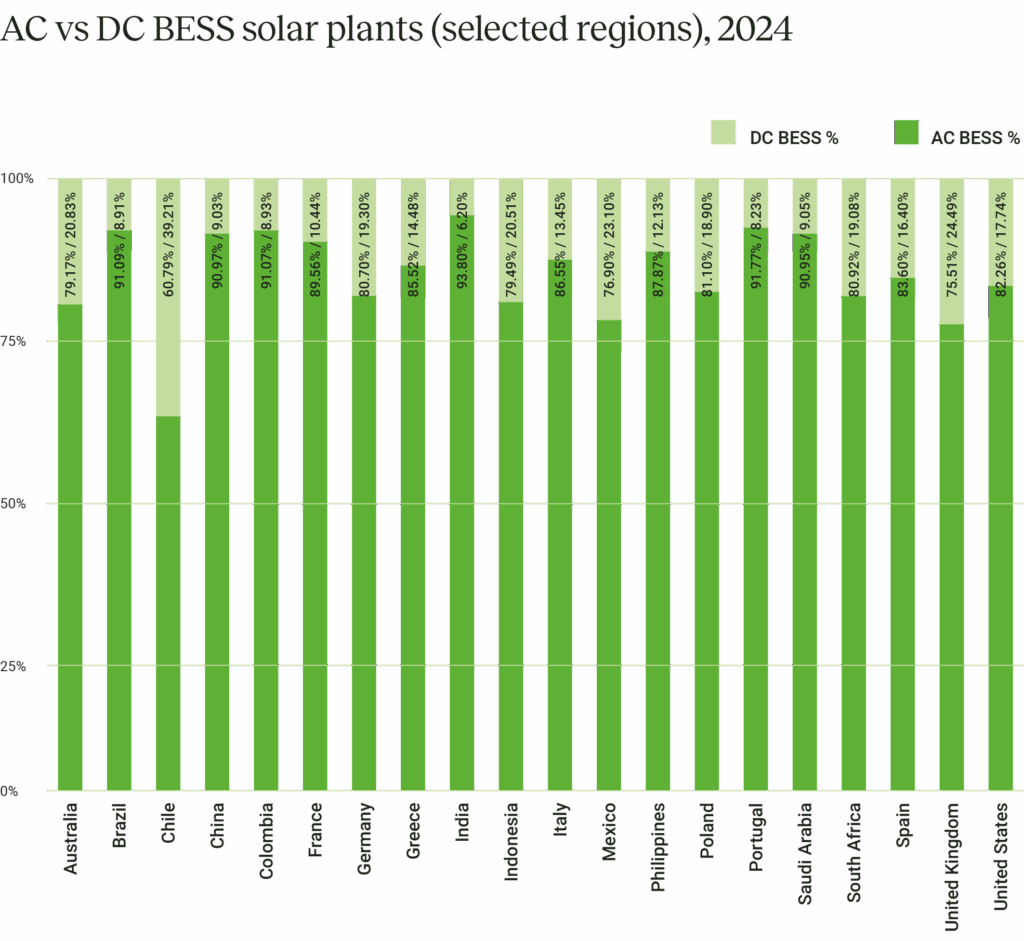

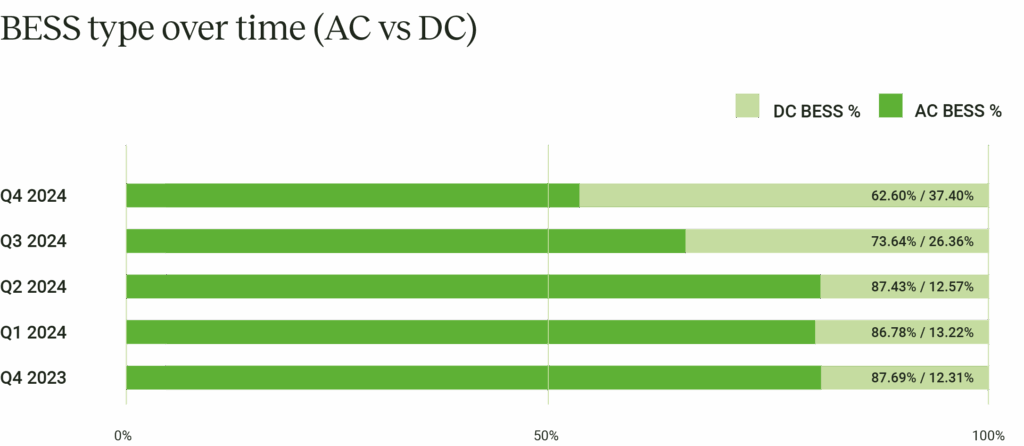

This year, we saw that AC BESS took up between 62% and 88% of hybrid simulations, a trend that translates across most regions. Currently AC BESS is still preferred over DC BESS but with all of the new features being added to the RatedPower platform around BESS design, it will be interesting to see what happens next year.

Renewable energy remains strong in the face of shifting international relations and supply chain disruptions. Looking ahead, solar continues to lead the charge. Concerns about permitting and regulations are gradually fading, signaling a market maturing under more robust government policies. However, grid stability remains a pressing problem as installations hit new peaks.

To address these issues, the sector is leaning into innovation. It is turning to hybrid solar plants, tracker-based structures and bifacial panels to increase energy output and optimize system performance.

With major markets like the United States, China and Europe racing to achieve their ambitious green targets, confidence in the sector shows no signs of weakening. Technological advancements in storage and inverters are also improving reliability and efficiency. If current trends continue, solar energy may soon become a consistent and dependable source that is ready to power national energy infrastructures, sustain zero-carbon cities and anchor renewable portfolios in energy markets.

Industry players must focus on diversifying resources and expanding regional reach to sustain this momentum. Solar engineers must also embrace digital tools to optimize operations and maintain efficiency. A combination of technological innovation, policy support and strong market demand will position renewables for unprecedented growth.

2025 is shaping up to be another groundbreaking year for renewables. Even amid uncertainties, enthusiasm is high. With a clear focus on innovation and strategic investments, including AI, digitization and workforce development, the sector is well-equipped to meet rising global energy demands. The year ahead promises to bring even more opportunities for growth and advancement, solidifying the role of renewables in the global energy transition.

In 2024, investment in energy reached new heights, with a large proportion directed toward renewable energy. In addition, the rise in investments has driven advancements in energy storage and infrastructure, helping to integrate renewables more effectively into power grids. This growth demonstrates the sector’s resilience amid economic uncertainties and geopolitical tensions.

Yet, the journey is far from straightforward. There are still key hurdles to overcome, including issues like grid congestion and curtailment, regulation and a skills gap, with demand for professionals in renewable technologies outpacing supply.

Looking ahead, the future for solar and renewables remains bright. The continued push for innovation and sustainability sets the stage for a cleaner, more resilient energy landscape. Enverus will keep working to address challenges and reduce risks, ensuring a smoother experience for energy organizations from beginning to end.

GM Power & Renewables, Enverus

Let’s get started!

Let’s get started!

We’ll follow up right away to show you a quick product tour.

Ready to Subscribe?

Ready to Get Started?

Ready to Subscribe?

Sign Up

Power Your Insights